Analysis & Go-to-market 2015

In cooperation with key Comptel experts, writing and editing key parts of Comptel’s book “Operation Nexterday” which was launched at Mobile World Congress 2015.

In cooperation with key Comptel experts, writing and editing key parts of Comptel’s book “Operation Nexterday” which was launched at Mobile World Congress 2015.

Analysis & Go-to-market 2015

In cooperation with key Comptel experts, writing and editing key parts of Comptel’s book “Operation Nexterday” which was launched at Mobile World Congress 2015.

In cooperation with key Comptel experts, writing and editing key parts of Comptel’s book “Operation Nexterday” which was launched at Mobile World Congress 2015.

Dutch operators KPN and Vodafone were both fined for violations of net neutrality today.

KPN got a fine of 250000 EUR for having blocked access to voice over IP services on public Wi-Fi hotspots. Vodafone was fined 200000 EUR for having zero-rated content from HBO. Continue reading Four years (and a net neutrality law) later, Dutch operators foul again

Bucket plans – with volume caps on the number of minutes, messages and Mbytes – have been offered by mobile operators for years. Even though the composition has varied over time (e.g. through elements made unlimited), the concept is well known to customers.

Bucket plans – with volume caps on the number of minutes, messages and Mbytes – have been offered by mobile operators for years. Even though the composition has varied over time (e.g. through elements made unlimited), the concept is well known to customers.

Monthly caps have become the standard of our industry. Another standard is to reset those caps at the start of a new month. This means that any balance left – minutes, messages, Mbytes – is voided. Or confiscated – to use the word of John Legere, CEO of T-Mobile USA. Continue reading Rollover: The next big thing for customer retention

Analysis & Consulting, 2014

Preparing and presenting “How are telcos, cellcos and cablecos using Wi-Fi to strengthen existing business?” for 200 participants at the Wi-Fi Innovation Summit in Copenhagen 9-10 December.

Preparing and presenting “How are telcos, cellcos and cablecos using Wi-Fi to strengthen existing business?” for 200 participants at the Wi-Fi Innovation Summit in Copenhagen 9-10 December.

Some of the presented content is available in this analysis.

Analysis & Consulting, 2014

Independently identifying and presenting customer-specific initiatives to increase efficiency to a key customer operator of a global services provider.

Analysis & Go-to-market, 2014

Analysis & Go-to-market, 2014

How have operators introduced mobile-fixed convergent quad-play in Europe’s most advanced markets France, Spain, Portugal – and in emerging quad markets like Belgium, the Netherlands, the UK and Germany? How has competition reacted?

Using facts: How have these quad introductions affected market share, churn, acquisition & retention cost, demand for mobile, fibre-speed broadband and TV – and revenue and margin? Which defensive actions can non-convergent operators take?

Which factors can be attributed to effective take-up of quad play? Market share, fibre deployment and homepass, TV offers, exclusive content – or is it just about bundling discounts? What discount levels are we talking about?

Based on international facts and best practice, what would tefficient recommend? Taking local conditions, operator strategy and market position into account.

Commissioned by two operators.

It’s been more than two years since the June 2012 launch of Verizon’s shared data plan which took out all other Verizon postpaid plans at one go. From this point on, new Verizon customers (or prolonging customers) had to take the Share Everything plan (later renamed More Everything). The initiative was Verizon’s final attempt to get rid of unlimited data and make usage-based data monetisation a reality.

It’s been more than two years since the June 2012 launch of Verizon’s shared data plan which took out all other Verizon postpaid plans at one go. From this point on, new Verizon customers (or prolonging customers) had to take the Share Everything plan (later renamed More Everything). The initiative was Verizon’s final attempt to get rid of unlimited data and make usage-based data monetisation a reality.

Since the standard US postpaid contract is running for 24 months, we should after two years consequently see a 100% adoption of Share/More Everything within Verizon’s postpaid accounts? No, it is 55%.

Verizon’s primary competitor, AT&T, launched their shared data plan, Mobile Share, in August 2012. Unlike Verizon, they kept other postpaid plans available to begin with. More than one year later, in October 2013, Mobile Share was eventually made the only plan. AT&T reports that 56% of their postpaid SIMs are on Mobile Share. Still not 100%.

Verizon’s primary competitor, AT&T, launched their shared data plan, Mobile Share, in August 2012. Unlike Verizon, they kept other postpaid plans available to begin with. More than one year later, in October 2013, Mobile Share was eventually made the only plan. AT&T reports that 56% of their postpaid SIMs are on Mobile Share. Still not 100%.

In its Q2 reporting of yesterday, AT&T says that 80% of postpaid smartphone subscribers are on usage-based data plans. Leaving 20% of smartphone subscribers (plus a bunch of data-only subscribers – no reporting for that segment) that still are unlimited.

Verizon and AT&T’s principal method to convince customers to let go of their unlimited plans has been equipment subsidy: You wouldn’t get any unless you go for the new plans.

But T-Mobile’s disruption of the subsidy model – later embraced by AT&T and (somewhat reluctantly) implemented by Verizon – has led to US customers shifting away from subsidy, instead going for installment plans or BYOD. And with these models, customers can easier hold onto their grandfathered unlimited data plans.

Analysis and Go-to-market, 2014

Download the analysis, commissioned by Comptel ![]() and published 2 June 2014 here.

and published 2 June 2014 here.

The reporting of Telefónica, PT and Orange show that quad-play is a hit in Spain, Portugal and France. Vodafone used 14,9 billion EUR to acquire cablecos in Germany and Spain – to enable quad.

Operators need to be realistic about the positives quad-play can bring and use facts to spot best practice. tefficient’s framework provides a great start if entering quad – or facing competition that do.

At tefficient, we’ve built a comprehensive before/after analysis framework of the results operators have achieved when transforming their offers from single-service to quad-play.

At tefficient, we’ve built a comprehensive before/after analysis framework of the results operators have achieved when transforming their offers from single-service to quad-play.

There are many indications that quad-play is about to become the new European standard: Telekom will go quad-play in Germany during 2014; Vodafone has acquired Kabel Deutschland and Ono to go beyond mobile-only; TeliaSonera reorganised 1 April to converge fixed and mobile on a national basis.

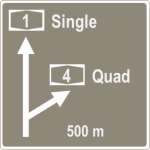

Quad is propagating over Europe with south-westerly winds. The map above shows the wind direction: From Portugal, Spain and France towards Central and North Europe.

The first step towards true quad is often what we call light quad – a discount that a customer gets if he or she adds mobile to triple-play. In this case, it’s typically not very prominent in operator’s marketing, there’s typically no product brand name, and far from the straight-forward pitch of true quad operators.

The current position of European operators – who have quad capability – is seen in our quad pyramid above. The arrows indicate operators that are seen to take action to move upwards.

Through our before/after analysis, we’ve spotted several very interesting outcomes – best as well as worst practices. These can be used to either prepare your own journey into quad – or understand how to best defend against quad-capable competitors.