In Europe, we woke up with the news that Vodafone and Liberty Global had agreed to merge their Dutch operations Vodafone and Ziggo.

In Europe, we woke up with the news that Vodafone and Liberty Global had agreed to merge their Dutch operations Vodafone and Ziggo.

Less than two weeks ago, Telenet, Liberty Global’s affiliate in Belgium, got a green light from the European Commission to buy the mobile operator BASE from KPN. So already before today, Liberty took a major step in the mobile direction.

Read the original commentary on what this means for Europe

Vodafone, on its part, has demonstrated an appetite for cablecos: In 2013, it began acquiring Kabel Deutschland and in 2014 it acquired Ono in Spain.

![]() In the case of Ziggo, it’s not a regular take-over, though, but a 50-50 joint venture. Ziggo’s fixed network assets have the potential to put an end to Vodafone’s not-so-successful journey from a mobile-only to an integrated operator in the Netherlands.

In the case of Ziggo, it’s not a regular take-over, though, but a 50-50 joint venture. Ziggo’s fixed network assets have the potential to put an end to Vodafone’s not-so-successful journey from a mobile-only to an integrated operator in the Netherlands.

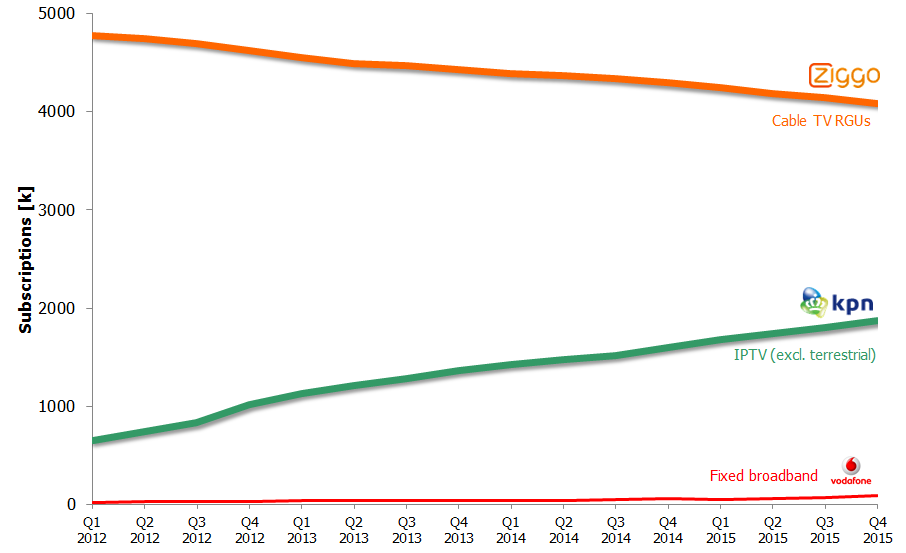

In the past three years, Vodafone’s reported fixed broadband base grew from 35k to 89k customers, some of which (unclear how many) are also TV customers to Vodafone. Even though growing, it’s still just about 1% of the fixed broadband connections in the Dutch market.

![]() Whom to blame? In their law suit in December, Vodafone points out KPN. Vodafone says that KPN delayed the nationwide launch of Vodafone’s triple play service by three years when not delivering what Vodafone needed.

Whom to blame? In their law suit in December, Vodafone points out KPN. Vodafone says that KPN delayed the nationwide launch of Vodafone’s triple play service by three years when not delivering what Vodafone needed.

With Ziggo’s cable network, Vodafone has access to a network which passes about 97% of all Dutch households. And in most cases it’s a better network than KPN’s which still relies on copper to access 70% of the Dutch households.

The problem? Ziggo’s performance:

Ziggo was acquired by Liberty Global’s UPC in November 2014 – and took the Ziggo brand for the combined operation. But the customers continue to leave: About 40k to 60k customers leave every quarter. And the take-up for KPN’s IPTV shows where they go.

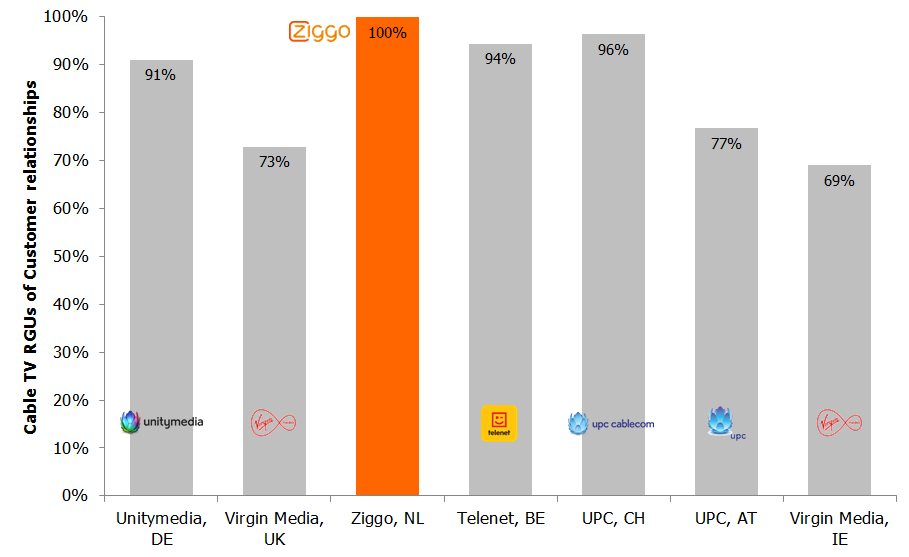

Unlike other cablecos, there is a close to 100% match between Ziggo’s number of customers and the number of customers who subscribe to TV.

