In our latest mobile data usage and revenue analysis, there are 43 countries. Of these, 27 are European. And among these, about half (13) of the regulators are not just reporting the mobile data traffic but also the fixed broadband traffic.

It allows us to compare the two and answer the question “is mobile eating fixed’s lunch?”

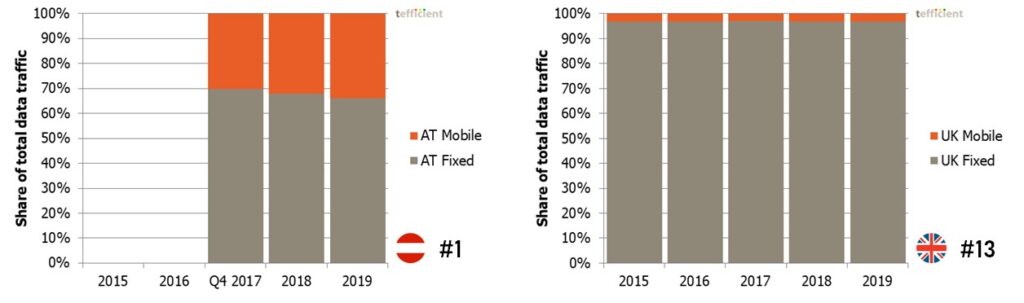

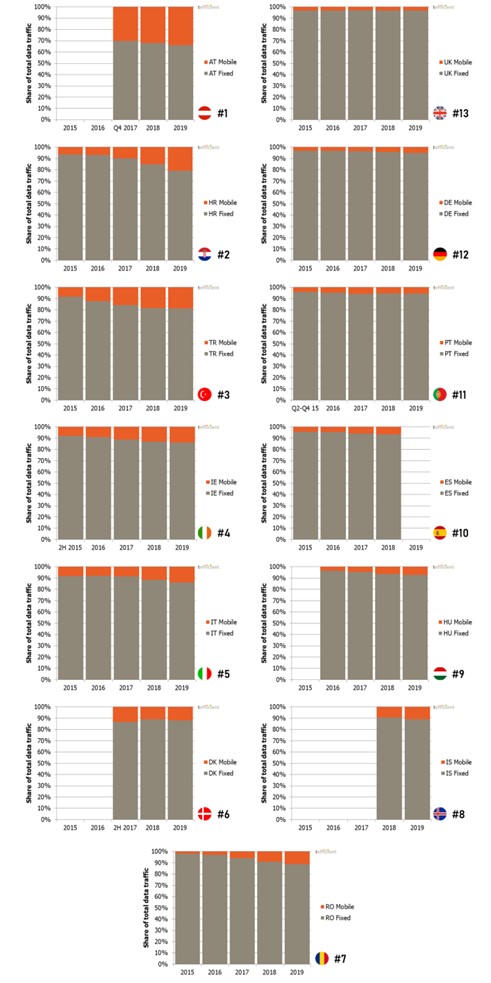

Let’s start with Austria 🇦🇹. No other reporting European country has a higher share of the total data traffic over mobile as Austria. In 2019, it was 34%. A major reason to the high share is that 76% of the mobile data traffic is generated by data-only subscriptions. Most of these are fixed wireless (FWA) type of subscriptions, serving a household or a business with general internet access via a Wi-Fi router using 4G, sometimes 5G, as backbone. That router is seldom very mobile; it typically sits still in the kitchen window. Although these home routers initially were brought to the market by Drei (3), all the Austrian operators have sold them for quite some time by now. Most often they are mobile-only, but there are also hybrid versions available in which mobile adds to the speed of fixed.

