When COVID-19 hit the world and governments and authorities enforced restrictions on the society, the whole economy trembled. The telco business was affected, but the change in movement and usage patterns didn’t just bring negatives. Although the high margin mobile roaming revenue was lost, mature market telcos have, generally speaking, never reported higher margins than what they did in the just-closed third quarter of 2020.

We’ll show you what the key to this margin increase is.

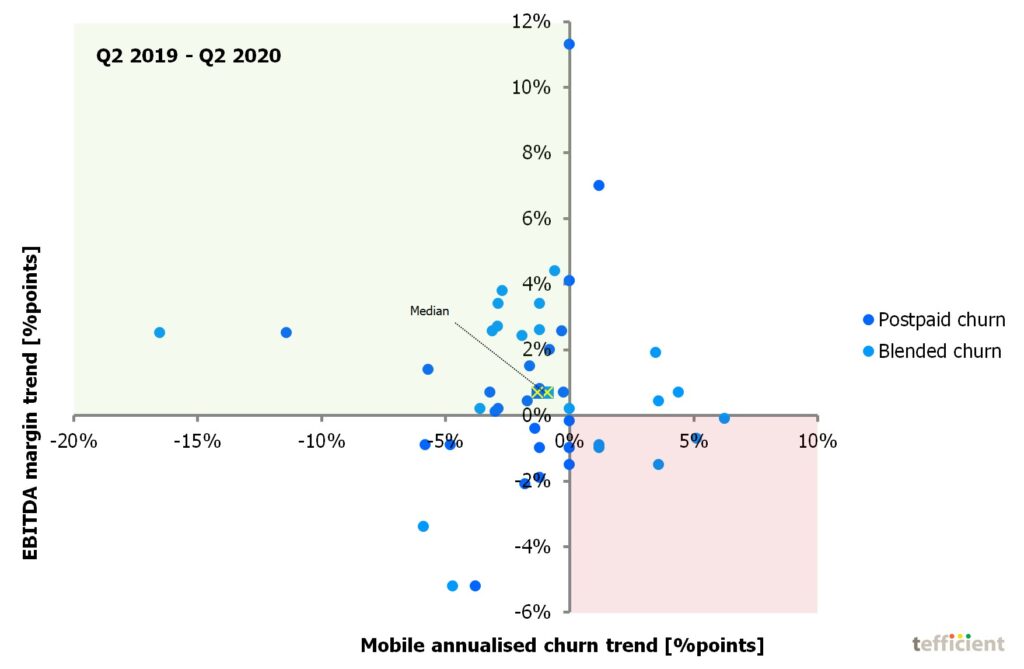

We have tracked about 40 mature market operators in Western Europe, USA, Japan and South Korea who all report mobile churn. The first graph shows the trend in integrated EBITDA vs. the trend in mobile churn for the year from Q2 2019 to Q2 2020. The second quarter of 2020 was the first full quarter with COVID-19 restrictions in our markets.

There are two types of markers in Graph 1: The darker blue represent mobile postpaid churn whereas the lighter blue represent blended churn. Different operators report churn differently; as we here look at the churn trend, we think it’s acceptable to mix the two in one chart.

As you can see, few operators experienced an increase in mobile churn during the first full COVID-19 quarter. And those that did experience an increase almost exclusively had it in blended churn. An explanation could be that many prepaid subscriptions weren’t renewed during the COVID-19 lockdowns. It could e.g. be migrant workers returning home or students simply not having a need for mobile services during remote learning periods at home.

Most operators are in the upper left, green, quadrant in Graph 1. The two square ‘X’ markers show the median operator: In Q2 2020, the median integrated EBITDA margin was 0.7 percentage points higher than in Q2 2019 – in spite of COVID-19. The key driver to it? 1.3 percentage points lower annualised mobile postpaid churn and 0.9 percentage points lower annualised blended mobile churn.