![]() “In the Netherlands and Romania, a subscriber must subscribe to our video service (or the video service in a partner network) in order to subscribe to our internet service. In our other markets, our broadband internet service is available on a standalone basis or in combination with one or more of our other services.”

“In the Netherlands and Romania, a subscriber must subscribe to our video service (or the video service in a partner network) in order to subscribe to our internet service. In our other markets, our broadband internet service is available on a standalone basis or in combination with one or more of our other services.”

From Liberty Global’s 10K report for 2015

So when the general trend is that households question why they subscribe to traditional TV – to instead subscribe to one or several over-the-top streaming services – it affects not only Ziggo’s TV base but customers are indeed leaving them fully.

Other cablecos – Virgin Media in the UK is a good example – have been able to spot this trend earlier and re-positioned as providers of fast fixed broadband. Virgin Media is today having 4.7 million broadband customers – compared to just 3.7 million TV customers. Non-Liberty Global cablecos like Comcast in the US (81%) and Com Hem in Sweden (97%) also have more broadband customers than TV customers.

Other cablecos – Virgin Media in the UK is a good example – have been able to spot this trend earlier and re-positioned as providers of fast fixed broadband. Virgin Media is today having 4.7 million broadband customers – compared to just 3.7 million TV customers. Non-Liberty Global cablecos like Comcast in the US (81%) and Com Hem in Sweden (97%) also have more broadband customers than TV customers.

But in order to have that, you must also be ready to push broadband as a stand-alone service – unbundled from TV.

If the JV with Vodafone should be able to turn Ziggo’s curve around, this must be done asap – whatever investments and changes are required. A 50-50 JV might be sub-optimal in the perspective of making fast and forceful changes, though. Ziggo has in 2015 invested less than what UPC and the old Ziggo did in 2014 – and 43% of the total CAPEX has been used on set-top boxes – a higher share than before.

We think that Ziggo/Vodafone should invest in becoming a true fixed broadband powerhouse. If not done, there’s little Ziggo/Vodafone can do to grow base.

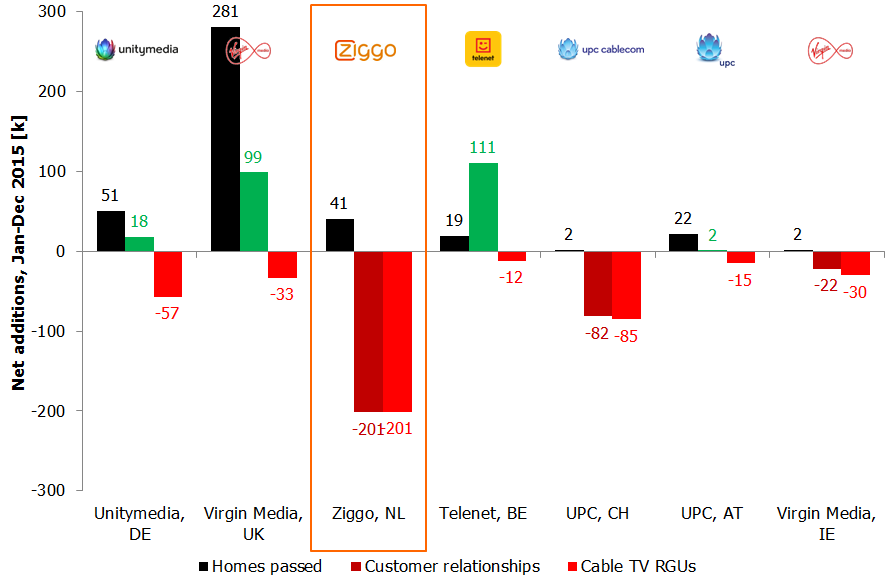

As shown in the graph above which compares Liberty Global’s operations in Western Europe, cablecos like Virgin Media who expand “homes passed” can also expect to convert a fair share of those newly covered homes to customers. In 2015, Virgin Media expanded “homes passed” by 281k and managed to sign up 99k new customers (net). While doing that, Virgin Media still lost 33k TV customers, though – which suggest that many of their new customers join as broadband-only customers.

Ziggo expanded its network with 41k new households in 2015 – but it still lost 201k customers (and as many TV subscribers). Since Ziggo already covers 97% of Dutch households, the coverage expansion route of Virgin Media isn’t really an option for Ziggo – there are so few households left who aren’t covered already.

The merger between UPC and the old Ziggo worsened Ziggo’s customer satisfaction and accelerated churn. The integration work is still ongoing. Vodafone and Ziggo ought to get going to improve the situation, but until the JV is approved by the authorities, the companies can’t. The wait and the associated uncertainty will in the short run likely just favour KPN, the main competitor to both Vodafone and Ziggo.