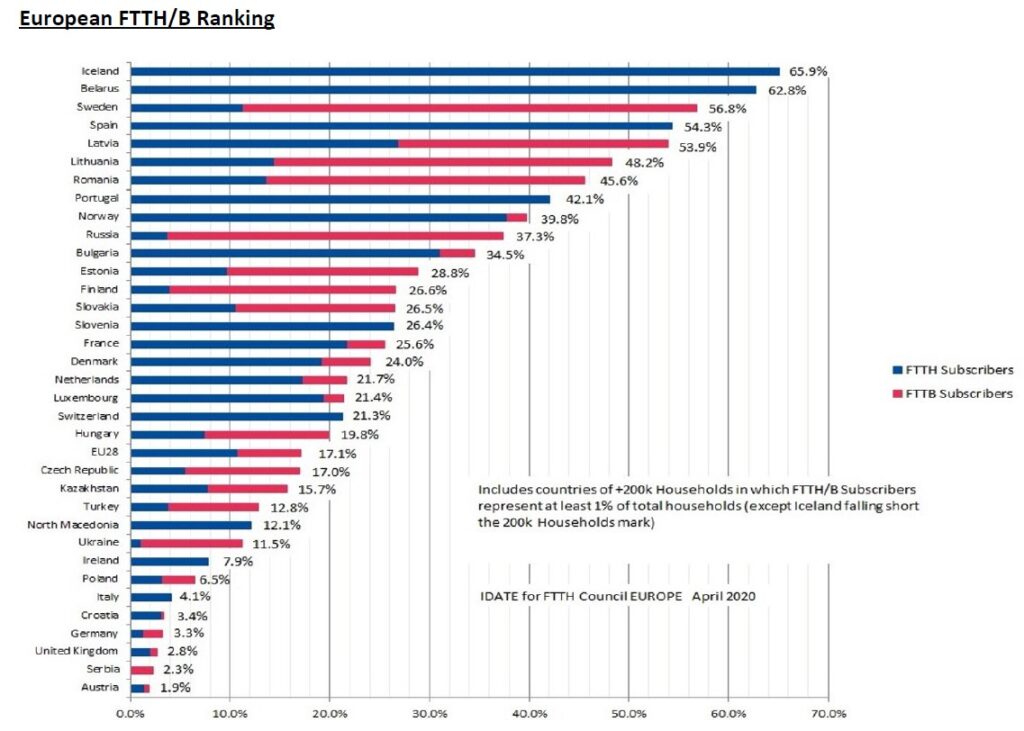

It’s often so that mobile internet is faster than fixed internet in Austria. An explanation to it is that Austria is one of Europe’s fibre laggards. In the latest ranking of FTTH Council Europe, Austria is ranked last of all European countries with just 1.9% of households subscribing to FTTH or FTTB broadband. And even if that figure grew somewhat over the years, you can see in our Austrian chart above that mobile represented a larger share of the Austrian data traffic in 2019 than in 2018 and in Q4 2017 (when the regulator RTR started to report fixed data traffic).

At the other end of our scale – as number 13 of 13 – we find the UK 🇬🇧. No other country has as small share of its total data traffic over mobile; just 3%. In the UK graph above you can also see that the mobile share of traffic hasn’t really grown over the years.

Interestingly, fibre connectivity in the UK is almost as unusual as in Austria. Just 2.8% of households subscribe to FTTH of FTTB broadband according to FTTH Council Europe. That ranks the UK third from the bottom.

Although UK fixed broadband is almost entirely DSL or cable based, the average fixed broadband connection still consumed a very high 315 GB per month in 2019 according to the regulator, Ofcom. But the appetite for mobile data is much lower – 3 GB per month. In contrast to Austria, FWA subscriptions are almost unheard of in the UK. Three (3) has readdressed the segment in a 5G context since its acquisition and rebranding of Relish. The limitations of Huawei equipment in the 5G networks of the UK (where Three bet more on Huawei than others) might have affected Three’s ability to deliver on its FWA promises. (As you know, that debate has now opened up again).

Let’s move further into our list. From top (left column) and from the bottom (right column).

