Decoupled, non-binding, unsubsidised: A game changer?

Our analysis shows that mature market mobile operators on average use 15-20% of service revenue on subscriber acquisition and subscriber retention cost (SAC/SRC). In most cases without growing.

Consequently, we examine the success of the operators who – in order to reduce SAC/SRC and improve margin – are challenging the mature market norm with binding contracts with coupled, subsidised, equipment. Continue reading Increase loyalty. Increase revenue. Reduce SAC/SRC. Is the combo possible?

In cooperation with key Comptel experts, writing and editing key parts of Comptel’s book “

In cooperation with key Comptel experts, writing and editing key parts of Comptel’s book “

Analysis & Go-to-market, 2014

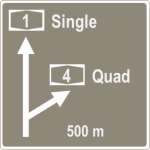

Analysis & Go-to-market, 2014 Preparing analysis and facilitating workshops on 4G LTE and fibre adoptionwith over 40 of Comptel’s operator customers from around the world as part of Comptel’s Focus Group in Helsinki 25-26 March 2014.

Preparing analysis and facilitating workshops on 4G LTE and fibre adoptionwith over 40 of Comptel’s operator customers from around the world as part of Comptel’s Focus Group in Helsinki 25-26 March 2014.