We’ve been awaiting Telenor’s official comments to OpenSignal’s new crowdsourced 4G coverage and speed test, but since Telenor hasn’t yet commented it we try to interpret the Norwegian results ourselves.

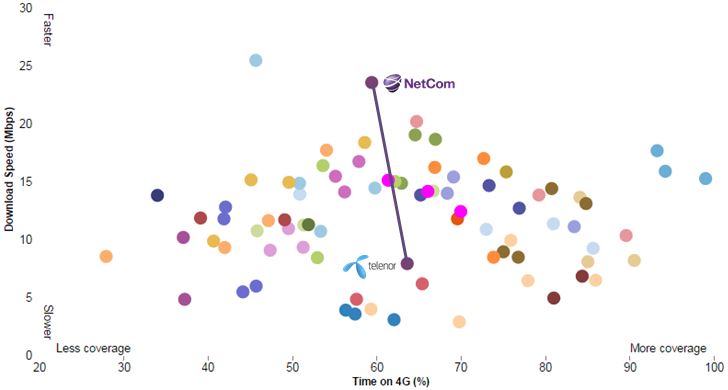

In the graph from OpenSignal above, we’ve highlighted the positions of the two 4G operators in Norway: NetCom and Telenor. The horisontal axis shows the proportion of time 4G customers spend on the 4G network (the rest of the time, their 4G terminals are on either 2G or 3G due to too weak 4G coverage). This is a customer-centric way to measure 4G coverage. Without exceptions, the “Time on 4G” value is lower than the population coverage reported by operators.

Telenor is slightly ahead of NetCom on “Time on 4G” suggesting that Telenor’s coverage is a bit wider of NetCom’s. In OpenSignal’s international comparison, values around 60% aren’t better than average, though.

The vertical axis shows the average download speed when on 4G – as experienced by actual customers. And now it becomes interesting: NetCom is number 2 in the world whereas Telenor is number 68 (of 82 if we got it right).

It didn’t take long until this picture was posted by NetCom:

It highlights NetCom’s position. And, you guessed right, also Telenor’s.

The peculiar thing with Norway is that operators monetise customers both on data volume and data throughput. In most other countries, operators who are charging customers for data volume provide them with the maximum speed:

If you sell Mbytes, what point is there to slow your customers’ data consumption down?

With maximum speed, operators make sure to maximise customers’ consumption of Mbytes – which gives operators great possibilities to up-sell data volume.

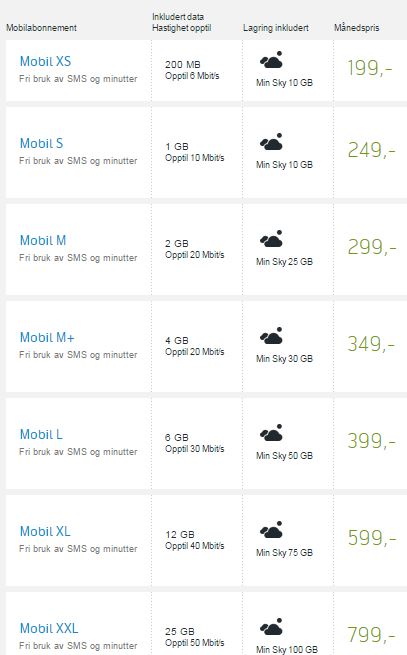

But in Norway, mobile plans with lower allowances are very slow, yet marketed under the 4G umbrella. This might be correct technically, but not in line with the customer experience. To exemplify, let’s look at Telenor’s current plan menu:

The Mobil XS plan at the top is throttled at 6 Mbit/s which most 3G networks have no issues delivering. In order to get 50 Mbit/s (up to) throughput, customers have to commit to the most expensive 799 NOK [92 EUR] plan with 25 GB.

Can Telenor’s low throughput in OpenSignal be a reflection of this policy? Yes. OpenSignal’s measurements don’t care why the throughput is what it is; it measures the actual throughput of customers.

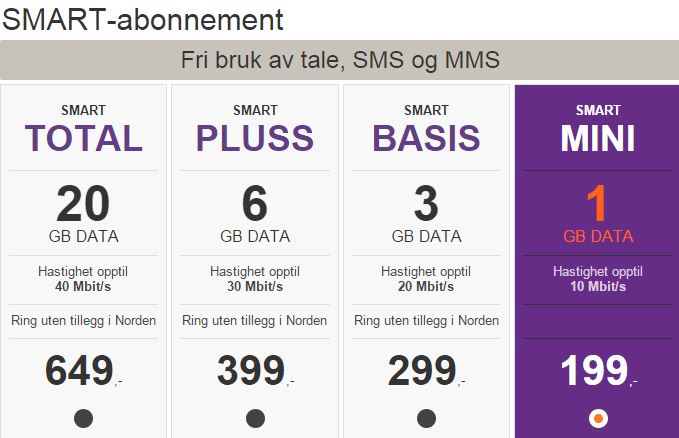

But this doesn’t explain NetCom’s position: NetCom has the same basic policy as Telenor – asking customers to pay for both volume and throughput at the same time:

To complicate things further, both Telenor and NetCom are treating plans differently also when it comes to overage policy. Overage on all but the most expensive plans is penalised charging 5 NOK (0.6 EUR) per Mbyte (yes, Mbyte, not Gbyte) – whereas the most expensive plans are just throttled when the monthly cap is reached.

Has NetCom then been much better selling the most expensive (thereby fastest) plans to their customers? Whereas Telenor’s customers are on the most basic plans?

Even though this might explain some of the difference between NetCom and Telenor, it isn’t the explanation. If so, NetCom would have higher ARPU than Telenor. In reality, Telenor’s ARPU is higher: 45 EUR in 2014 vs. NetCom’s 39 EUR. Leaving one possible explanation:

Whereas Telenor actually slows customers down to the communicated 6, 10, 20, 30, 40 and 50 Mbit/s maximums, NetCom doesn’t. They just pretend they do?

It’s time for Norwegian operators to make up with over-engineered policies and instead start monetising mobile data on volume and nothing but volume. It will be transparent, it will improve the customer experience, Nordics’ lowest data usage will increase and operators’ will be able to up-sell data to customers who used their quota, still thirsting for more.