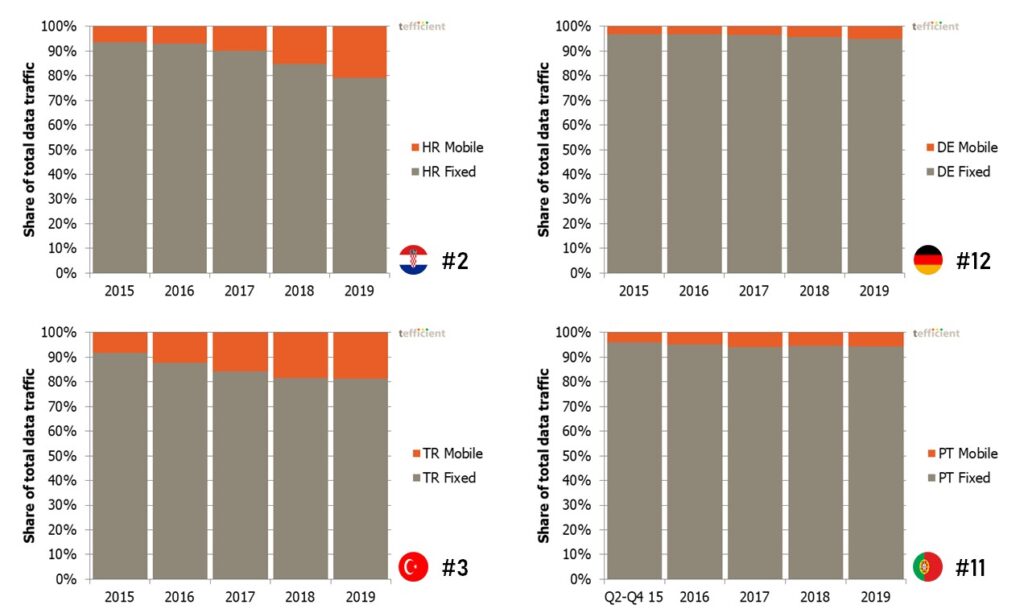

Second-ranked Croatia 🇭🇷 had 21% of the total data traffic over mobile networks in 2019. As you can see in the graph above, that share is growing rapidly, driven by very affordable unlimited mobile data plans.

Turkey 🇹🇷 is ranked as number three with 19%. Its profile is similar to Croatia, but the development didn’t continue in 2019.

If we move to the bottom of our list again, we can see that Germany 🇩🇪 is second last as number 12. With just 1.7 GB per mobile subscription per month in 2019, Germany has one of the lowest mobile data usage levels in the world – but it still represents 5% of the total data traffic. In contrast to the UK, not even the fixed broadband usage is high in Germany. Europe’s largest economy is also ranked fourth from the bottom in FTTH Council Europe’s ranking with just 3.3%. For years, Deutsche Telekom fought the notion of (full) fibre connectivity, but has finally started to plan for FTTH rollout, often in partnership with others.

If we look at the graph for Portugal 🇵🇹 above, it looks almost identical to Germany’s. Portugal has as low mobile data usage as Germany, 1.7 GB. But where Germany has super-low fibre take-up, Portugal is one of Europe’s leaders with 42.1% FTTH adoption. Yet these two countries have the same mix between fixed and mobile data traffic.

