Consumers often think of carriers being somewhat stuffy and dusty, being slow to give customers flexibility and big at small print. But there are great exceptions to the rule with T-Mobile in the US, Free in France and Tele2 in Sweden, and we believe the next two years will see some further fun, entertaining and disruptive carrier offerings on the market. Continue reading Freedom to stay – The power of 40000 Tweets

Category Archives: Churn

Zero-SIM game

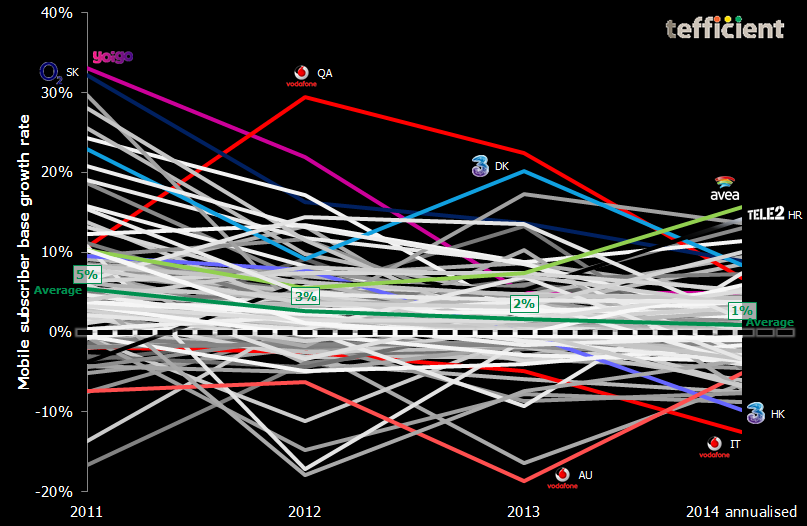

The graph below shows the annual (2014: annualised) growth rate in reported mobile SIM base for about 100 mobile operators in mature markets globally.

Churn: Still a concern

The subsidy model – which dominated operators’ handset and equipment sales in mature markets for decades – is rightfully retiring. It wasn’t a brilliant idea to discount goods not produced inhouse (taking cost pressure away from equipment manufacturers like Apple) and, to compensate, overcharge for the services actually produced (making over-the-top services and Wi-Fi more attractive). Continue reading Churn: Still a concern

The art of balancing SAC and SRC

This is our fourth analysis on subscriber acquisition cost (SAC) and subscriber retention cost (SRC). Previous SAC & SRC analyses showed that an increase in SRC had a positive effect on contract churn without any negative effect on EBITDA – as long as not exceeding 100% of contract SAC.

This is our fourth analysis on subscriber acquisition cost (SAC) and subscriber retention cost (SRC). Previous SAC & SRC analyses showed that an increase in SRC had a positive effect on contract churn without any negative effect on EBITDA – as long as not exceeding 100% of contract SAC.

Our new analysis shows that much has happened in 2013: Average unit SAC and SRC have decreased significantly. How come – and what has it led to?

Based on data from 35 mobile operators in 24 mature markets globally.

The analysis comes in two versions: A public version which you can download below – and a premium version which adds country-specific SAC & SRC analyses on eight countries: France, Germany, Poland, Austria, the Netherlands, UK, Denmark and Canada.

Download public version: tefficient industry analysis 2 2014 SAC vs SRC – public version