Austria, with a population of 8.5 million, used to have five mobile network operators, making it one of the most competitive mobile markets in Europe. Now there are three left.

When Hutchison-Whampoa, the owner of ‘3’, made a bid on Orange, the European Union needed 11 months to approve it. EU appears to have changed their thinking since. It’s roaming that is under scrutiny now: If operators would agree to abolish roaming fees within EU, maybe EU could be more forgiving to national M&A?

Consequently, European operator executives are publicly advocating the need to cut the number of mobile operators to three per country. If Telefónica’s bid for E-plus in Germany is approved by KPN’s shareholders and by the EU, it will be the ultimate starting signal for Europe’s march towards national consolidation: If it can be done in EU’s largest country, why not elsewhere?

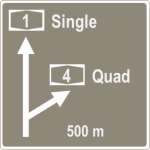

But since Austria serves as the 4-to-3 precedent of Europe, let’s check what the first six months with three mobile operators did to the business results.

Download analysis: tefficient public industry analysis 10 2013 From 4 to 3 Austria

Analysis of operator business upsides and downsides when launching 4G LTE. Commissioned by Comptel. Live presentation of an extract of the analysis, titled “Pinpoint the right customers: LTE handsets in wrong hands will dilute margin” to Comptel’s customers at two occasions during MWC in Barcelona.

Analysis of operator business upsides and downsides when launching 4G LTE. Commissioned by Comptel. Live presentation of an extract of the analysis, titled “Pinpoint the right customers: LTE handsets in wrong hands will dilute margin” to Comptel’s customers at two occasions during MWC in Barcelona.