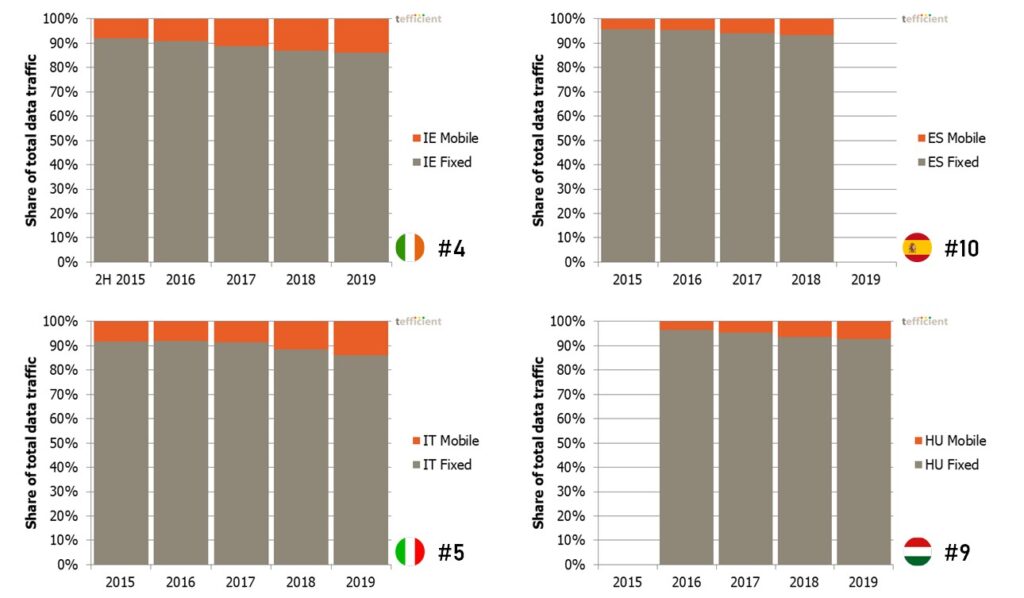

If we move further into our top/bottom lists, we find Ireland 🇮🇪 as number four. 14% of the total data traffic was carried by mobile networks in 2019 – and that share grew every year. While the fibre adoption in Ireland is low, but not totally hopeless; 7.9%, unlimited mobile data plans have gained traction in Ireland since 2019.

Not only is the flag of Italy 🇮🇹 similar to Ireland, the azure country had the same 14% split between mobile and fixed data traffic as Ireland. But it was only in 2018 that the mobile share of traffic started to grow. This aligns with the launch of the new fourth MNO in Italy – Iliad. This sister operation of the enfant terrible Free in France fundamentally disrupted the Italian mobile market. From May 2018, Iliad provide dirt cheap offers including much more mobile data than previously seen in Italy. The churn of the competing networks Wind Tre, TIM and Vodafone jumped and Iliad has to date gained 6 million mobile subscribers. To mitigate Iliad’s growth, the competitors (just like Free’s competitors did in France), launched or renewed sub-brands featuring almost as good propositions as Iliad. The result was an explosion in the mobile data consumption in 2018 and 2019 – clearly visible in the Italian chart above.

Italy is another of Europe’s fibre laggards with an adoption of 4.1%. But a lot of activity is currently ongoing to change this. There is perhaps more bad news for the incumbent TIM in that Iliad just a few days ago signed an agreement with the independent fibre provider Open Fiber. Iliad’s plan was always to move into fixed too, but the company has now accelerated that plan.

Going back to the collection of graphs above, we note that in Spain 🇪🇸, mobile data traffic only consisted of 7% of the total data traffic in 2018 (2019 data for fixed is not yet available from the CNMC), but that its share is growing although Spain is one of Europe’s absolute fibre leaders with 54.3% FTTH adoption. Spain is also the country in Europe where fixed-mobile convergence (FMC) has the strongest foothold, so it’s a bit surprising to see that Spain doesn’t look like the UK or Germany with even more of the traffic on fixed networks. The affordability of mobile data has improved in Spain, though – driven by the strengthened position of Másmóvil group. Through numerous brands, Másmóvil takes market share in mobile but also in fixed broadband and in the converged market.

The graph of ninth-ranked Hungary 🇭🇺 looks very much like Spain’s graph. The fibre adoption in Hungary is at 19.8%.

