For operators, the biggest piece of news in Apple’s event yesterday isn’t the iPhone 6S or the iPad Pro. Instead it’s Apple’s introduction of its own iPhone Upgrade Program. Continue reading With the iPhone Upgrade Program Apple makes operators replaceable

Category Archives: equipment sales

Increase loyalty. Increase revenue. Reduce SAC/SRC. Is the combo possible?

Decoupled, non-binding, unsubsidised: A game changer?

Our analysis shows that mature market mobile operators on average use 15-20% of service revenue on subscriber acquisition and subscriber retention cost (SAC/SRC). In most cases without growing.

Consequently, we examine the success of the operators who – in order to reduce SAC/SRC and improve margin – are challenging the mature market norm with binding contracts with coupled, subsidised, equipment. Continue reading Increase loyalty. Increase revenue. Reduce SAC/SRC. Is the combo possible?

4G penetration top 21 of Europe

Not many operators in Europe report the number of 4G subscribers, but in this graph we have collected those who have. We recalculated end of March 2015 figures into penetration figures of the total SIM base. Continue reading 4G penetration top 21 of Europe

Tele2: From industry’s black sheep to customer’s best friend?

Late November last year, Tele2 launched a major transformation campaign in Sweden under the Tele2.0 banner.

Late November last year, Tele2 launched a major transformation campaign in Sweden under the Tele2.0 banner.

The message? Tele2 had questioned all industry practices and concluded that many of them were outright stupid. And consequently stopped or changed them. Continue reading Tele2: From industry’s black sheep to customer’s best friend?

Churn: Still a concern

The subsidy model – which dominated operators’ handset and equipment sales in mature markets for decades – is rightfully retiring. It wasn’t a brilliant idea to discount goods not produced inhouse (taking cost pressure away from equipment manufacturers like Apple) and, to compensate, overcharge for the services actually produced (making over-the-top services and Wi-Fi more attractive). Continue reading Churn: Still a concern

Early upgrade plans: Sweet now. Turns sour?

The equipment instalment plan has proven capable of substituting the subsidy model in mobile – even in traditional subsidy markets like the USA and the UK.

The equipment instalment plan has proven capable of substituting the subsidy model in mobile – even in traditional subsidy markets like the USA and the UK.

While the EIP opens for more competitive service pricing, it also opens for flexibility when it comes to equipment upgrades: Pay remaining instalments – and upgrade. Some operators go further, though:

Realising that customers aren’t particularly interested in obtaining the ownership of (aged) equipment, pioneering operators introduced a variant of the EIP – based on an early return of equipment: The early upgrade plan.

It’s a recurring upgrade promise – often without any additional fee. Take-up has been great, but it’s only now the pioneering operators need to start delivering on this promise.

Download analysis: tefficient industry analysis 5 2014 early upgrade plans 19 Sep

