At tefficient, we’ve built a comprehensive before/after analysis framework of the results operators have achieved when transforming their offers from single-service to quad-play.

At tefficient, we’ve built a comprehensive before/after analysis framework of the results operators have achieved when transforming their offers from single-service to quad-play.

There are many indications that quad-play is about to become the new European standard: Telekom will go quad-play in Germany during 2014; Vodafone has acquired Kabel Deutschland and Ono to go beyond mobile-only; TeliaSonera reorganised 1 April to converge fixed and mobile on a national basis.

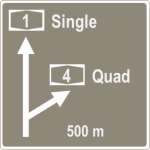

Quad is propagating over Europe with south-westerly winds. The map above shows the wind direction: From Portugal, Spain and France towards Central and North Europe.

The first step towards true quad is often what we call light quad – a discount that a customer gets if he or she adds mobile to triple-play. In this case, it’s typically not very prominent in operator’s marketing, there’s typically no product brand name, and far from the straight-forward pitch of true quad operators.

The current position of European operators – who have quad capability – is seen in our quad pyramid above. The arrows indicate operators that are seen to take action to move upwards.

Through our before/after analysis, we’ve spotted several very interesting outcomes – best as well as worst practices. These can be used to either prepare your own journey into quad – or understand how to best defend against quad-capable competitors.

Analysis of operator business upsides and downsides when launching 4G LTE. Commissioned by Comptel. Live presentation of an extract of the analysis, titled “Pinpoint the right customers: LTE handsets in wrong hands will dilute margin” to Comptel’s customers at two occasions during MWC in Barcelona.

Analysis of operator business upsides and downsides when launching 4G LTE. Commissioned by Comptel. Live presentation of an extract of the analysis, titled “Pinpoint the right customers: LTE handsets in wrong hands will dilute margin” to Comptel’s customers at two occasions during MWC in Barcelona.