After 14 years, BT is back into consumer mobile. The long-rumoured launch of BT Mobile happened today. Continue reading BT Mobile: Surprisingly disruptive

Category Archives: 4G LTE

If you sell Mbytes, why slow your customers down?

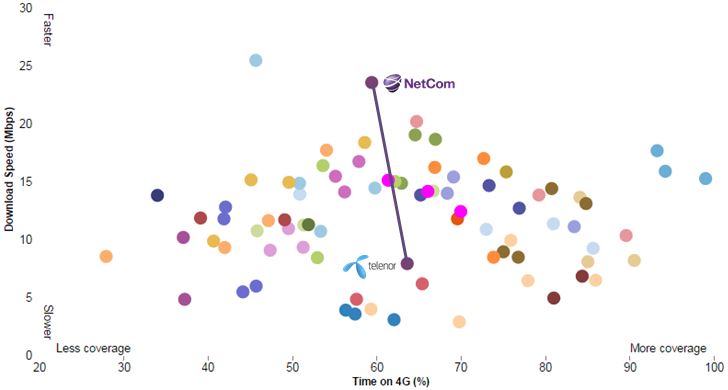

We’ve been awaiting Telenor’s official comments to OpenSignal’s new crowdsourced 4G coverage and speed test, but since Telenor hasn’t yet commented it we try to interpret the Norwegian results ourselves.

Continue reading If you sell Mbytes, why slow your customers down?

Finland: The land of three thousand megabytes

In our public industry analysis “Peak data” in sight? we use regulator data to identify Finland as the number 1 country in the world when it comes to mobile data usage, beating all the countries which typically are followed closely – USA, South Korea, Japan.

It’s with great pleasure we note that Finland’s third operator, DNA, has followed in its larger competitor Elisa’s footsteps and reported total mobile data traffic. And it is a blast. Too. Continue reading Finland: The land of three thousand megabytes

Why 100% population coverage on 4G doesn’t imply a great customer experience

Once you pop, you can’t stop?

When the rollout of 4G LTE eventually got up to speed in Western, Central and Southern Europe, it wasn’t long until operators started to report that the rollout was more or less completed, using population coverage as the proof point.

Let’s look at the stats from 19 operators who reported 4G population coverage both for December 2013 and 2014: Continue reading Why 100% population coverage on 4G doesn’t imply a great customer experience

4G LTE coverage: Europe catching up, led by less populated countries

For a long time, lobbyists used the 4G LTE rollout and -adoption discrepancy between US and Korea/Japan (on one hand) and Europe (on the other hand) as a “proof” of too rigid European telecom regulation.

The basic fact that major US, Korean and Japanese operators are running CDMA2000 without the European possibility to gracefully migrate to 4G LTE was tactically neglected in this comparison. Continue reading 4G LTE coverage: Europe catching up, led by less populated countries

“Peak data” in sight

This is tefficient’s 10th public analysis on the development of mobile data usage. For the first time, we see clear signs of saturation.

This is tefficient’s 10th public analysis on the development of mobile data usage. For the first time, we see clear signs of saturation.

Operators’ squeeze-out of unlimited customers continues. The growth in smartphone penetration has levelled out in high usage markets. 4G is becoming mainstream. Public Wi-Fi starts to disrupt.

Are we approaching “peak data”?

Download analysis: tefficient industry analysis 7 2014 mobile data usage peak ver 2

