During the last decade, fixed-mobile convergence – FMC for short – has come to dominate how connectivity and entertainment are sold to households in European markets like Spain, France, Portugal, Belgium and the Netherlands.

In Spain, around three quarters of the households currently subscribe to an FMC plan covering at least fixed broadband and one or multiple mobile subscriptions. Often TV or other entertainment services are included too.

Initially FMC was sold with massive discounts and the base grew quickly as it was a no-brainer not to buy everything from the same operator. Churn levels were improved dramatically too when a churn decision no longer just affected one service for one household member, but many different services consumed by many different people. [Some find it easier to negotiate with an operator than with members of the family].

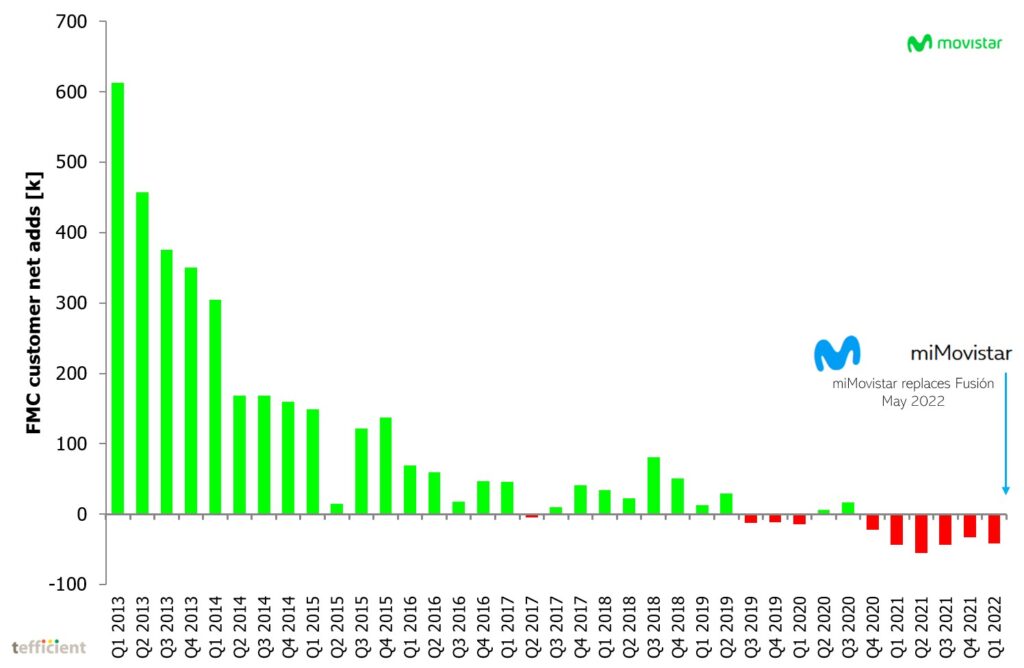

In later years, FMC ARPU increased much, driven by more content (and more expensive content such as football) in the mix. Eventually, the operator thirst for higher and higher ARPU might have been the start of a negative base trend for FMC. In the graph below, we show the FMC net adds for Movistar (Telefónica Spain) since the launch of its Fusión FMC product.