The subsidy model – which dominated operators’ handset and equipment sales in mature markets for decades – is rightfully retiring. It wasn’t a brilliant idea to discount goods not produced inhouse (taking cost pressure away from equipment manufacturers like Apple) and, to compensate, overcharge for the services actually produced (making over-the-top services and Wi-Fi more attractive). Continue reading Churn: Still a concern

Category Archives: Analysis

4G LTE coverage: Europe catching up, led by less populated countries

For a long time, lobbyists used the 4G LTE rollout and -adoption discrepancy between US and Korea/Japan (on one hand) and Europe (on the other hand) as a “proof” of too rigid European telecom regulation.

The basic fact that major US, Korean and Japanese operators are running CDMA2000 without the European possibility to gracefully migrate to 4G LTE was tactically neglected in this comparison. Continue reading 4G LTE coverage: Europe catching up, led by less populated countries

“Peak data” in sight

This is tefficient’s 10th public analysis on the development of mobile data usage. For the first time, we see clear signs of saturation.

This is tefficient’s 10th public analysis on the development of mobile data usage. For the first time, we see clear signs of saturation.

Operators’ squeeze-out of unlimited customers continues. The growth in smartphone penetration has levelled out in high usage markets. 4G is becoming mainstream. Public Wi-Fi starts to disrupt.

Are we approaching “peak data”?

Download analysis: tefficient industry analysis 7 2014 mobile data usage peak ver 2

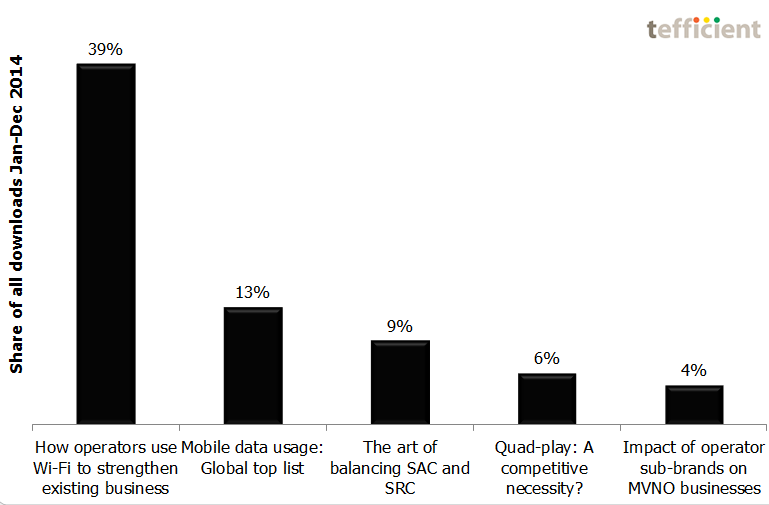

New operator Wi-Fi analysis: Straight to the top

Our new public analysis of How operators use Wi-Fi to strengthen existing business went right into the No 1 position of most downloaded in 2014 – even though it was made available as late as 8 December.

The presentation at the Wi-Fi Innovation Summit seems to have created a lot of interest: The analysis was downloaded 800 times in the two weeks thereafter.

You’ll find the other top 5 analyses – and a few more – at the Analysis page.

Speaker at the Wi-Fi Innovation Summit

Analysis & Consulting, 2014

Preparing and presenting “How are telcos, cellcos and cablecos using Wi-Fi to strengthen existing business?” for 200 participants at the Wi-Fi Innovation Summit in Copenhagen 9-10 December.

Preparing and presenting “How are telcos, cellcos and cablecos using Wi-Fi to strengthen existing business?” for 200 participants at the Wi-Fi Innovation Summit in Copenhagen 9-10 December.

Some of the presented content is available in this analysis.

How operators use Wi-Fi to strengthen existing business

Wi-Fi has become a tool in the operator toolbox. In this analysis – our third on the subject – we show how telcos, cellcos and cablecos use Wi-Fi to strengthen existing business. It’s a mixture of hotspots, homespots and new business models.

Wi-Fi has become a tool in the operator toolbox. In this analysis – our third on the subject – we show how telcos, cellcos and cablecos use Wi-Fi to strengthen existing business. It’s a mixture of hotspots, homespots and new business models.

Time is right for operators to include Wi-Fi into a combined connectivity experience for customers – a carrier-grade experience. This analysis contains the best practices and the motivation you need.

Download analysis: tefficient public industry analysis 6 2014 How operators use Wi-Fi to strengthen existing business

Identifying non-traditional initiatives to increase efficiency

Analysis & Consulting, 2014

Independently identifying and presenting customer-specific initiatives to increase efficiency to a key customer operator of a global services provider.