“Build it, and they will come” – 4G LTE in Europe

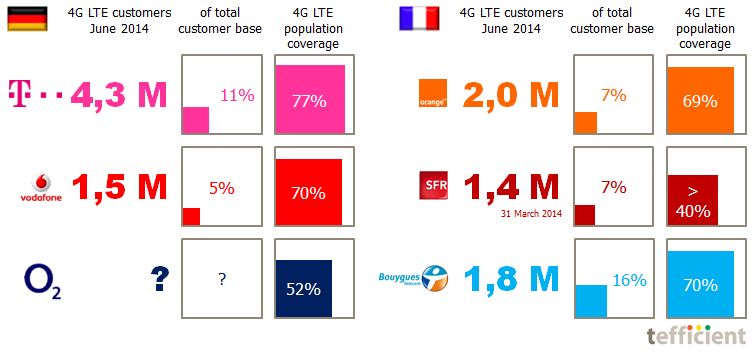

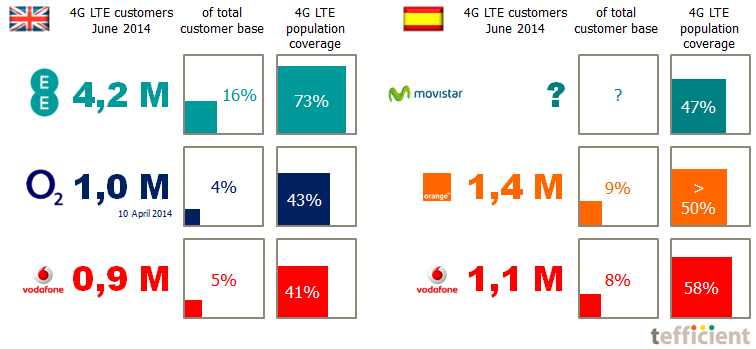

In four of the largest European markets – Germany, France, UK and Spain – we see three out of four mobile operators reporting their 4G LTE rollout status. Most of them also report (or indicate) their 4G LTE customer base.

After much hesitation, the 4G LTE rollout eventually started also in Europe. And you know what? Customers are coming. If they are covered, that is.

The country pictures show the overall market leader at the top. Telekom has the largest 4G LTE network in Germany and had 11% of its customer base on 4G LTE by the end of June.

In France, Bouygues Telecom shows how a small No 3 operator through aggressive focus on 4G LTE rollout can challenge the 2.5x larger Orange on the total 4G LTE customer base. 16% adoption is among the highest in Europe.

SFR – in the process of being acquired by Numericable – didn’t report their 4G LTE figures in Q2. Arcep, the French telecom regulator, however critisised SFR in June for their 4G LTE coverage claims, saying their population coverage was just 30%. [Bouygues and Orange claims were OK whereas also Free was critisised. Their population coverage was said to be 24%].

UK is behind on 4G LTE rollout, partly because of late licensing. Market leader EE was given a head start when it was allowed to refarm 1800 MHz spectrum and use it for 4G LTE.

In Spain, market leader Movistar is behind Vodafone and Orange on 4G LTE rollout. Telefónica doesn’t report the number of 4G LTE customers in Movistar which might be an indication of that it’s low.

Neither E-plus, Free, ‘3’ nor Yoigo report figures on 4G LTE. We see this an indication of them being behind on rollout and adoption. E-plus is now in the process of merging with O2.

Workshops on 4G LTE and fibre adoption with Comptel’s customers

Analysis & Go-to-market, 2014

Preparing analysis and facilitating workshops on 4G LTE and fibre adoptionwith over 40 of Comptel’s operator customers from around the world as part of Comptel’s Focus Group in Helsinki 25-26 March 2014.

Preparing analysis and facilitating workshops on 4G LTE and fibre adoptionwith over 40 of Comptel’s operator customers from around the world as part of Comptel’s Focus Group in Helsinki 25-26 March 2014.

