Reference: Analysis and Go-to-market, 2018

Quantitative and qualitative exploration and analysis project starting with a Nonstop Retention® benchmark for a specific country market.

Analysing a wide area of propositions and tactics from several different markets:

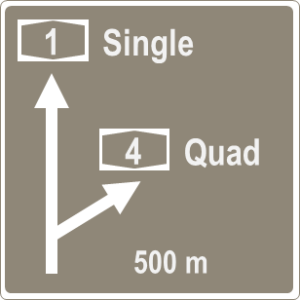

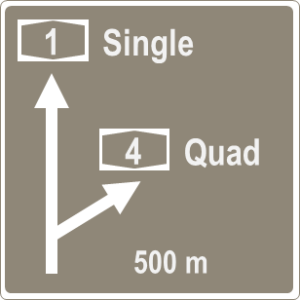

- Multi-user and multi-device plans

- Fixed-mobile convergent plans

- Premium value plans and options

- Flexible plans and sub-brands

- Early upgrade plans for handsets

- Loyalty programmes

Identifying best practice with regards to impact on revenue, take-up and customer loyalty. Applying it to the local market competitive context, resulting in a recommendation presented during interactive workshops.

Continue reading How to continue to improve mobile service revenue and customer loyalty →

Analysis and Go-to-market, 2016

Nonstop Retention® benchmark: Calculating and comparing the Nonstop Retention Index for mobile brands (MNOs, sub-brands and main MVNOs) in one specific major European market. Identifying best practice and showing current trends. Recommending propositions and actions to improve customer loyalty per brand.

Nonstop Retention® benchmark: Calculating and comparing the Nonstop Retention Index for mobile brands (MNOs, sub-brands and main MVNOs) in one specific major European market. Identifying best practice and showing current trends. Recommending propositions and actions to improve customer loyalty per brand.

European quad-play best practice: Fact-based before/after analysis of how the introduction of quad-play propositions changed key business Continue reading Nonstop Retention benchmark and European quad-play best practice →

European quad-play best practice: Fact-based before/after analysis of how the introduction of quad-play propositions changed key business Continue reading Nonstop Retention benchmark and European quad-play best practice →

Even though there are some high-profiled exceptions (Verizon, most of Vodafone Group and Free to mention three), few telcos are today trusting its ability to attract all customer segments – across consumer and business markets – with one single brand.

Having one or several sub-brands has become the norm of a modern telco. In some cases, e.g. with KPN’s Telfort and TDC’s Telmore, sub-brands have been added as a result of acquisitions (often of a successful disruptive brand). In other cases, e.g. Orange’s Sosh or 3 Denmark’s Oister, telecos have themselves created the sub-brand – often with the intention to isolate the main brand from a new price fighter brand. Continue reading When your sub-brand takes over →

We look at what happened to the MVNO businesses when Orange, SFR and Bouygues launched their sub-brands Sosh, Red and B&YOU during second half of 2011 in preparation for the announced launch of Free mobile.

We look at what happened to the MVNO businesses when Orange, SFR and Bouygues launched their sub-brands Sosh, Red and B&YOU during second half of 2011 in preparation for the announced launch of Free mobile.

MVNOs were once the challengers typically differentiating through targeted segmentation or price – or both. With the emergence of MNO sub-brands one could fear for what happens to MVNOs in a market.

Download analysis: tefficient public industry analysis 3 2014 Impact of sub-brands on MVNOs

Measure, compare and improve competitiveness in telecoms

We look at what happened to the MVNO businesses when Orange, SFR and Bouygues launched their sub-brands Sosh, Red and B&YOU during second half of 2011 in preparation for the announced launch of Free mobile.

We look at what happened to the MVNO businesses when Orange, SFR and Bouygues launched their sub-brands Sosh, Red and B&YOU during second half of 2011 in preparation for the announced launch of Free mobile.