Yoigo lost 53% of equipment sales as Telefónica reinstated handset subsidy

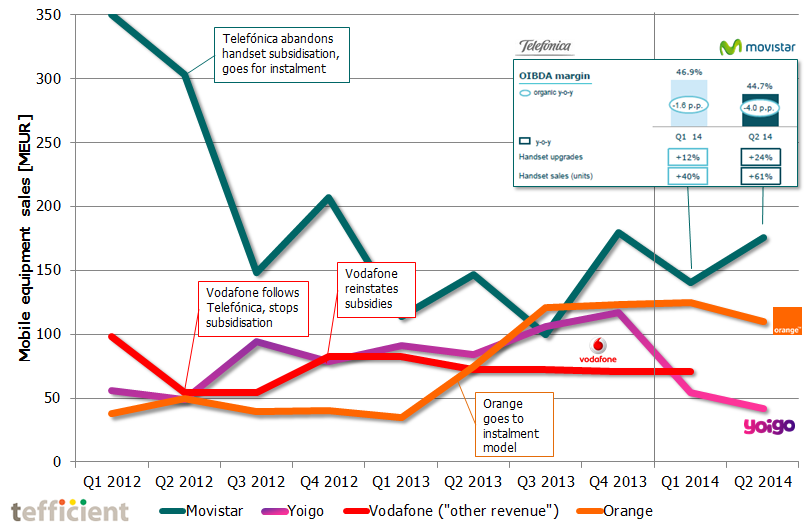

The economic crisis put significant pressure on the Spanish telcos. Telefónica (Movistar) and Vodafone each lost around 4 millions SIMs in the past two and a half years. Orange and Yoigo have fared much better. Yoigo, with its no-frills low cost profile, grew subscriber base from 3 to 4 million at the same time. But suddenly – in Q1 2014 – Yoigo’s total revenue fell 26% quarter-on-quarter.

In TeliaSonera’s new reporting format – implemented Q2 2014 – we could see why total revenue fell: Equipment revenue declined 53% quarter-to-quarter. We could also see that in Q4 2013, 40% of Yoigo’s total revenue stemmed from equipment sales. By any standard, that is high.

Why was it so high? In March 2012, Telefónica decided to abandon handset subsidisation altogether. It had an immediate negative impact on Telefónica’s equipment revenue: From Q2 to Q3 2012, equipment revenue fell from 300 to 150 MEUR (see graph). When Telefónica didn’t any longer discount customer equipment, customers bought it elsewhere. Vodafone followed the market leader and stopped subsidisation as well. Orange did not – and had a few easy quarters during which it churned over customers from Telefónica and Vodafone. Yoigo’s differentiation was instead its low service prices. Many cost-aware mobile users went to Yoigo for this reason, even if it meant that they had to pay the full price of a handset. Yoigo’s service revenue was low, but it was compensated by an increasing revenue from equipment sales…

…until Telefónica decided that they saved enough. The inserted frame in the graph shows that Telefónica grew handset sales 40% in Q1 2014 and 61% in Q2. At the same time, Telefónica’s margin fell. Equipment revenue expanded, but not in line with the number of handsets sold. All this together signal handset subsidisation. Telefónica: back in the game. Yoigo: equipment sales halfed.

TeliaSonera was for a long time open about their interest in selling Yoigo. With the improved results 2012 and 2013, that message changed. But after the Q1 2014 surprise, TeliaSonera put Yoigo back on the transfer list. All of Yoigo’s revenue expansion 2012-2013 was based on hardware sales. A weak foundation when the market leader changes direction.

Why “grandfathering” is a four letter word inside Verizon and AT&T

It’s been more than two years since the June 2012 launch of Verizon’s shared data plan which took out all other Verizon postpaid plans at one go. From this point on, new Verizon customers (or prolonging customers) had to take the Share Everything plan (later renamed More Everything). The initiative was Verizon’s final attempt to get rid of unlimited data and make usage-based data monetisation a reality.

It’s been more than two years since the June 2012 launch of Verizon’s shared data plan which took out all other Verizon postpaid plans at one go. From this point on, new Verizon customers (or prolonging customers) had to take the Share Everything plan (later renamed More Everything). The initiative was Verizon’s final attempt to get rid of unlimited data and make usage-based data monetisation a reality.

Since the standard US postpaid contract is running for 24 months, we should after two years consequently see a 100% adoption of Share/More Everything within Verizon’s postpaid accounts? No, it is 55%.

Verizon’s primary competitor, AT&T, launched their shared data plan, Mobile Share, in August 2012. Unlike Verizon, they kept other postpaid plans available to begin with. More than one year later, in October 2013, Mobile Share was eventually made the only plan. AT&T reports that 56% of their postpaid SIMs are on Mobile Share. Still not 100%.

Verizon’s primary competitor, AT&T, launched their shared data plan, Mobile Share, in August 2012. Unlike Verizon, they kept other postpaid plans available to begin with. More than one year later, in October 2013, Mobile Share was eventually made the only plan. AT&T reports that 56% of their postpaid SIMs are on Mobile Share. Still not 100%.