LTE doesn’t drive Korean smartphone penetration any longer

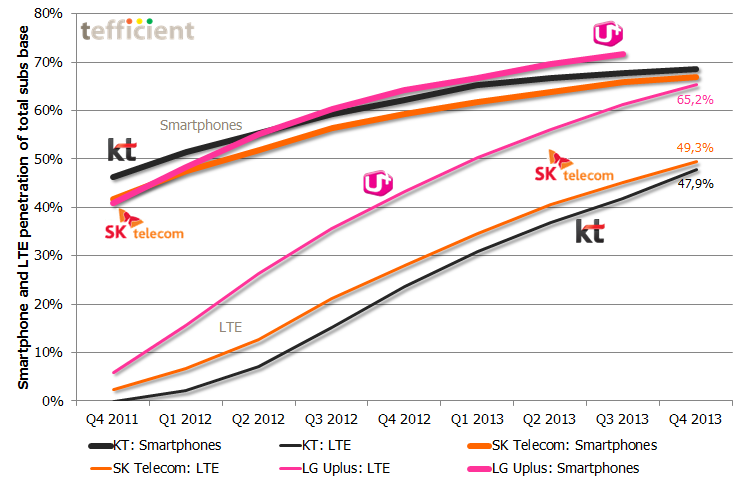

2013 ended with over 1 billion smartphones sold – a new record. But mature market operators should look at Korea as a projection of what will come: It is the world’s most advanced LTE market based on penetration and usage levels.

The operators in Korea – SK Telecom, KT and LG Uplus – are continuing to sell a lot of LTE equipment to its customers, even though sales slowed somewhat during 2013. But whereas the sales of LTE equipment earlier led to a lift in overall smartphone penetration, it looks as if it’s not going to drive smartphone penetration very much longer: See how the three top curves in the graph slow down even though the LTE curves go up.

Note: LG Uplus hasn’t yet stated overall smartphone penetration for Q4 2013. Non-LTE smartphones are soon phased out of LG Uplus.

In the world’s most advanced LTE market, LTE seems to run out of fuel. Existing smartphone customers do upgrade to LTE smartphones, but the overall smartphone penetration in Korea doesn’t climb above 70% [SK Telecom holds 50% of market, KT 30% and Uplus 20%]. If we extrapolate, the LTE penetration will equal the smartphone penetration during 2014 – more or less.

For mature market operators believing in LTE’s ability to take smartphone penetration levels beyond the 70% level observed today in countries like e.g. Sweden, Norway, the Netherlands, Australia, the UK and France this is bad news. The Korean development indicates that LTE as such is not enough.

The situation resembles 2007 – before the arrival of the iPhone. Incremental improvements had made products from e.g. Nokia the best ever, but disruption was needed to create new growth. iPhone was the catalyst in 2007. The mobile world – including Apple – are back into incremental improvements and the current products are the best ever. From where will the innovation come that creates new growth in mature markets?

How 4G LTE became mainstream (for some)

Examining the strategic choices of operators: At tefficient, we’ve been having our ears to the ground for some time picking up and summarising operator data on how 4G LTE adoption is developing globally. An absolute majority of operators who have launched 4G LTE still fail to report their 4G LTE customer number, their 4G LTE device penetration and their 4G LTE traffic level – but it’s on its way up.

And for those that do report, the third quarter of 2013 represents a shift: No longer is 4G LTE a niche service for a few early adopters – instead it is mainstream. At least in parts of the world.

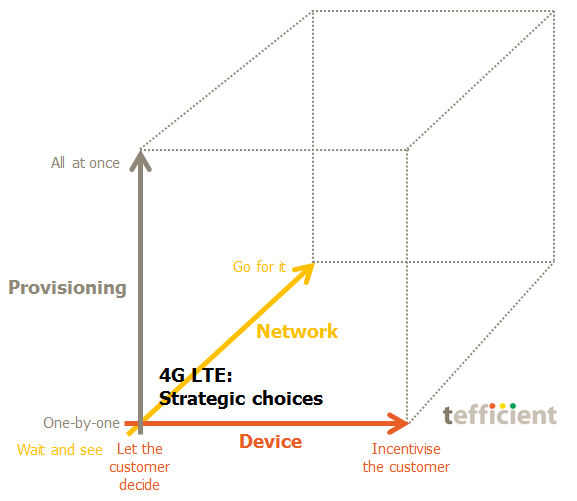

Three criteria need to be fulfilled to be able to count a user as a 4G LTE user. This analysis introduces the 4G LTE cube which visualises the strategic choices operators have when it comes to all three. So far, strategies differ very much – and they affect adoption strongly.

Download analysis: tefficient public industry analysis 14 2013 LTE