Orange Switzerland (which since 2012 isn’t owned by Orange Group) is just about to be sold to Xavier Niel’s private holding company. What makes it interesting is that Niel is the person behind Iliad, the company who operates under the Free brand in France. Continue reading Niel buys Orange Switzerland: So will Swiss headcount follow French?

Category Archives: Blog

Four years (and a net neutrality law) later, Dutch operators foul again

Dutch operators KPN and Vodafone were both fined for violations of net neutrality today.

KPN got a fine of 250000 EUR for having blocked access to voice over IP services on public Wi-Fi hotspots. Vodafone was fined 200000 EUR for having zero-rated content from HBO. Continue reading Four years (and a net neutrality law) later, Dutch operators foul again

Rollover: The next big thing for customer retention

Bucket plans – with volume caps on the number of minutes, messages and Mbytes – have been offered by mobile operators for years. Even though the composition has varied over time (e.g. through elements made unlimited), the concept is well known to customers.

Bucket plans – with volume caps on the number of minutes, messages and Mbytes – have been offered by mobile operators for years. Even though the composition has varied over time (e.g. through elements made unlimited), the concept is well known to customers.

Monthly caps have become the standard of our industry. Another standard is to reset those caps at the start of a new month. This means that any balance left – minutes, messages, Mbytes – is voided. Or confiscated – to use the word of John Legere, CEO of T-Mobile USA. Continue reading Rollover: The next big thing for customer retention

Zero-SIM game

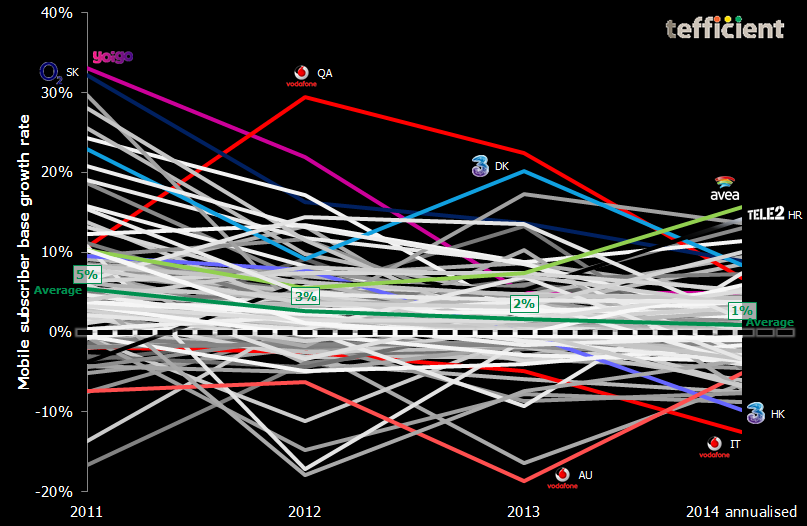

The graph below shows the annual (2014: annualised) growth rate in reported mobile SIM base for about 100 mobile operators in mature markets globally.

Copper Europe?

Whereas the “Europe is behind” accusation today is a myth rather than a fact when it comes to 4G LTE rollout, Europe still has an issue when it comes to really fast, two-way, fixed broadband – something only fiber-to-the-home (FTTH) or fiber-to-the-building (FTTB) networks can deliver. Continue reading Copper Europe?

Churn: Still a concern

The subsidy model – which dominated operators’ handset and equipment sales in mature markets for decades – is rightfully retiring. It wasn’t a brilliant idea to discount goods not produced inhouse (taking cost pressure away from equipment manufacturers like Apple) and, to compensate, overcharge for the services actually produced (making over-the-top services and Wi-Fi more attractive). Continue reading Churn: Still a concern

4G LTE coverage: Europe catching up, led by less populated countries

For a long time, lobbyists used the 4G LTE rollout and -adoption discrepancy between US and Korea/Japan (on one hand) and Europe (on the other hand) as a “proof” of too rigid European telecom regulation.