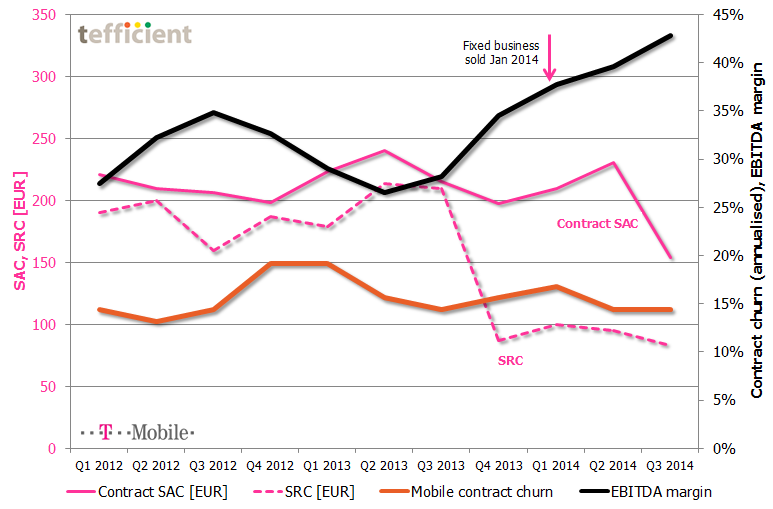

How to improve EBITDA margin from 28% to 43% in 12 months

T-Mobile in the Netherlands continues its rally towards higher EBITDA margin: One year ago, it was 28%. Now it’s 43%. T-Mobile’s reported figures shows just how sensitive sales costs are to the mobile business margin.

In Q4 2013, T-Mobile cut its subscriber retention cost (SRC) from a level above 200 EUR to less than half. It has stayed at the new, lower, level since. Even though done during fourth quarter – where margin normally is weak due to seasonal sales – T-Mobile’s EBITDA margin took a leap upwards quarter-to-quarter. Another leap came in Q1 2014 when T-Mobile sold its fixed business (traded under the “Online” brand).

In the just-reported third quarter, T-Mobile’s EBITDA margin took yet a leap: This time due to a significant reduction in contract SAC (subscriber acquisition cost).

The text book says that such dramatic reductions in SAC/SRC would immediately penalise T-Mobile who would experience a shrinking base and market share since existing customers would churn out and new customers would’t join. The interesting thing is that existing customers haven’t left: The orange curve shows a stabilising contract churn of about 15%. T-Mobile has, however, still experienced a decline in their total base, but this has mainly been within prepaid. [The reported reduction in Q3 was almost exclusively to the disposal of the Simpel brand].

According to T-Mobile, the answer to how this has been possible comes in two parts:

- Increasing mobile data usage and revenue

- Increasing revenue from equipment

In a market where T-Mobile’s two current MNO competitors KPN and Vodafone both go in the converged multi-play direction, it will be interesting to follow if T-Mobile can stay on this route – especially as Tele2 is about to enter the Dutch market as MNO within short.

Quad and convergent play: tefficient provides fact-based recommendations

Analysis & Go-to-market, 2014

Analysis & Go-to-market, 2014

How have operators introduced mobile-fixed convergent quad-play in Europe’s most advanced markets France, Spain, Portugal – and in emerging quad markets like Belgium, the Netherlands, the UK and Germany? How has competition reacted?

Using facts: How have these quad introductions affected market share, churn, acquisition & retention cost, demand for mobile, fibre-speed broadband and TV – and revenue and margin? Which defensive actions can non-convergent operators take?

Which factors can be attributed to effective take-up of quad play? Market share, fibre deployment and homepass, TV offers, exclusive content – or is it just about bundling discounts? What discount levels are we talking about?

Based on international facts and best practice, what would tefficient recommend? Taking local conditions, operator strategy and market position into account.

Commissioned by two operators.

Early upgrade plans: Sweet now. Turns sour?

The equipment instalment plan has proven capable of substituting the subsidy model in mobile – even in traditional subsidy markets like the USA and the UK.

The equipment instalment plan has proven capable of substituting the subsidy model in mobile – even in traditional subsidy markets like the USA and the UK.

While the EIP opens for more competitive service pricing, it also opens for flexibility when it comes to equipment upgrades: Pay remaining instalments – and upgrade. Some operators go further, though:

Realising that customers aren’t particularly interested in obtaining the ownership of (aged) equipment, pioneering operators introduced a variant of the EIP – based on an early return of equipment: The early upgrade plan.

It’s a recurring upgrade promise – often without any additional fee. Take-up has been great, but it’s only now the pioneering operators need to start delivering on this promise.

Download analysis: tefficient industry analysis 5 2014 early upgrade plans 19 Sep