We have published numerous analyses on mobile data usage. The two latest are:

- Country comparison: “More for more” isn’t happening

- Operator comparison: The luxury of the commodity gigabyte

Our readers also know that we follow operator Wi-Fi closely, see e.g. this piece.

At tefficient, we believe that the world is (or is about to become) mobile-first. But it doesn’t mean that the mobile networks will carry most of the traffic. In contrast, as shown in this post based on OpenSignal data, the regular smartphone user is most often more on Wi-Fi than on mobile networks. And when the smartphone is on Wi-Fi, the traffic volume is often higher since fixed broadband users seldom have to worry about data caps. Mobile operating systems are also set up to prefer (or in the case of upgrades, mandate) Wi-Fi. All Wi-Fi traffic ends up on the fixed access network, not on the mobile access network.

At tefficient, we believe that the world is (or is about to become) mobile-first. But it doesn’t mean that the mobile networks will carry most of the traffic. In contrast, as shown in this post based on OpenSignal data, the regular smartphone user is most often more on Wi-Fi than on mobile networks. And when the smartphone is on Wi-Fi, the traffic volume is often higher since fixed broadband users seldom have to worry about data caps. Mobile operating systems are also set up to prefer (or in the case of upgrades, mandate) Wi-Fi. All Wi-Fi traffic ends up on the fixed access network, not on the mobile access network.

We don’t take a side in the tiring conflict between the cellular camp and the Wi-Fi camp and will continue to argue that it’s not cellular or Wi-Fi, it’s cellular and Wi-Fi. It’s not licensed or unlicensed spectrum, it’s licensed and unlicensed.

For this post we have, for the first time, gathered reported fixed data usage stats from regulators and operators globally to try to answer two questions:

- Are countries with low mobile data usage having higher fixed broadband usage? I.e. is fixed broadband compensating?

- Are countries with high mobile data usage having lower fixed broadband usage? I.e. is mobile ‘cannibalising’ fixed?

Fixed broadband data usage

Let’s first compare how much data usage there is per fixed broadband subscription per month (click to enlarge):

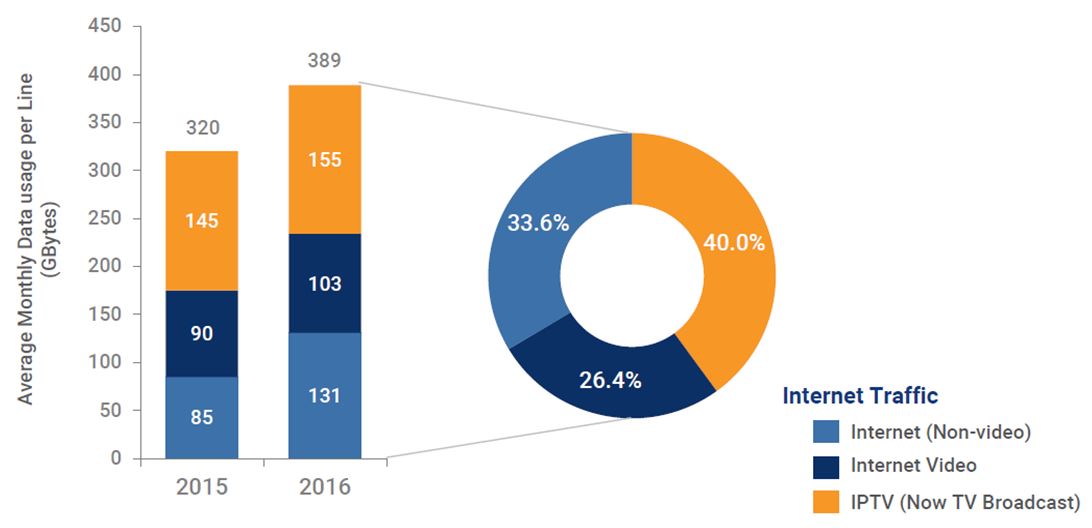

Hong Kong’s HKT tops the chart with an impressive 235 GB per fixed broadband subscription per month in 2016. In reality, HKT’s usage could be even higher – we have in the graph omitted an additional 155 GB of IPTV related usage which would take the average usage to a whopping 389 GB per month, see below.

As you might have guessed, Hong Kong is in general having high fixed data usage. This is shown by Hong Kong following as number 2 in our chart based on stats from Hong Kong’s telecom regulator, OFCA.

In the bottom of our chart you find Germany, Movistar in Argentina and Colombia and DNA of Finland. The average fixed broadband subscriber of DNA only used 26 GB per month in 2016. Have this is mind when we go to the next chart.

Read more: DNA reports higher total mobile data traffic than total fixed data traffic

Mobile data usage

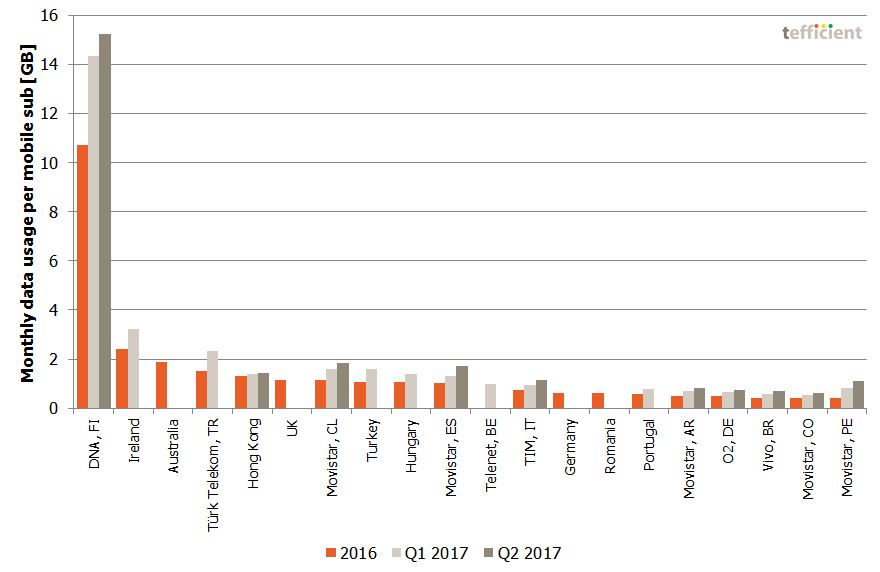

There are many more countries and operators that report mobile data usage than fixed broadband data usage. Our chart below just contains those that report both. [If you want to compare mobile data usage for 111 operators and 33 countries, please check here and here].

