Analysis & Go-to-market 2015

In cooperation with key Comptel experts, writing and editing key parts of Comptel’s book “Operation Nexterday” which was launched at Mobile World Congress 2015.

In cooperation with key Comptel experts, writing and editing key parts of Comptel’s book “Operation Nexterday” which was launched at Mobile World Congress 2015.

Analysis & Go-to-market 2015

In cooperation with key Comptel experts, writing and editing key parts of Comptel’s book “Operation Nexterday” which was launched at Mobile World Congress 2015.

In cooperation with key Comptel experts, writing and editing key parts of Comptel’s book “Operation Nexterday” which was launched at Mobile World Congress 2015.

Analysis & Consulting, 2014

Preparing and presenting “How are telcos, cellcos and cablecos using Wi-Fi to strengthen existing business?” for 200 participants at the Wi-Fi Innovation Summit in Copenhagen 9-10 December.

Preparing and presenting “How are telcos, cellcos and cablecos using Wi-Fi to strengthen existing business?” for 200 participants at the Wi-Fi Innovation Summit in Copenhagen 9-10 December.

Some of the presented content is available in this analysis.

Analysis & Consulting, 2014

Independently identifying and presenting customer-specific initiatives to increase efficiency to a key customer operator of a global services provider.

Analysis & Go-to-market, 2014

Analysis & Go-to-market, 2014

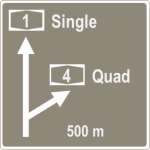

How have operators introduced mobile-fixed convergent quad-play in Europe’s most advanced markets France, Spain, Portugal – and in emerging quad markets like Belgium, the Netherlands, the UK and Germany? How has competition reacted?

Using facts: How have these quad introductions affected market share, churn, acquisition & retention cost, demand for mobile, fibre-speed broadband and TV – and revenue and margin? Which defensive actions can non-convergent operators take?

Which factors can be attributed to effective take-up of quad play? Market share, fibre deployment and homepass, TV offers, exclusive content – or is it just about bundling discounts? What discount levels are we talking about?

Based on international facts and best practice, what would tefficient recommend? Taking local conditions, operator strategy and market position into account.

Commissioned by two operators.

For the second consecutive year: Comprehensive business benchmark including a total of 159 KPIs covering revenue, OPEX, CAPEX, productivity, traffic load and network quality – with a peer group solely consisting of network sharing joint ventures.

Due to pre-agreed confidentiality requirements, the identities of participating JVs are fully anonymous.

Once again, the results demonstrate the value of the JV-specfic benchmark approach: Network sharing JVs have throughfocus on core activities, higher freedom in selecting operation methods and attention to detail established cost and productivity levels that are elevated beyond the obvious sharing effect. Also network quality is very high even though traffic load increases when sharing. To improve further, JVs need to compare with their likes – other JVs – and not to regular mobile operators. The benchmark will run again in March 2015.

![]() For the second consecutive year: Comprehensive business benchmark including a total of 577 KPIs covering revenue, OPEX, CAPEX, headcount productivity, subscriptions & channels, performance, load, quality and innovation & growth – for 33 functions within a mobile operator.

For the second consecutive year: Comprehensive business benchmark including a total of 577 KPIs covering revenue, OPEX, CAPEX, headcount productivity, subscriptions & channels, performance, load, quality and innovation & growth – for 33 functions within a mobile operator.

Peer group consisting exclusively of primary data from Swedish, Finnish and Norwegian operators. Due to pre-agreed confidentiality requirements, the identities of the participating operators are fully anonymous.

The results again demonstrate the value of a region-specific benchmark approach: Swedish, Finnish and Norwegian operators have global leadership in a wide array of business aspects and a global benchmark would therefore leave them without guidance on how to improve further. In contrast, participating operators now have a great tool to improve their local competitiveness even further. The benchmark will run again in January 2015 and then cover also Danish operators. Operators can participate either as a mobile entity or as an integrated (fixed and mobile) entity.

Analysis and Go-to-market, 2014

Download the analysis, commissioned by Comptel ![]() and published 2 June 2014 here.

and published 2 June 2014 here.

Analysis & Go-to-market, 2014

Preparing analysis and facilitating workshops on 4G LTE and fibre adoptionwith over 40 of Comptel’s operator customers from around the world as part of Comptel’s Focus Group in Helsinki 25-26 March 2014.

Preparing analysis and facilitating workshops on 4G LTE and fibre adoptionwith over 40 of Comptel’s operator customers from around the world as part of Comptel’s Focus Group in Helsinki 25-26 March 2014.

Analysis & Consulting, 2014

Presented to the members of the Ambassadors of Telecom organisation in the Netherlands 13 March 2014. The title was “Benchmarking – and the tale of a wing clipped Dutch opportunity”. In addition to tefficient’s approach to benchmarking, we discussed if there is a mobile data dilemma in the Netherlands (comparing to the rest of the world).

Presented to the members of the Ambassadors of Telecom organisation in the Netherlands 13 March 2014. The title was “Benchmarking – and the tale of a wing clipped Dutch opportunity”. In addition to tefficient’s approach to benchmarking, we discussed if there is a mobile data dilemma in the Netherlands (comparing to the rest of the world).

The presented slides can be viewed here.

Analysis & Consulting, 2014

How have mobile operators introduced single- and multi-user shared plans in USA, Sweden, Finland, Norway, Denmark, Canada and the UK? Which business results have operators achieved and how has competition reacted? Which modifications have been necessary and when? Can the same customer loyalty effects be achieved without the heavy implementation of multi-user shared plans? Which defensive actions have proven to be most successful?

Based on these international facts and best practice, what would tefficient recommend? Taking local conditions, operator strategy and market position into account.

Commissioned twice by two different operators.