Tefficient’s 39th public analysis of mobile data development and drivers compares 39 countries worldwide, where M2M/IoT can be excluded from the total bases. Mobile data usage grew in 38 of them – with Bahrain as the only exception.

If you’d rather see the analysis including M2M, go here.

When usage grows, the growth rates are slowing. Portugal leads with a growth rate of 47%, contrasting with Taiwan‘s modest 8% growth. Bahrain experienced a decline of 6% in data usage.

Data-only subscriptions continue to dominate average mobile data usage, although their market share remains limited. Latvia‘s average data-only subscription consumed 138 GB per month in 2022 while Austria recorded 115 GB in the first half of 2023. In the FWA-only category, Australia had a remarkable 334 GB per month in 1H 2023.

While data-only drives traffic, the same can’t be said for 5G

Reporting is imperfect, but there are only three countries with disproportionately high 5G traffic in relation to their 5G bases: South Korea, Austria and Saudi Arabia. We explain what these countries do and what other countries are missing.

Continue reading Data-only drives traffic. The same can’t be said for 5G.

Two years ago, telcos were still proudly reporting their progress in utilisation of their own public Wi-Fi hotspots for cost efficient offloading of mobile data. Public Wi-Fi was also positioned as an investment in a better customer experience – especially in public indoor environments. Telcos that were late with 4G – such as in Taiwan and Belgium – could utilise their public Wi-Fi to bridge the transition from 3G to 4G.

Two years ago, telcos were still proudly reporting their progress in utilisation of their own public Wi-Fi hotspots for cost efficient offloading of mobile data. Public Wi-Fi was also positioned as an investment in a better customer experience – especially in public indoor environments. Telcos that were late with 4G – such as in Taiwan and Belgium – could utilise their public Wi-Fi to bridge the transition from 3G to 4G.

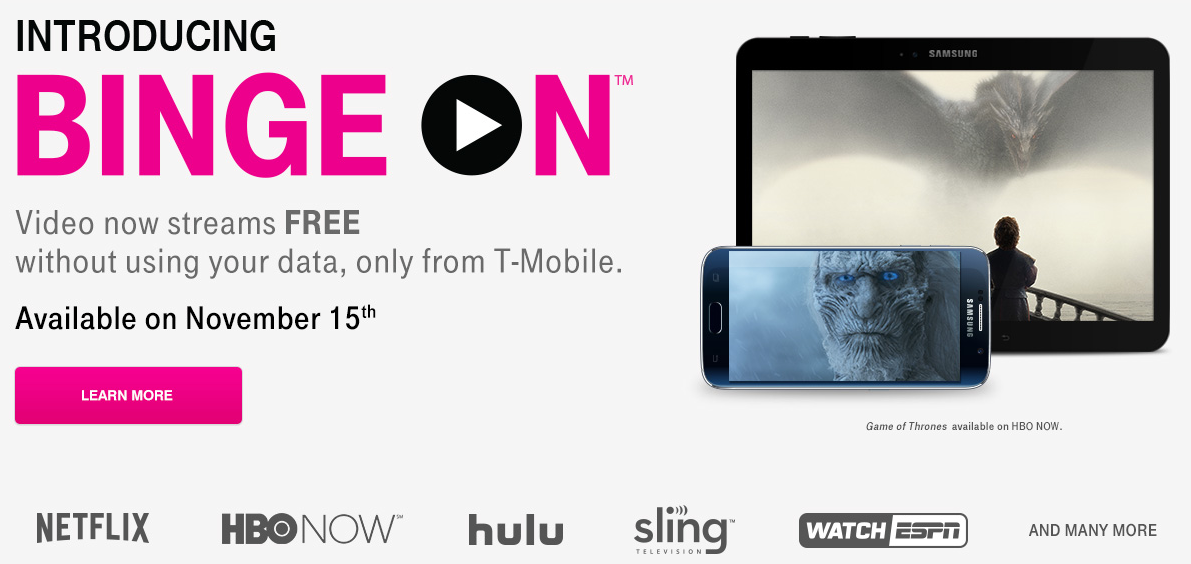

T-Mobile’s 5G will – to use their own words – have more ‘

T-Mobile’s 5G will – to use their own words – have more ‘

When Canning Fok, the co-managing director of

When Canning Fok, the co-managing director of