Reference: Analysis, 2018

Capturing and summarising how the mobile switching and number porting processes are implemented in ten countries.

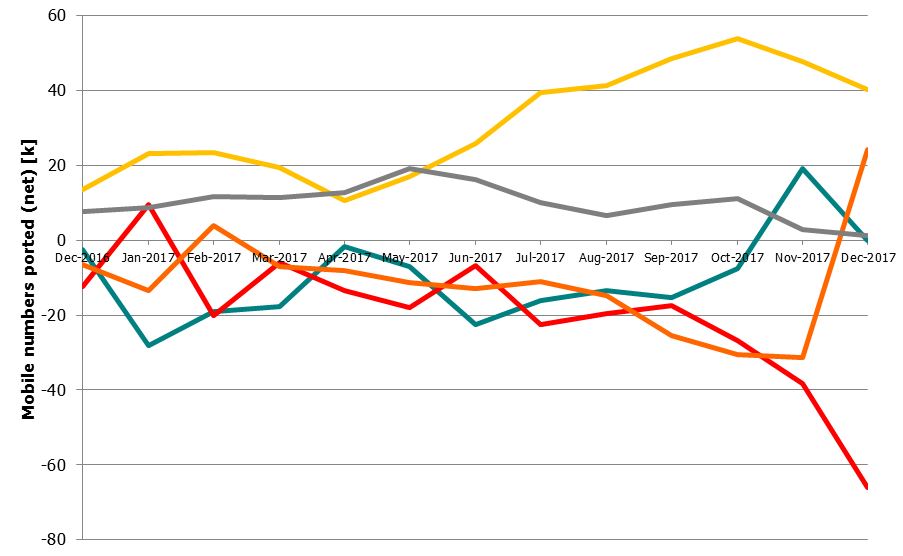

Capturing and presenting the mobile switching and porting volume trends – per country and/or per operator.

Analysing how the stipulated process (and the way operators have implemented it in practice) affect these trends. Developing KPIs allowing countries to be compared. Identifying best practice.

Identifying the triggers for switching and porting – and the elasticity between factors like gross adds, churn, numbers ported and net adds. Using international examples to predict what a change in the switching and porting process might mean for another country. Continue reading International mobile switching and number porting analysis