Reference: Analysis, 2024

The Hellenic Telecommunications & Post Commission, EETT, functions as Greece’s national regulatory authority for telecommunications.

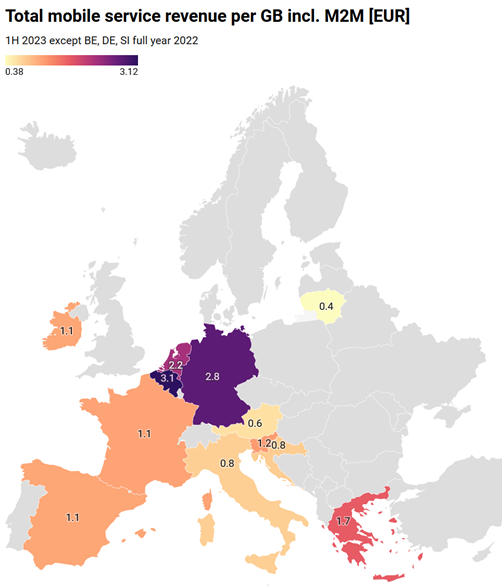

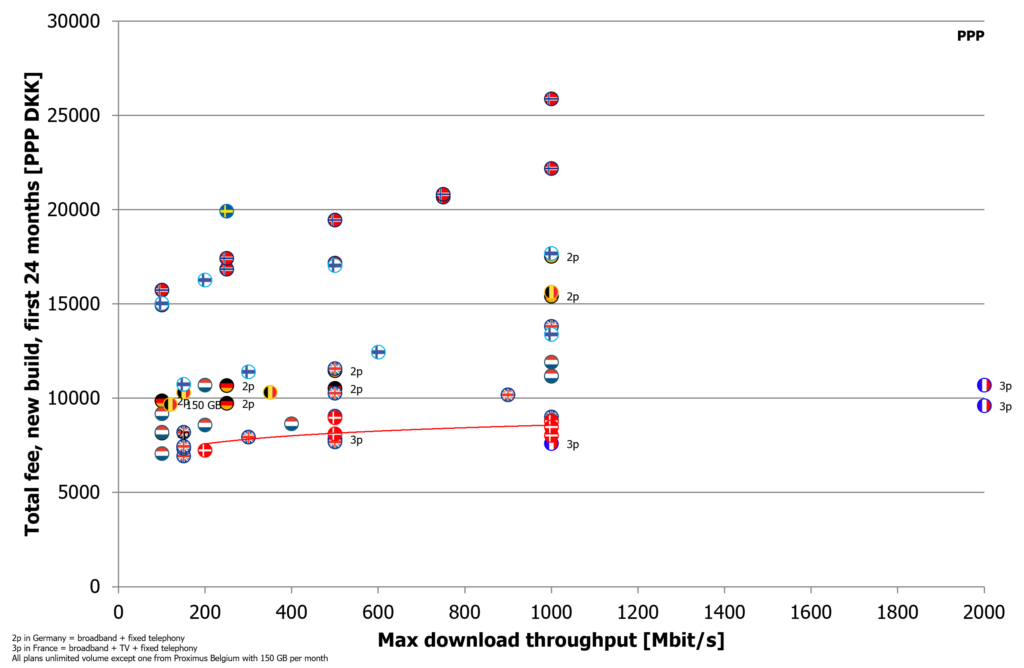

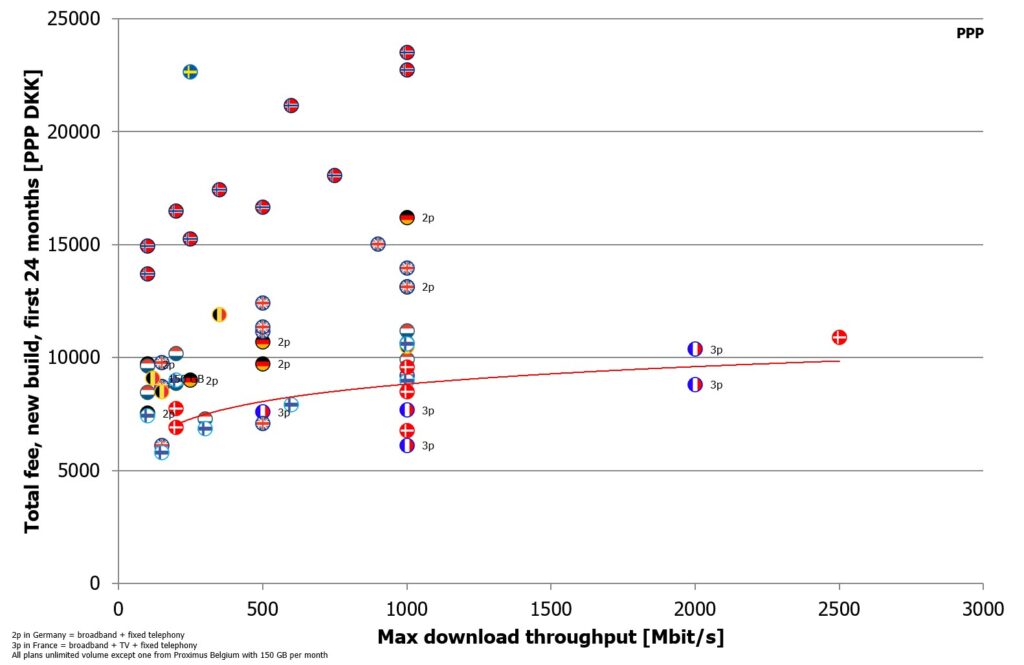

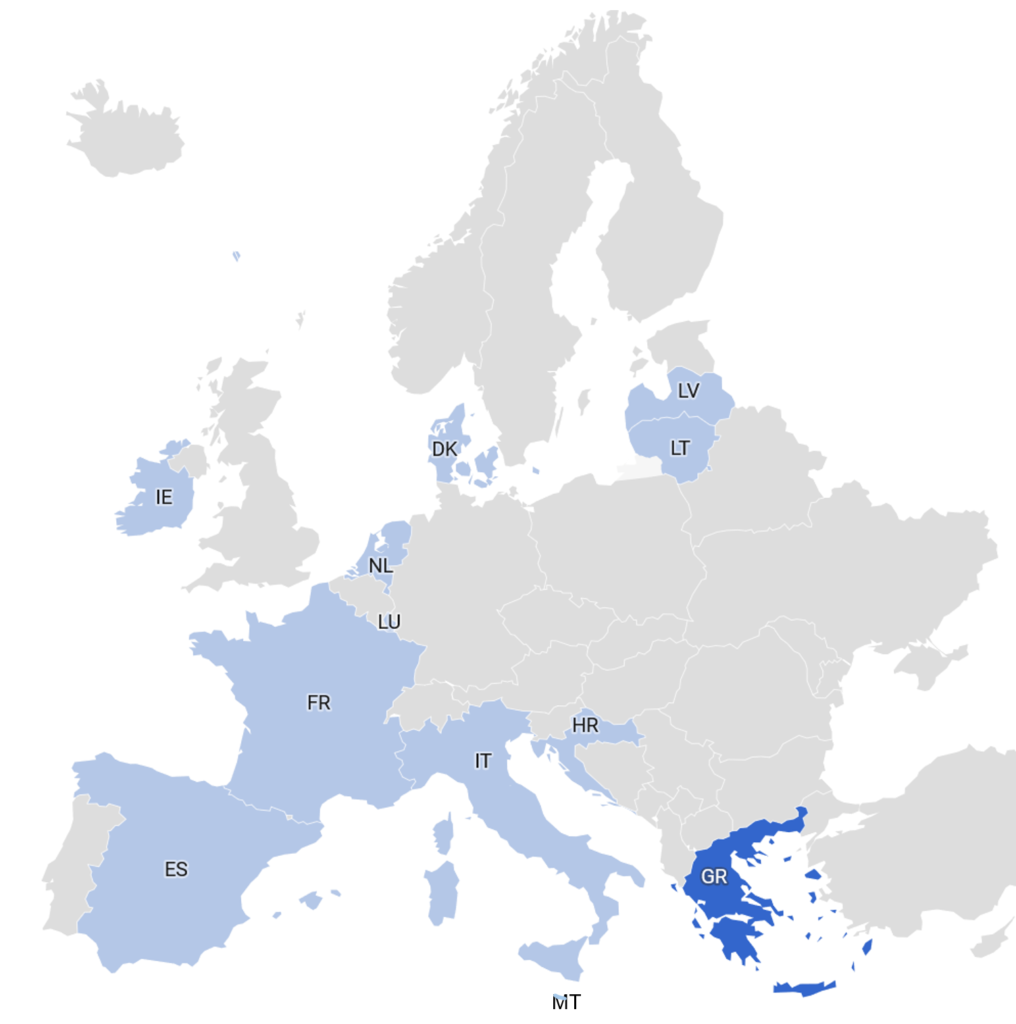

In response to EETT’s request, Tefficient has conducted an extensive benchmark analysis, focusing on value for money for fixed broadband and telephony services, spanning twelve EU countries: Croatia, Denmark, France, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, and Spain.

While the primary focus of the benchmark is on Greece, its insights provide valuable perspectives for the telecommunications industry in the remaining eleven countries.

Key conclusions for Greece include:

Continue reading Evaluating fixed broadband and telephony value for money across 12 EU countries