A1, the Austrian incumbent, today reports a year-on-year EBITDA decrease of 19.4% for 2013. In this situation, you have to highlight the positives. Telekom Austria group is e.g. saying: “A1 Premium Monthly Churn Rate at Historic Low“.

By now, our industry should have learned that churn figures never can be referred to without also referring to the subscriber retention cost (SRC). It’s simple to decrease postpaid churn – if you have deep pockets: Pay higher SRC to get more customers to stay.

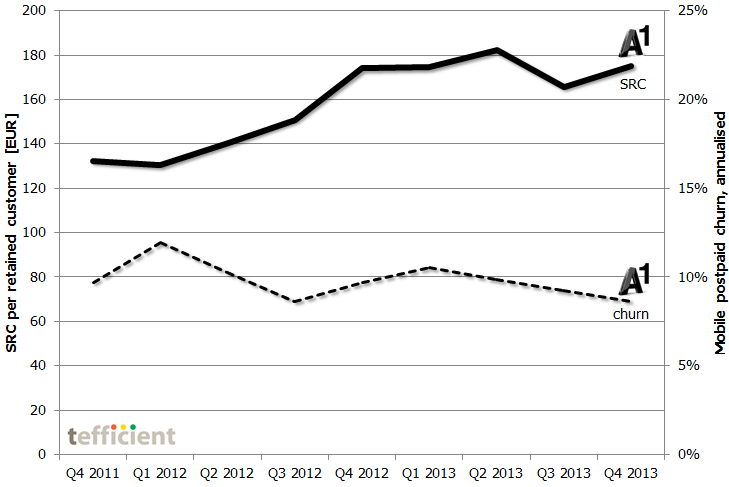

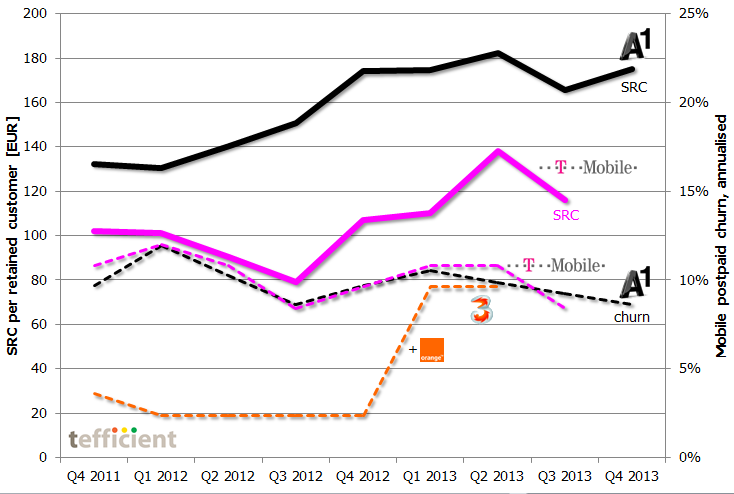

So since Telekom Austria hasn’t done it – let us plot postpaid churn against SRC. It’s the graph below.

In 2013, A1 has been able to reduce postpaid churn to below 10% on annual basis which – internationally compared – is very low. But starting Q4 2012, A1’s SRC elevated from around 140 EUR to about 170 EUR. This happened at the same time as smartphone price points started to come down which, in other markets, was positive for SRC. The reason to A1’s increase must therefore be found in the local market: In January 2013, ‘3’ incorporated Orange to become a strong number 3 in Austria.

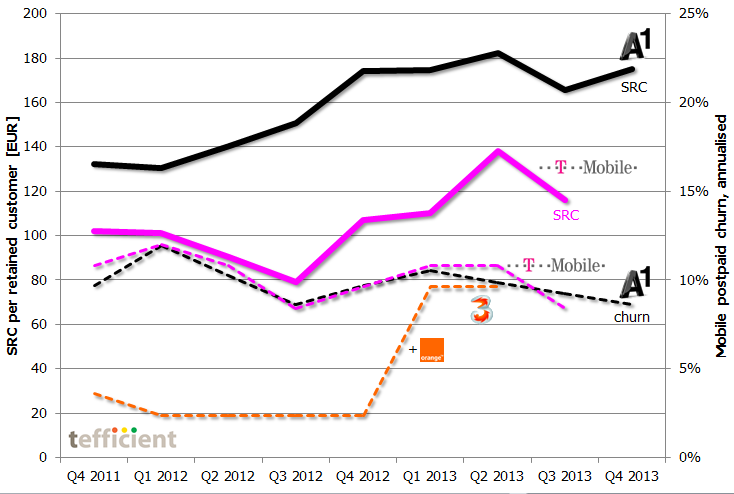

But how good is A1’s churn rate? If we plot the figures of T-Mobile and ‘3’ into the graph just above, we can see that competitors report as low churn as A1. (Prior to adding Orange, ‘3’ was even at annual churn levels below 3%). T-Mobile has followed A1’s SRC upwards, but from a lower level. In a local perspective, A1’s achievements seem in line or even substandard.

Note. T-Mobile and ‘3’ have not yet reported Q4/2H 2013. ‘3’ doesn’t report SRC.