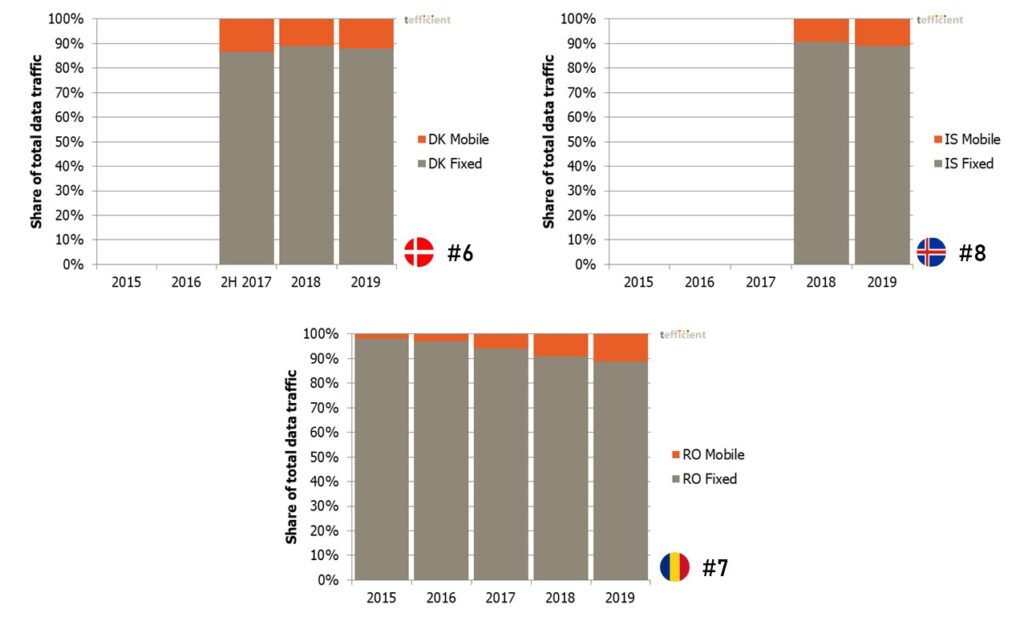

Finally our mid-ranked countries; see below. In Denmark 🇩🇰, 12% of the total data traffic in 2019 was carried by mobile networks. It’s quite a high share given Denmark’s compact size and few truly rural areas. It’s even higher considering that none of the Danish operators were keen to push FWA plans. Until February 2019 when Tre (3) launched ‘Internet til hjemmet’ with 1 terabyte of data for 230 DKK per month (31 EUR), modem included. According to Tre, this has been a success. The fibre adoption in Denmark is mid-ranked at 24.0% but its distribution is highly unusual for a country in that the adoption is higher outside of the most populous areas. The explanation is that the incumbent, TDC, decided not to do fibre but instead rely on its YouSee cable TV network for faster broadband. That decision allowed the Danish energy companies to find a new adjacent business – fibre connectivity. Their rollout came to focus on areas outside of the largest cities where they had most of their household electricity customers. In 2018, TDC finally reversed its fibre-avoidance strategy following a change in ownership that saw Macquarie and a consortium of Danish pension funds take full control over the company. Today, TDC is playing catch-up in fibre and has upped its investment level significantly.

Romania 🇷🇴 is the middle market in our analysis. If you think high fibre adoption comes to high GDP markets first, think again. Romania has been one of Europe’s fibre spearheads and its current adoption is 45.6%. Even if so, mobile’s share of data traffic is growing quickly and was 11% in 2019.

Finally Iceland 🇮🇸: 11% of the data traffic was mobile in 2019 and that share is growing (data on fixed wasn’t reported until 2018) although Iceland leads FTTH Council Europe’s ranking with 65.9% FTTH adoption. Also here unlimited mobile data plays a role. The challenger operator Nova carried a whopping 61% of the mobile data traffic in the country in 2019. According to our own analysis as summarised in the tweet below, this is higher than any other operator in Europe.

The 61% of mobile traffic is almost double that of Nova’s market share in mobile subscriptions, which is 33%. Nova is keen on unlimited mobile data and is less involved in the fibre market where its share is 19%.

So, is mobile eating fixed’s lunch? Let’s visually inspect all thirteen countries at once:

Mobile’s share of total traffic is growing in every country. So, yes, mobile is eating from fixed’s plate. But it also true to say that mobile isn’t dominating fixed anywhere – not even in Austria.

There are also markets where the mobile data traffic hardly can’t be seen if plotted on the same scale as the fixed traffic: UK and Germany. These two countries are unusually fixed and Wi-Fi centric – and here’s the irony – they are also European laggards in fibre adoption. Copper huggers?

The gradual introduction of unlimited FWA will continue to direct more of the total data traffic to mobile networks (even though that use case isn’t mobile). We sense that operators that haven’t yet tried unlimited FWA (like almost all operators in Germany and the UK) are considering it in a 5G perspective. If not throughout the country, then at least in certain regions.

So even though the fixed data traffic will continue to grow, mobile’s share of the total data traffic will too. Mobile is eating some of fixed’s lunch but that lunch plate is growing.

Now that so many countries have taken up that practice to report also fixed data traffic, we’d like to recommend regulators in all other European countries to start too. We know that the mobile data usage is very high in e.g. Finland and that Sweden is a European fibre adoption leader and we believe that data for more countries would allow a yet better comparison between mobile and fixed data traffic.