Our downsized mobile data usage chart has one operator with an exceptionally high mobile data usage – DNA of Finland. The average mobile subscription used 10.7 GB per month in 2016, 14.3 GB per month in Q1 2017 and 15.2 GB per month in Q2. It is much higher than all other countries and operators in the chart – and an almost unparalleled mobile data usage figure in the world.

Our downsized mobile data usage chart has one operator with an exceptionally high mobile data usage – DNA of Finland. The average mobile subscription used 10.7 GB per month in 2016, 14.3 GB per month in Q1 2017 and 15.2 GB per month in Q2. It is much higher than all other countries and operators in the chart – and an almost unparalleled mobile data usage figure in the world.

What makes the extreme position of DNA extra interesting is of course the extremely low position DNA had in our previous, fixed broadband usage, graph. For DNA it thus seems so that mobile data usage – because of DNA’s unlimited (but speed tiered) contracts – ‘cannibalises’ fixed. But is this also the case for other countries and operators?

Fixed vs. mobile data usage factor

The graph below calculates the factor between fixed broadband data usage per subscription and mobile data usage per subscription. For DNA, this factor is 2x, i.e. the average fixed broadband subscription of DNA carries twice the data volume per month compared to the average mobile subscription of DNA.

It’s clear that DNA’s factor is exceptionally low. In all other cases, the average fixed broadband subscription carries 44 to 300 times more traffic than the average mobile subscription. Likely with a lot of Wi-Fi in play.

A fixed broadband subscriber of Vivo of Brazil used 300 times more data in 2016 than a mobile subscriber of Vivo. The same factor for DNA is 2.

In both the fixed broadband data usage and the mobile data usage charts we could see increasing usage trends from 2016 into Q1 and Q2 2017. But in our factor graph above, we can see a weakening factor trend: Mobile data usage is thus increasing faster than the fixed broadband data usage.

Returning to our two questions:

Are countries with low mobile data usage having higher fixed broadband usage? I.e. is fixed broadband compensating?

![]() Not necessarily. Let’s take Germany as an example. With just 0.6 GB per mobile subscription per month in 2016, Germany is one of the lowest ranked mature markets in mobile data usage. But the average German fixed broadband subscription did only carry 60 GB per month in 2016. Sure, it’s 95x higher than a mobile subscription, but 60 GB isn’t much compared to where other markets are. Fellow EU countries UK, Ireland and Romania are all above 100 GB. Germany’s low usage goes across both mobile and fixed. From a data usage point of view, Germany is one of the least advanced markets in Europe. And with the incumbent Deutsche Telekom still pretending as if FTTH networks are unnecessary – and all German operators just slowly rolling out 4G (and even 3G) – it’s not a quick fix.

Not necessarily. Let’s take Germany as an example. With just 0.6 GB per mobile subscription per month in 2016, Germany is one of the lowest ranked mature markets in mobile data usage. But the average German fixed broadband subscription did only carry 60 GB per month in 2016. Sure, it’s 95x higher than a mobile subscription, but 60 GB isn’t much compared to where other markets are. Fellow EU countries UK, Ireland and Romania are all above 100 GB. Germany’s low usage goes across both mobile and fixed. From a data usage point of view, Germany is one of the least advanced markets in Europe. And with the incumbent Deutsche Telekom still pretending as if FTTH networks are unnecessary – and all German operators just slowly rolling out 4G (and even 3G) – it’s not a quick fix.

Are countries with high mobile data usage having lower fixed broadband usage? I.e. is mobile ‘cannibalising’ fixed?

![]() Based on DNA of Finland, it’s tempting to answer yes. Without a doubt, DNA’s customers use their fixed broadband lines much less as they have mobile subscriptions with unlimited data. But in our sample, there are also markets like Ireland where the mobile data usage is relatively high at the same time as the fixed broadband usage is relatively high. The same can be said for Australia.

Based on DNA of Finland, it’s tempting to answer yes. Without a doubt, DNA’s customers use their fixed broadband lines much less as they have mobile subscriptions with unlimited data. But in our sample, there are also markets like Ireland where the mobile data usage is relatively high at the same time as the fixed broadband usage is relatively high. The same can be said for Australia.

To conclude, it’s not as simple as thinking of data usage as a fixed-sum game where fixed will compensate for mobile or vice versa.

As little as it’s cellular or Wi-Fi, it’s fixed or mobile. It when it’s cellular and Wi-Fi, it’s when it’s fixed and mobile that data usage takes off in a country.

The devices and services we use aren’t cellular or Wi-Fi or fixed or mobile – they are all of it.

A closing remark: If you think this post is based on too little data we can only agree. More regulators and more operators should report also fixed broadband traffic. Best practices? Telefónica that reports both per operating country. And the regulators of Germany, Turkey, Ireland, Hong Kong, Hungary and Romania that transparently report both. We would love to see the regulators of the Nordic countries, Belgium, France, Austria and the Netherlands to follow.