Prediction 1 – mobile data usage of 10 GB per month

At least one mobile operator will reach an average mobile data consumption of 10 GB per any SIM and month in 2016

![]() We think this operator is Finnish and that Elisa and DNA both have a chance to snatch this world first. Finland is already having the highest mobile data usage in the world and the current usage level will not even have to double as in 2015 to reach 10 GB in 2016.

We think this operator is Finnish and that Elisa and DNA both have a chance to snatch this world first. Finland is already having the highest mobile data usage in the world and the current usage level will not even have to double as in 2015 to reach 10 GB in 2016.

Prediction 2 – VoLTE + Wi-Fi calling dominates

At least one mobile operator will carry more than two-thirds of voice calls on 4G/Wi-Fi in 2016

Since T-Mobile USA said that they in the end of 2015 were close to 40% of calls over VoLTE, we think the odds are low for T-Mobile. T-Mobile is also leading in Wi-Fi calling. But were holding Tele2 Netherlands as an outsider – even though they haven’t yet launched VoLTE. This is because Tele2 built a 4G-only network and only sells VoLTE phones.

Since T-Mobile USA said that they in the end of 2015 were close to 40% of calls over VoLTE, we think the odds are low for T-Mobile. T-Mobile is also leading in Wi-Fi calling. But were holding Tele2 Netherlands as an outsider – even though they haven’t yet launched VoLTE. This is because Tele2 built a 4G-only network and only sells VoLTE phones.

Prediction 3 – fibre dominates over DSL/cable

At least one European country will have more than 60% of all fixed broadband subscribers connected with FTTB/FTTH in 2016

We think that country will be Lithuania or Latvia. Or perhaps Sweden. It will definitely not be the UK or Germany where incumbents still act as if copper is irreplaceable.

We think that country will be Lithuania or Latvia. Or perhaps Sweden. It will definitely not be the UK or Germany where incumbents still act as if copper is irreplaceable.

Prediction 4 – Wi-Fi homespots in more than 60% of homes

At least one European country will have Wi-Fi homespots in more than 60% of country households in 2016

![]() This country will likely be Belgium, France or the Netherlands. Belgium’s 4,6 million households are already hosting something like 2,6 million Wi-Fi homespots which are open to use for other customers.

This country will likely be Belgium, France or the Netherlands. Belgium’s 4,6 million households are already hosting something like 2,6 million Wi-Fi homespots which are open to use for other customers.

Prediction 5 – roam like home ahead of legislation

At least one mobile operator per EU country will have launched roam like home in 2016 – ahead of legislation

The European Union has decided that roam like home is mandatory from 15 June 2017, but many operators will follow in the footsteps of Free in France and 3 in the UK and Denmark to realise that roam like home has a first mover advantage.

The European Union has decided that roam like home is mandatory from 15 June 2017, but many operators will follow in the footsteps of Free in France and 3 in the UK and Denmark to realise that roam like home has a first mover advantage.

Prediction 6 – no mobile mergers unless subscribers sold

No mobile merger will be approved by EU in 2016 – unless one party sells its customer base

The European Union will approve national mergers between mobile and fixed/cable operators as long as the overlaps are minimised. EU will also approve cross-border mergers. But we predict that EU will not approve one mobile operator acquiring another operator in the same country – unless the customer base of one merging party is sold. If so, it’s not unlikely that 3 UK’s 10 million SIMs end up with e.g. Virgin Media and that the merged 3+O2 will have to be satisfied with O2’s 25 million customers to get the merger approved. Is it fair when BT and EE are allowed to merge? Or when O2 Germany could buy E-plus? No, but this is politics and the wind has changed.

The European Union will approve national mergers between mobile and fixed/cable operators as long as the overlaps are minimised. EU will also approve cross-border mergers. But we predict that EU will not approve one mobile operator acquiring another operator in the same country – unless the customer base of one merging party is sold. If so, it’s not unlikely that 3 UK’s 10 million SIMs end up with e.g. Virgin Media and that the merged 3+O2 will have to be satisfied with O2’s 25 million customers to get the merger approved. Is it fair when BT and EE are allowed to merge? Or when O2 Germany could buy E-plus? No, but this is politics and the wind has changed.