The basic fact that major US, Korean and Japanese operators are running CDMA2000 without the European possibility to gracefully migrate to 4G LTE was tactically neglected in this comparison. Continue reading 4G LTE coverage: Europe catching up, led by less populated countries

O2 is better for BT than EE – it might even be a love marriage

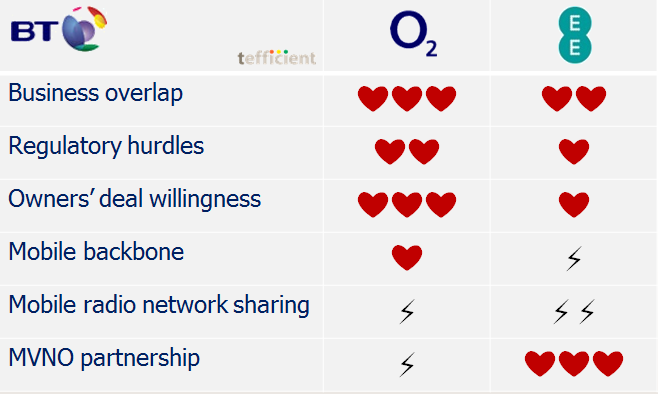

BT confirmed yesterday that they are in talks with two mobile operators about a possible merger in the UK – one being O2. EE is believed to be the other. To assist BT, tefficient presents a matchmaking table.

Business overlap: Since O2 last year sold its fixed business to Sky, a BT-O2 marriage means a minimal business overlap. EE is not bad as a partner either; EE’s fixed business is small. What complicates is that EE recently positioned itself in the upcoming quad-play market through the launch of EE TV. But it helps that EE didn’t enter the same content arena as BT to compete with e.g. BT Sport.

Regulatory hurdles: It took EU a year or more to agree to the mergers of ‘3’ and Orange in Austria, of ‘3’ and O2 in Ireland and of O2 and E-plus in Germany. These mergers were all consolidating mobile operators. Numericable, a French cable operator, received green light from French authorities to acquire SFR, an integrated operator, in just six months (and EU kept out). Since the experience from the merger in Austria is that prices went up, the new EU commission is believed to be more skeptical to mergers which increase market consolidation. A merger between BT and O2 would create a giant, but with the old way of looking at it (fixed and mobile are separate markets), approval might be as easy as in Numericable-SFR. A marriage with EE is somewhat more complicated since it would be a merger of two No 1 operators (in fixed and mobile respectively) plus, of course, the fact that EE today is competing with BT in fixed (and TV).

Owners’ deal willingness: Telefónica, who owns O2, sold O2 branded operations in Ireland and Czech Republic in 2013. Telefónica was behind O2’s entry into UK fixed market in 2006-2007, but demonstrated deal willingness when it was sold to Sky last year. Telefónica has also merged its O2 operation in Germany with E-plus. With all these deals in mind and with a need to control debt after the acquisition in Germany and the upcoming GVT acquisition in Brazil, Telefónica is so ready to sell. EE, on the other hand, has been surrounded by rumours on deals and IPOs, but EE’s owners have recently put an end to it saying that time is not now. The 50/50 ownership split between Orange and Deutsche Telekom makes decisions on EE slow.

Mobile backbone: O2 has continued to rely on BT as a provider not only for backbone transmission but also for field engineering services. EE has sourced much of its backbone from BT’s competitor Virgin Media.

Mobile radio network sharing: Regardless of choosing O2 or EE, BT will get a third party involved through network sharing within mobile. In O2’s case, that sharing partner is Vodafone (who recently said they would go after BT also in the consumer business in the UK), but O2 and Vodafone never went further than sharing passive infrastructure like masts and transmission. Marrying EE would bring ‘3‘ to the table since EE shares network with ‘3’. In contrast to O2/Vodafone, the EE/’3′ network sharing is based on sharing also active infrastructure like radio equipment. It’s not a showstopper, but calls for more coordination.

MVNO partnership: At last, a category where a marriage with EE would be the easiest: BT has a fresh MVNO agreement with EE which grants BT’s mobile customers access to EE’s network. In spite of being part of BT until 2001, O2 never had such an agreement with BT; it was Vodafone who was BT’s host prior to the change to EE this year.

To conclude, both O2 and EE would be good partners to BT. But a marriage with O2 would be quicker to the altar and contain more love. Hopefully.

