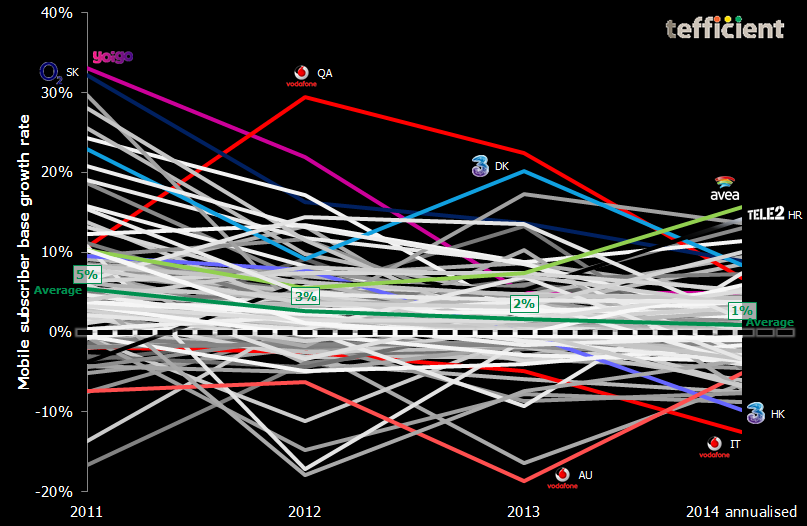

The graph below shows the annual (2014: annualised) growth rate in reported mobile SIM base for about 100 mobile operators in mature markets globally.

It’s looks as if we are approaching a zero-sum SIM situation where the total number of SIM cards no longer will increase in mature markets: The annualised average growth rate in 2014 is just 1%.

Operators who have been involved in mergers or acquisitions in this time period are excluded: the graph consequently compares organic growth. This means that e.g. T-Mobile USA isn’t included (MetroPCS was acquired by T-Mobile in 2013) even though they grow quickly and would lead in 2014.

Operators who have done clean-ups of inactive SIMs or changed their activity definition are included with their figures as reported.

The graph highlights some of the operators who historically have had the fastest organic SIM growth: Yoigo in Spain, O2 in Slovakia, Vodafone in Qatar, 3 in Denmark, Avea in Turkey and Tele2 in Croatia.

Most of the operators who have lost many SIMs one year fall into the clean-up category. The graph highlights three operators who haven’t done such clean-ups: Vodafone (VHA) in Australia, Vodafone in Italy and 3 in Hong Kong.

Pre- to postpaid migration contributes to the declining growth. On the other hand, auxiliary data-only SIMs in e.g. tablets and M2M should have been able to compensate.

Mobile operators in mature markets are facing a situation where they – from now on – will exchange customers with each other. This puts additional pressure on their operational efficiency and makes it even more important to control churn – cost effectively.

More on SAC, SRC and churn: tefficient industry analysis 2 2014 SAC vs SRC – public version