Prediction 7 – Wi-Fi first mobile comes to Europe

The first Wi-Fi first mobile provider will launch in Europe in 2016

US is ahead of Europe and have a few Wi-Fi first providers already (like Google Fi, Republic Wireless and Freewheel) – where mobile devices traffic mobile networks only when there’s no Wi-Fi available (and unused mobile data tends to be refunded). After years of technology and business model experiments, somebody will address Europe with a Wi-Fi first proposition in 2016. Country borders won’t matter much and the number of mobile fallback networks can be more than one – just like with Google Fi.

US is ahead of Europe and have a few Wi-Fi first providers already (like Google Fi, Republic Wireless and Freewheel) – where mobile devices traffic mobile networks only when there’s no Wi-Fi available (and unused mobile data tends to be refunded). After years of technology and business model experiments, somebody will address Europe with a Wi-Fi first proposition in 2016. Country borders won’t matter much and the number of mobile fallback networks can be more than one – just like with Google Fi.

Prediction 8 – from skinny bundles to no bundles

By the end of 2016, all cablecos have unbundled TV from fixed broadband and selling TV content on-demand to whoever wants to watch it

Since cablecos are slow movers, partly due to old fashioned contracts with content owners, we realise that we risk to be wrong on this prediction, but with customers leaving, cablecos have no alternative than to realise that fixed broadband to homes will be their primary service and TV now is a discretionary purchase.

Since cablecos are slow movers, partly due to old fashioned contracts with content owners, we realise that we risk to be wrong on this prediction, but with customers leaving, cablecos have no alternative than to realise that fixed broadband to homes will be their primary service and TV now is a discretionary purchase.

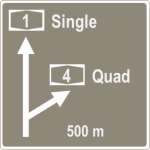

Prediction 9 – the quad-play market saturates

At least one of the European quad-play first-movers has to realise that the customer take-up stalls in 2016 when no new households sign up

Fuelled by heavy discounts, South Europeans were attracted to heavy quad-play bundles containing fixed voice (which they don’t care about) and TV (which they care less and less about) in order to get a good discount on the fixed broadband and the mobile services they actually do care about. The hangover quad-play customers experience when they realise that all of these services – including mobile, potentially for the whole family – can’t be cancelled or downgraded for two whole years is significant. Quad-play first-movers like Telefónica/Movistar, Portugal Telecom/MEO and Orange will continue to tell investors that the take-up is good, but few new households will join in 2016 and in the end of the year there might even be losses: Two years have elapsed since many quad-play customers joined and some of them will now churn in order to enjoy the freedom of non-binding mobile agreements and unbundled over-the-top TV.

Fuelled by heavy discounts, South Europeans were attracted to heavy quad-play bundles containing fixed voice (which they don’t care about) and TV (which they care less and less about) in order to get a good discount on the fixed broadband and the mobile services they actually do care about. The hangover quad-play customers experience when they realise that all of these services – including mobile, potentially for the whole family – can’t be cancelled or downgraded for two whole years is significant. Quad-play first-movers like Telefónica/Movistar, Portugal Telecom/MEO and Orange will continue to tell investors that the take-up is good, but few new households will join in 2016 and in the end of the year there might even be losses: Two years have elapsed since many quad-play customers joined and some of them will now churn in order to enjoy the freedom of non-binding mobile agreements and unbundled over-the-top TV.

Those were our nine predictions. A year from now, we’ll measure the outcome. And publish it.

We considered three other predictions, but since these are trending facts already we thought they weren’t worthy to be called predictions:

- Apple will continue to challenge operator business when addressing the customer directly. Other equipment providers will follow with similar lease & upgrade programs. The binding two-year service contract will de facto die in 2016. Operators need to fill the retention toolbox with new, sharper, tools.

- The number of network sharing JVs will continue to grow – with e.g. France, Finland and Israel.

- Time will become the preferred complement to volume in monetising mobile data. Live already.