Wi-Fi Calling is relatively new – and then, not really. In 2014, Apple’s launch of iOS 8 with embedded Wi-Fi Calling marked a milestone for voice calling with mobile devices, despite several years of Voice over Wi-Fi services in various guises preceding iOS 8.

Aptilo Networks – a leading provider of carrier-class systems to manage data services with advanced functions for authentication, policy control and charging – has released a White Paper titled “Seamless Next Generation Wi-Fi Calling”, which is written by Allan Greve of tefficient.

Continue reading Wi-Fi Calling – read all about it… →

Continue reading Wi-Fi Calling – read all about it… →

On 11 September 2015, Telia and Telenor announced that they had been unsuccessful in reaching an agreement with the EU Commission for Competition concerning a merger of the two operators in Denmark, which was announced 9 months earlier on 3 December 2014.

On 11 September 2015, Telia and Telenor announced that they had been unsuccessful in reaching an agreement with the EU Commission for Competition concerning a merger of the two operators in Denmark, which was announced 9 months earlier on 3 December 2014.

The concerns from EU presumably centered around a weakened competitive market in Denmark if Telia and Telenor were allowed to merge. As a background, the two companies had already merged their networks into a common JV called TT-Netværket.

So what has happened since – it has now been 5 months or so since the news about the failed merger? So you know what to expect in e.g. the UK and in Italy if the mobile mergers won’t be approved there. Continue reading Denmark – 5 months after the non-merger →

We look at what happened to the MVNO businesses when Orange, SFR and Bouygues launched their sub-brands Sosh, Red and B&YOU during second half of 2011 in preparation for the announced launch of Free mobile.

We look at what happened to the MVNO businesses when Orange, SFR and Bouygues launched their sub-brands Sosh, Red and B&YOU during second half of 2011 in preparation for the announced launch of Free mobile.

MVNOs were once the challengers typically differentiating through targeted segmentation or price – or both. With the emergence of MNO sub-brands one could fear for what happens to MVNOs in a market.

Download analysis: tefficient public industry analysis 3 2014 Impact of sub-brands on MVNOs

Analysis & Consulting, 2014

Presented to the members of the Ambassadors of Telecom organisation in the Netherlands 13 March 2014. The title was “Benchmarking – and the tale of a wing clipped Dutch opportunity”. In addition to tefficient’s approach to benchmarking, we discussed if there is a mobile data dilemma in the Netherlands (comparing to the rest of the world).

Presented to the members of the Ambassadors of Telecom organisation in the Netherlands 13 March 2014. The title was “Benchmarking – and the tale of a wing clipped Dutch opportunity”. In addition to tefficient’s approach to benchmarking, we discussed if there is a mobile data dilemma in the Netherlands (comparing to the rest of the world).

The presented slides can be viewed here.

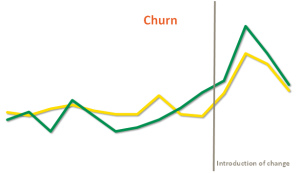

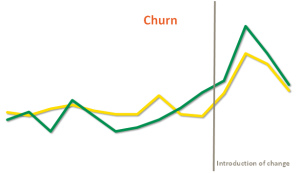

Denmark has had it for more than 10 years, Belgium got it a year ago and now EU proposes it for all of EU: Maximum effective binding period of 6 months for consumer mobile contracts.

Denmark has had it for more than 10 years, Belgium got it a year ago and now EU proposes it for all of EU: Maximum effective binding period of 6 months for consumer mobile contracts.

What happens to a mobile market when such a change is introduced and why is this change actually so significant?

This analysis shows that when Belgian consumers no longer are locked into long contracts, it has a major impact. The question is also if the transition is over in Belgium: Danish figures suggest it might get worse.

Since the EU commission – as part of the 11 September 2013 “Connected Continent: Building a Telecoms Single Market” plan – is proposing that EU consumers should have a similar right to cancel contracts after six months, the question is obviously: Is this also your future?

Download analysis: tefficient public industry analysis 12 2013 Six months contracts

Measure, compare and improve competitiveness in telecoms

We look at what happened to the MVNO businesses when Orange, SFR and Bouygues launched their sub-brands Sosh, Red and B&YOU during second half of 2011 in preparation for the announced launch of Free mobile.

We look at what happened to the MVNO businesses when Orange, SFR and Bouygues launched their sub-brands Sosh, Red and B&YOU during second half of 2011 in preparation for the announced launch of Free mobile. Presented to the members of the Ambassadors of Telecom organisation in the Netherlands 13 March 2014. The title was “Benchmarking – and the tale of a wing clipped Dutch opportunity”. In addition to tefficient’s approach to benchmarking, we discussed if there is a mobile data dilemma in the Netherlands (comparing to the rest of the world).

Presented to the members of the Ambassadors of Telecom organisation in the Netherlands 13 March 2014. The title was “Benchmarking – and the tale of a wing clipped Dutch opportunity”. In addition to tefficient’s approach to benchmarking, we discussed if there is a mobile data dilemma in the Netherlands (comparing to the rest of the world).