Our nine predictions for 2016 were designed to be measurable. The outcome doesn’t look bad at all – we project that 7 (or 7 and a half) will be fulfilled – but we need to wait for the fourth quarter reports to give you the final outcome. ETA February.

For 2017, we thought we’d make our predictions more courageous. We think 2017 will be the year when the telecoms industry finally becomes customer oriented and customer friendly having realised that greed and fine print make a bad foundation for business – but that customers who are given attention and choice reward you with their loyalty – and then are surprisingly willing to pay.

Prediction 1: Unlimited mobile data to everyone who pays

Every mobile operator will offer unlimited mobile data in 2017

Unlimited mobile data is in vogue. Sure, the definition of “unlimited” is full of limitations – speed, tethering, video resolution, time, even volume – but let’s not be too touchy. Mobile users love unlimited and are willing to pay for it. Operators can monetise the peace of mind it brings and will not face the elevated churn risk they currently do every time a customer empties the data bucket.

Unlimited mobile data is in vogue. Sure, the definition of “unlimited” is full of limitations – speed, tethering, video resolution, time, even volume – but let’s not be too touchy. Mobile users love unlimited and are willing to pay for it. Operators can monetise the peace of mind it brings and will not face the elevated churn risk they currently do every time a customer empties the data bucket.

Wild card: Verizon surprises everyone when launching their “Kick the bucket” plan with totally unlimited data in April 2017.

Prediction 2: The “control & zero-rate content” bundle fails

Incumbent operators’ attempt to control and zero-rate content costs a fortune in 2017 but customers prefer freedom

AT&T’s mega-acquisition of TimeWarner might well go through, but incumbents’ ambition to control the content and make it exclusive to their own customers will prove very costly in the long run – just look at how much money BT poured into football rights since 2013 instead of building FTTH in the UK (Prediction 3). Many customers will realise that they pay for the zero-rating with a commitment to buy certain content – or with a contract that locks them in for years. The unlimited propositions by competition (Prediction 1) will dismantle the “control & zero-rate content” bundle since those with unlimited data volume couldn’t care less about zero-rating. In addition, there’s a regulatory unknown: Some regulators will fine operators that use zero-rating and take them to court if needed.

AT&T’s mega-acquisition of TimeWarner might well go through, but incumbents’ ambition to control the content and make it exclusive to their own customers will prove very costly in the long run – just look at how much money BT poured into football rights since 2013 instead of building FTTH in the UK (Prediction 3). Many customers will realise that they pay for the zero-rating with a commitment to buy certain content – or with a contract that locks them in for years. The unlimited propositions by competition (Prediction 1) will dismantle the “control & zero-rate content” bundle since those with unlimited data volume couldn’t care less about zero-rating. In addition, there’s a regulatory unknown: Some regulators will fine operators that use zero-rating and take them to court if needed.

Wild card: Sky will still like to give content+mobile bundling a try and announces the acquisition of O2 UK in summer 2017.

Prediction 3: BT and DT admit that FTTH is the future

Every fixed operator have in 2017 realised that without FTTH there’s no digital future

Faced with the threat of being separated into a service company and a network company, the copper couple BT and DT make a U-turn admitting that their previous agenda to say that copper-based technologies were good enough was wrong. The companies also ask us to forgive them for having deceived the public when calling VDSL “fibre”.

Faced with the threat of being separated into a service company and a network company, the copper couple BT and DT make a U-turn admitting that their previous agenda to say that copper-based technologies were good enough was wrong. The companies also ask us to forgive them for having deceived the public when calling VDSL “fibre”.

Wild card: In the Q2 2017 earnings webcast, Deutsche Telekom’s CEO Tim Höttges is seen wearing a magenta-coloured helmet, spitting in his hands and grabbing a shovel. DT announces the most ambitious FTTH rollout programme ever seen called “Glasfaser für alle!”.

Prediction 4: Binding contracts a thing of the past

All mobile operators finally abandon binding contracts in 2017 realising that binding just fuelled churn

Having studied how US operators one after the other abandoned binding contracts and were rewarded with higher customer loyalty and higher EBITDA margin, the last doubters develop a Nonstop Retention agenda and cease to lock customers in on multi-year contracts.

Wild card: During an event at Canada Day 1 July 2017, the three Canadian operators Rogers, Telus and Bell are (together with Justin Trudeau) declaring that all Canadians are immediately released from their binding contracts.

