Denmark has had it for more than 10 years, Belgium got it a year ago and now EU proposes it for all of EU: Maximum effective binding period of 6 months for consumer mobile contracts.

Denmark has had it for more than 10 years, Belgium got it a year ago and now EU proposes it for all of EU: Maximum effective binding period of 6 months for consumer mobile contracts.

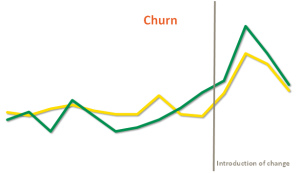

What happens to a mobile market when such a change is introduced and why is this change actually so significant?

This analysis shows that when Belgian consumers no longer are locked into long contracts, it has a major impact. The question is also if the transition is over in Belgium: Danish figures suggest it might get worse.

Since the EU commission – as part of the 11 September 2013 “Connected Continent: Building a Telecoms Single Market” plan – is proposing that EU consumers should have a similar right to cancel contracts after six months, the question is obviously: Is this also your future?

Download analysis: tefficient public industry analysis 12 2013 Six months contracts

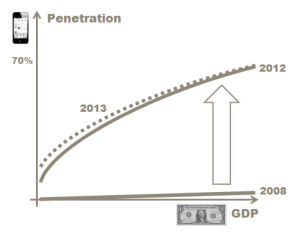

An amazing growth story comes to an end: Smartphone penetration isn’t really growing any longer in mature markets. Smartphones are still sold in high volumes, but the difference is that they’re now primarily sold – subsidised or not – to existing smartphone owners, who upgrades.

An amazing growth story comes to an end: Smartphone penetration isn’t really growing any longer in mature markets. Smartphones are still sold in high volumes, but the difference is that they’re now primarily sold – subsidised or not – to existing smartphone owners, who upgrades.

Analysis of operator business upsides and downsides when launching 4G LTE. Commissioned by Comptel. Live presentation of an extract of the analysis, titled “Pinpoint the right customers: LTE handsets in wrong hands will dilute margin” to Comptel’s customers at two occasions during MWC in Barcelona.

Analysis of operator business upsides and downsides when launching 4G LTE. Commissioned by Comptel. Live presentation of an extract of the analysis, titled “Pinpoint the right customers: LTE handsets in wrong hands will dilute margin” to Comptel’s customers at two occasions during MWC in Barcelona.