In its Q2 reporting of yesterday, AT&T says that 80% of postpaid smartphone subscribers are on usage-based data plans. Leaving 20% of smartphone subscribers (plus a bunch of data-only subscribers – no reporting for that segment) that still are unlimited.

Verizon and AT&T’s principal method to convince customers to let go of their unlimited plans has been equipment subsidy: You wouldn’t get any unless you go for the new plans.

But T-Mobile’s disruption of the subsidy model – later embraced by AT&T and (somewhat reluctantly) implemented by Verizon – has led to US customers shifting away from subsidy, instead going for installment plans or BYOD. And with these models, customers can easier hold onto their grandfathered unlimited data plans.

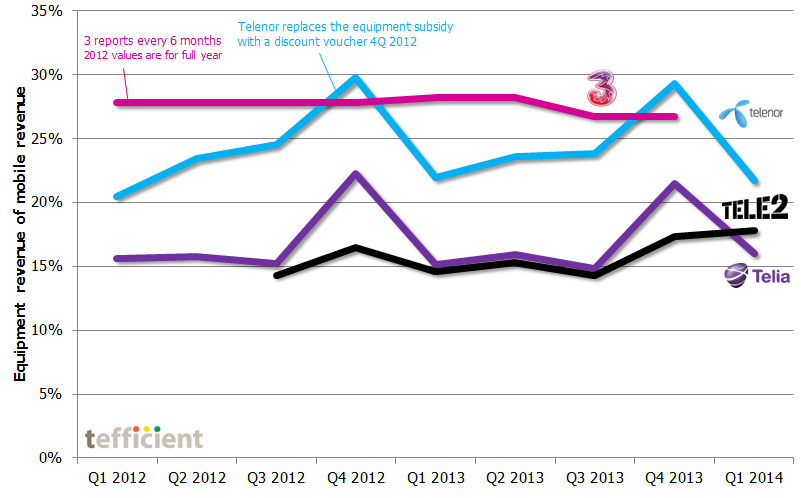

Telenor and ‘3’ sell more equipment than Telia and Tele2 – or?

TeliaSonera started to separate out equipment revenue in their new reporting format. Lovely!

We can now compare the equipment revenue vs. mobile revenue ratio for all Swedish operators (see graph). According to reporting notes, Telenor and ‘3’ realise the full equipment price as equipment revenue and let the equipment subsidy dilute service revenue instead. Telia and Tele2 realise the actual equipment sales price after subsidy as equipment revenue.

Active in the same market, there is likely no material difference between the equipment sales of the operators; the differences between Telenor/’3′ on one side and Telia/Tele2 on the other are rather a consequence of the revenue recognition used.

If so, we can by comparing these two approaches estimate that Swedish operators averagely subsidise around one third of the nominal equipment price. That is how much Telia and Tele2’s lines would have to be raised to match the lines of Telenor and ‘3’.

The art of balancing SAC and SRC

This is our fourth analysis on subscriber acquisition cost (SAC) and subscriber retention cost (SRC). Previous SAC & SRC analyses showed that an increase in SRC had a positive effect on contract churn without any negative effect on EBITDA – as long as not exceeding 100% of contract SAC.

This is our fourth analysis on subscriber acquisition cost (SAC) and subscriber retention cost (SRC). Previous SAC & SRC analyses showed that an increase in SRC had a positive effect on contract churn without any negative effect on EBITDA – as long as not exceeding 100% of contract SAC.

Our new analysis shows that much has happened in 2013: Average unit SAC and SRC have decreased significantly. How come – and what has it led to?

Based on data from 35 mobile operators in 24 mature markets globally.

The analysis comes in two versions: A public version which you can download below – and a premium version which adds country-specific SAC & SRC analyses on eight countries: France, Germany, Poland, Austria, the Netherlands, UK, Denmark and Canada.

Download public version: tefficient industry analysis 2 2014 SAC vs SRC – public version