Prediction 5: Increased precision and unlicensed spectrum allow operators to build truly awesome networks

All mobile operators start to use predictive analytics (AI) in 2017 to find exactly where capacity and quality is needed

The days of building mobile networks to satisfy an average customer that doesn’t exist are counted. Progressive operators have already started to use predictive analytics to foresee the capacity demand. In 2017, operators will take the step fully into AI to be able to deliver the targetted network quality to individual customers using specific services. As part of this, operators overcome their fear of using Wi-Fi (and unlicensed spectrum) to satisfy a demand for quality and capacity. The increase in precision makes CAPEX efficiency much higher than in the past which contributes to operators feeling comfortable offering unlimited data (Prediction 1). Customers are happy, churn goes down and the business results of operators improve.

The days of building mobile networks to satisfy an average customer that doesn’t exist are counted. Progressive operators have already started to use predictive analytics to foresee the capacity demand. In 2017, operators will take the step fully into AI to be able to deliver the targetted network quality to individual customers using specific services. As part of this, operators overcome their fear of using Wi-Fi (and unlicensed spectrum) to satisfy a demand for quality and capacity. The increase in precision makes CAPEX efficiency much higher than in the past which contributes to operators feeling comfortable offering unlimited data (Prediction 1). Customers are happy, churn goes down and the business results of operators improve.

Wild card: In a special investor day in May 2017, Vodafone Group explains that it pauses its 5G plans until 2022 to instead, under the “WoFo” header, use Wi-Fi and unlicensed spectrum as support to 4G in thousands of surgically pinpointed locations. Vodafone supports the development of 802.11ax and urges regulators to make more unlicensed spectrum available.

Prediction 6: The cable TV industry kills the bundle

By the end of 2017, all cablecos have stopped necessitating pre-packaged TV bundles to let anybody select from a full meny

Want to see a sports game, a series or just two hours of all channels? Everything is now possible for everyone at any given time, location or over any Internet access. Just select, pay and stream.

Want to see a sports game, a series or just two hours of all channels? Everything is now possible for everyone at any given time, location or over any Internet access. Just select, pay and stream.

Cablecos suddenly get many content-only customers and expand its business outside of its access network. Demand for cable Internet continues to increase in areas where telcos can’t supply FTTH (Prediction 3).

Wild card: The content industry voluntarily proposes a stop to all geoblocking from March 2017 and their army of lawyers are photographed drinking “Vana Tallinn” with the EU commissioner Andrus Ansip to celebrate.

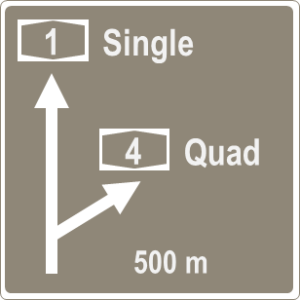

Prediction 7: Peak quad-play

Key European quad-play first-movers watch customer take-up stall in 2017 when no new households sign up

Albeit heavily discounted, European households turn their back on quad-play bundles since they have become too expensive, containing services that aren’t in demand (fixed voice) with TV bundles that are too big (Prediction 6) and forcing households to accept binding contracts (Prediction 4) against the trend in the digital world.

Albeit heavily discounted, European households turn their back on quad-play bundles since they have become too expensive, containing services that aren’t in demand (fixed voice) with TV bundles that are too big (Prediction 6) and forcing households to accept binding contracts (Prediction 4) against the trend in the digital world.

With unlimited data (Prediction 1), mobile-only operators make it difficult for incumbents to argue for the quad-play bundle. Challenger operators who just offer a bundle of mobile with unlimited data and FTTH to let the customer select the content they like in the open market (Prediction 6) take all the fixed market growth.

Wild card: Telefónica admits that Fusión was negative for Movistar’s revenue and market share development in Spain and that the company is refocusing on being competitive within mobile and FTTH respectively.

Prediction 8: Smartphone upgrade fatigue

New smartphones launched in 2017 fail to impress and operator margins have never been higher

Mobile users continue to be addicted to their smartphones – but see little reason to replace them unless they break.

Mobile users continue to be addicted to their smartphones – but see little reason to replace them unless they break.

Relieved from a self-imposed obligation to provide smartphones to customers, the margins of operators surge as more and more customers source their own device and select service contracts without binding (Prediction 4).

Wild card: Apple removes also the Lightning port in the iPhone fulfilling a vision of a product without connectors. A new unique wireless charging device called the AirPad is introduced for 399 USD. The iPhone can’t be used while being charged on the AirPad. “Bravery”, says Apple.

Those were our eight predictions for 2017. A year from now, we’ll measure the outcome. We hope we are right, but suspect we won’t be.