2013 ended with over 1 billion smartphones sold – a new record. But mature market operators should look at Korea as a projection of what will come: It is the world’s most advanced LTE market based on penetration and usage levels.

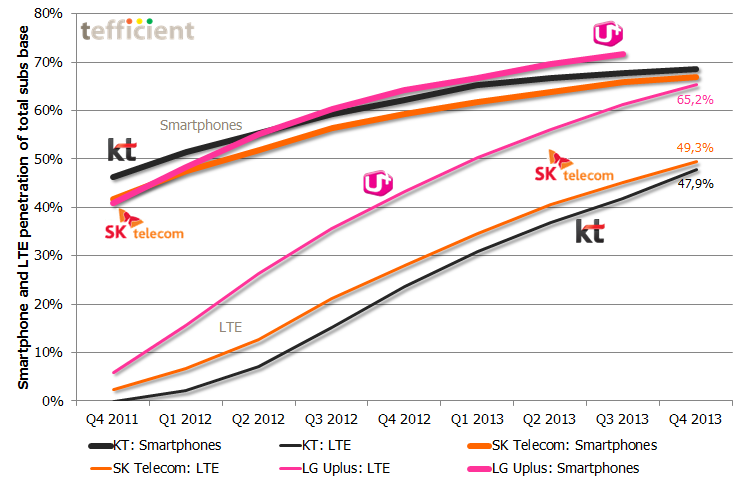

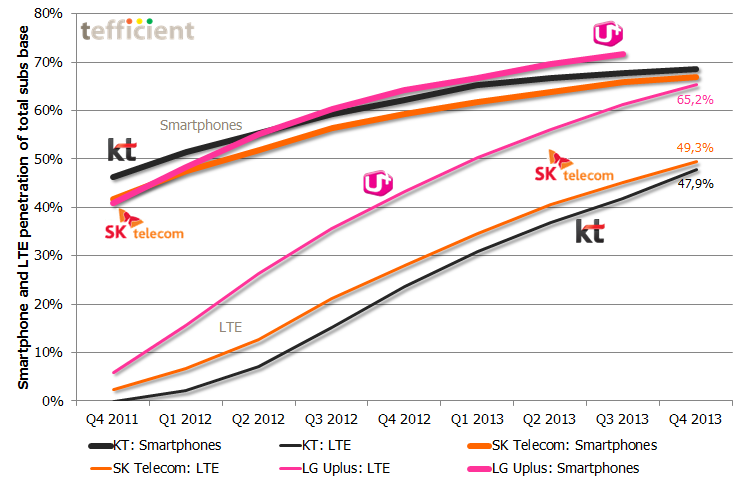

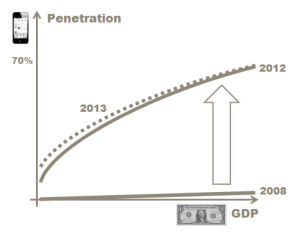

The operators in Korea – SK Telecom, KT and LG Uplus – are continuing to sell a lot of LTE equipment to its customers, even though sales slowed somewhat during 2013. But whereas the sales of LTE equipment earlier led to a lift in overall smartphone penetration, it looks as if it’s not going to drive smartphone penetration very much longer: See how the three top curves in the graph slow down even though the LTE curves go up.

Note: LG Uplus hasn’t yet stated overall smartphone penetration for Q4 2013. Non-LTE smartphones are soon phased out of LG Uplus.

In the world’s most advanced LTE market, LTE seems to run out of fuel. Existing smartphone customers do upgrade to LTE smartphones, but the overall smartphone penetration in Korea doesn’t climb above 70% [SK Telecom holds 50% of market, KT 30% and Uplus 20%]. If we extrapolate, the LTE penetration will equal the smartphone penetration during 2014 – more or less.

For mature market operators believing in LTE’s ability to take smartphone penetration levels beyond the 70% level observed today in countries like e.g. Sweden, Norway, the Netherlands, Australia, the UK and France this is bad news. The Korean development indicates that LTE as such is not enough.

The situation resembles 2007 – before the arrival of the iPhone. Incremental improvements had made products from e.g. Nokia the best ever, but disruption was needed to create new growth. iPhone was the catalyst in 2007. The mobile world – including Apple – are back into incremental improvements and the current products are the best ever. From where will the innovation come that creates new growth in mature markets?

Of global smartphone shipments Q3 2013, the four major operating systems stood for 99.4% – entirely dominated by Android. Why on earth should telecom operators then care to support the remaining 0.6%? Like Firefox, Tizen, Ubuntu and Sailfish?

Of global smartphone shipments Q3 2013, the four major operating systems stood for 99.4% – entirely dominated by Android. Why on earth should telecom operators then care to support the remaining 0.6%? Like Firefox, Tizen, Ubuntu and Sailfish?

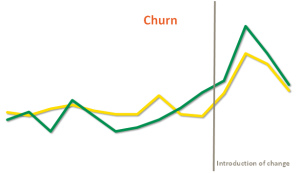

An amazing growth story comes to an end: Smartphone penetration isn’t really growing any longer in mature markets. Smartphones are still sold in high volumes, but the difference is that they’re now primarily sold – subsidised or not – to existing smartphone owners, who upgrades.

An amazing growth story comes to an end: Smartphone penetration isn’t really growing any longer in mature markets. Smartphones are still sold in high volumes, but the difference is that they’re now primarily sold – subsidised or not – to existing smartphone owners, who upgrades.