How to improve EBITDA margin from 28% to 43% in 12 months

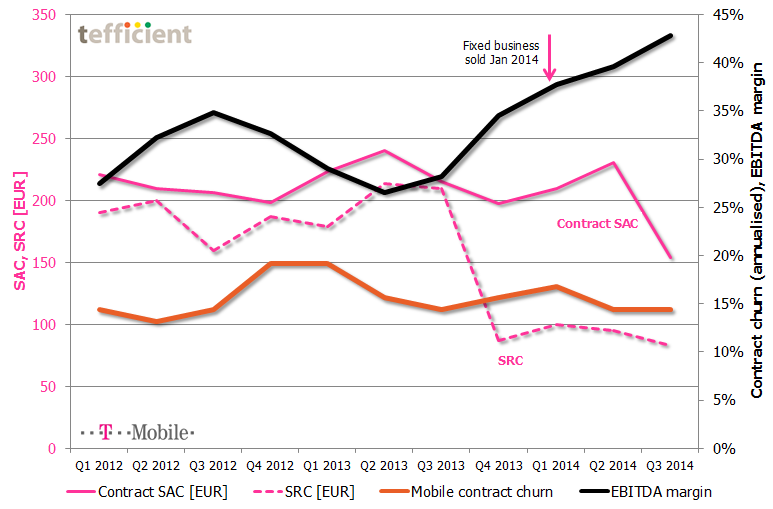

T-Mobile in the Netherlands continues its rally towards higher EBITDA margin: One year ago, it was 28%. Now it’s 43%. T-Mobile’s reported figures shows just how sensitive sales costs are to the mobile business margin.

In Q4 2013, T-Mobile cut its subscriber retention cost (SRC) from a level above 200 EUR to less than half. It has stayed at the new, lower, level since. Even though done during fourth quarter – where margin normally is weak due to seasonal sales – T-Mobile’s EBITDA margin took a leap upwards quarter-to-quarter. Another leap came in Q1 2014 when T-Mobile sold its fixed business (traded under the “Online” brand).

In the just-reported third quarter, T-Mobile’s EBITDA margin took yet a leap: This time due to a significant reduction in contract SAC (subscriber acquisition cost).

The text book says that such dramatic reductions in SAC/SRC would immediately penalise T-Mobile who would experience a shrinking base and market share since existing customers would churn out and new customers would’t join. The interesting thing is that existing customers haven’t left: The orange curve shows a stabilising contract churn of about 15%. T-Mobile has, however, still experienced a decline in their total base, but this has mainly been within prepaid. [The reported reduction in Q3 was almost exclusively to the disposal of the Simpel brand].

According to T-Mobile, the answer to how this has been possible comes in two parts:

- Increasing mobile data usage and revenue

- Increasing revenue from equipment

In a market where T-Mobile’s two current MNO competitors KPN and Vodafone both go in the converged multi-play direction, it will be interesting to follow if T-Mobile can stay on this route – especially as Tele2 is about to enter the Dutch market as MNO within short.

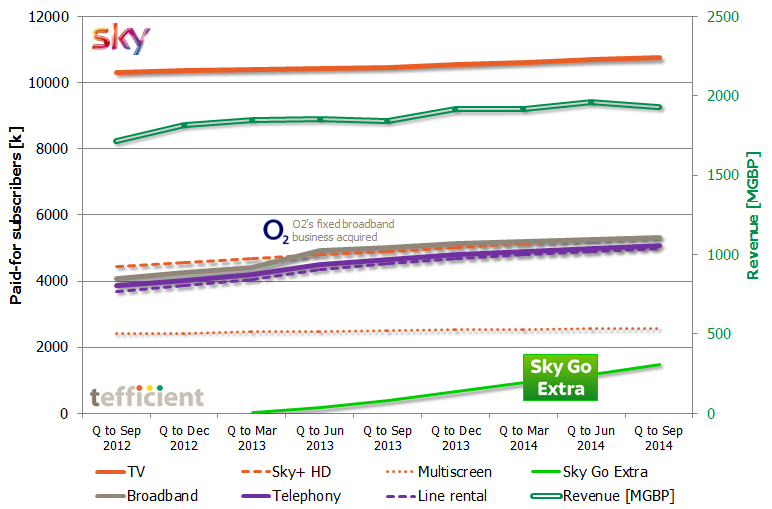

Sky: New products fence off telco and OTT – 1.5M pay not to stream

You have to admire the way Sky continues to grow customer base and revenue in the UK and Ireland. Most of us thought that satellite TV belonged in the past century, but Sky has through constant development of their products and offerings, by e.g. integrating broadband, multi-screen and streaming, revitalised and modernised the customer experience.

Have in mind that Sky in this period was challenged by BT who in August 2013 launched BT Sport – their own sports channel with exclusive rights to football games which previously were exclusive to Sky. A channel which BT provides for free to their broadband customers.

Sky is of course at the same time challenged by Netflix and other streaming services. On this part, it’s interesting to note how successful Sky Go Extra is. The “Extra” allows customers to download content to portable devices like tablets and bring it with them – to watch offline. This is a premium service (5 GBP extra per month) whereas the streaming-only variant (Sky Go) is without any extra charge.

This is an indication that people now are ready to pay not to stream. Access to Wi-Fi is unpredictable. Mobile data allowances are typically low in the UK and 4G network coverage is not yet universal. Are we getting tired of streaming?