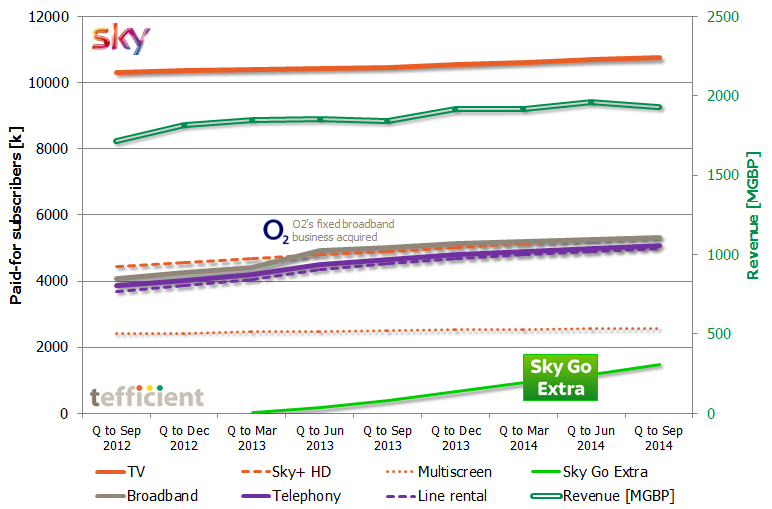

You have to admire the way Sky continues to grow customer base and revenue in the UK and Ireland. Most of us thought that satellite TV belonged in the past century, but Sky has through constant development of their products and offerings, by e.g. integrating broadband, multi-screen and streaming, revitalised and modernised the customer experience.

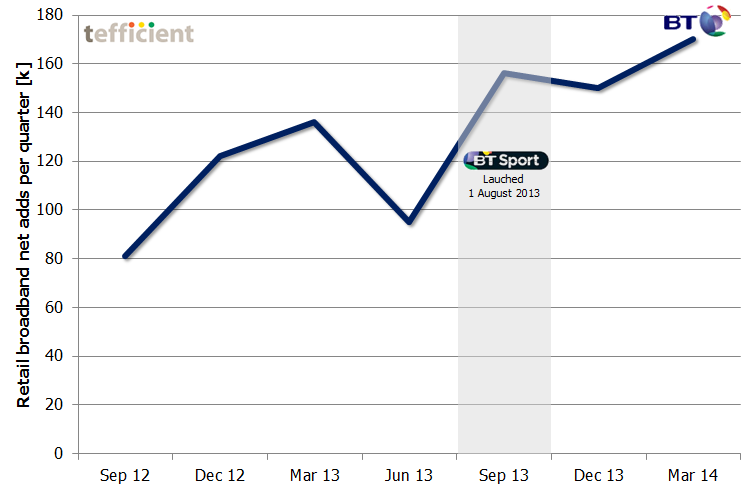

Have in mind that Sky in this period was challenged by BT who in August 2013 launched BT Sport – their own sports channel with exclusive rights to football games which previously were exclusive to Sky. A channel which BT provides for free to their broadband customers.

Sky is of course at the same time challenged by Netflix and other streaming services. On this part, it’s interesting to note how successful Sky Go Extra is. The “Extra” allows customers to download content to portable devices like tablets and bring it with them – to watch offline. This is a premium service (5 GBP extra per month) whereas the streaming-only variant (Sky Go) is without any extra charge.

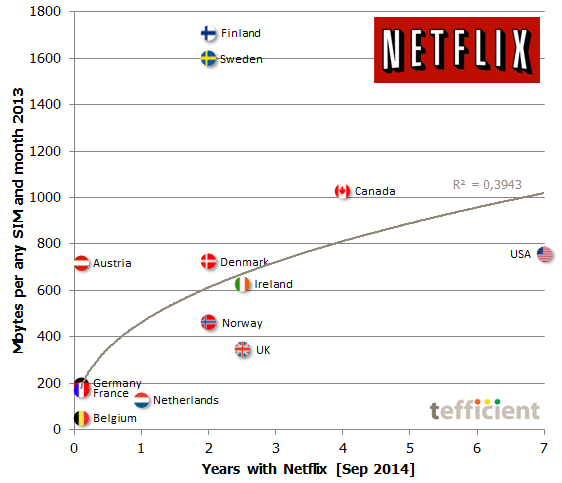

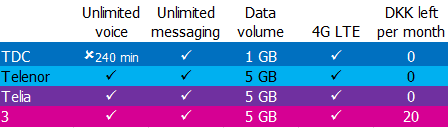

This is an indication that people now are ready to pay not to stream. Access to Wi-Fi is unpredictable. Mobile data allowances are typically low in the UK and 4G network coverage is not yet universal. Are we getting tired of streaming?

Verizon’s primary competitor, AT&T, launched their shared data plan, Mobile Share, in August 2012. Unlike Verizon, they kept other postpaid plans available to begin with. More than one year later, in October 2013, Mobile Share was eventually made the only plan. AT&T reports that 56% of their postpaid SIMs are on Mobile Share. Still not 100%.

Verizon’s primary competitor, AT&T, launched their shared data plan, Mobile Share, in August 2012. Unlike Verizon, they kept other postpaid plans available to begin with. More than one year later, in October 2013, Mobile Share was eventually made the only plan. AT&T reports that 56% of their postpaid SIMs are on Mobile Share. Still not 100%.

At tefficient, we’ve built a comprehensive before/after analysis framework of the results operators have achieved when transforming their offers from single-service to quad-play.

At tefficient, we’ve built a comprehensive before/after analysis framework of the results operators have achieved when transforming their offers from single-service to quad-play.