There is no better cost saver for mobile operators than when customers stay loyal. Mature market operators averagely spend 15% of its annual mobile service revenue on standing still. That’s how much operators burn in subscriber acquisition cost (SAC) and subscriber retention cost (SRC) to end the year with as many mobile customers as in the beginning of the year. So if the churn drops one percentage point, even if because of COVID-19 measures, that’s a major cost saver.

As a rule of thumb, one percentage point lower churn means one percentage point higher EBITDA margin.

To be clear: We are not trying to diminish COVID-19 here; the virus is a threat to us all and the effects on health and society are definitely not positive. Also operators would of course be happier without it.

But since most COVID-19 lockdowns ended in Q2 2020, isn’t the third quarter different? Surely the churn reductions didn’t continue when people were allowed to leave their homes again?

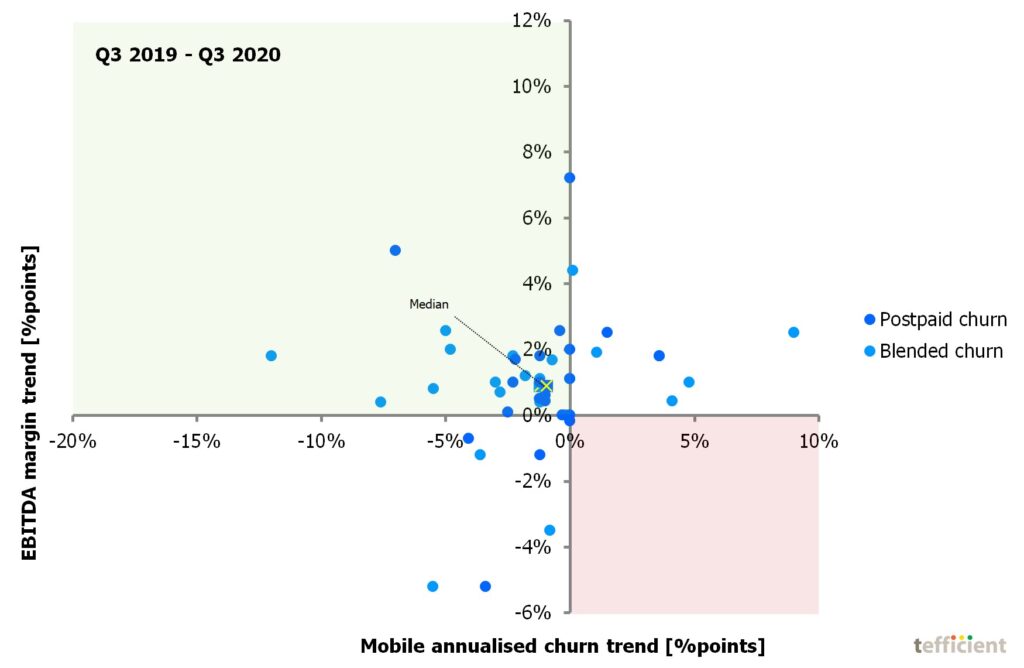

Well, Graph 2 might have a bit less spread than Graph 1, but it is still so that most operators are in the upper left, green, quadrant. There are even less operators with a trend towards higher churn.

The median operator’s integrated margin was 0.9 percentage points higher than in Q3 2019 – yes, a slightly higher improvement than in the previous quarter. The key driver to it is still the same – loyalty improvement: 1.0 percentage points lower annualised mobile postpaid churn and 1.2 percentage points lower annualised blended mobile churn.

Q2 2020 and Q3 2020 are actually very similar. Maybe it isn’t lockdown vs. non-lockdown, maybe it’s pre-COVID vs. post-COVID?

The world is now regretfully facing a second wave of COVID-19 infections and new mitigation measures including lockdowns are imposed. Let’s hope that these won’t be necessary for long and that the situation improves again. Some believe that the longer the uncertainty continues, the more likely that our present social and work code will establish itself as the ‘new normal’.

If so, the operator business isn’t going back to what it once was. From a customer loyalty and margin point of view this is actually positive.

For the past five years or so, operators in mature markets have essentially had one job: To keep the churn levels down. Every single activity performed should contribute. That job hasn’t changed, but the benchmark of what is low churn might have.