The shock waves reverberate in the European telecoms industry ever since Telenor and TeliaSonera in September deemed it pointless to continue negotiations with the European Commission to win support for a mobile merger between Telenor and Telia in Denmark. Continue reading Plan B: Avoid the merger-to-no-merger journey

The shock waves reverberate in the European telecoms industry ever since Telenor and TeliaSonera in September deemed it pointless to continue negotiations with the European Commission to win support for a mobile merger between Telenor and Telia in Denmark. Continue reading Plan B: Avoid the merger-to-no-merger journey

Category Archives: Denmark

The best Nordic 4G networks: Crowdsourced reality vs. marketed population coverage

OpenSignal released its crowdsourced 4G speed and coverage stats for Q3 2015 today. The data was anonymously collected from a total of 325221 iOS and Android smartphone users globally during June to August.

But before looking into OpenSignal’s new stats, let’s summarise what the Nordic operators have stated with regards to their 4G outdoor population coverage: Continue reading The best Nordic 4G networks: Crowdsourced reality vs. marketed population coverage

What buys you a load of data in Finland, France & Denmark, buys you nothing in Belgium & Switzerland

How much mobile services do you get for 20 EUR?

For 25? 30? 35? 40 EUR?

We have compared the service prices of all mobile operator brands in eleven countries: Germany, the UK, France, the Netherlands, Belgium, Sweden, Austria, Switzerland, Denmark, Finland and Norway.

And Europe is divided. Continue reading What buys you a load of data in Finland, France & Denmark, buys you nothing in Belgium & Switzerland

CAPEX pays off in customer experience: Checking Omnitele’s measurement results

The Finland-based consulting and engineering firm Omnitele has – independently – during first half of 2015 measured the mobile customer experience in three countries: Latvia, Denmark and Estonia. Continue reading CAPEX pays off in customer experience: Checking Omnitele’s measurement results

Nordic operator benchmark 2015

For the third consecutive year: Comprehensive business benchmark including more than 500 KPIs covering revenue, OPEX, CAPEX, headcount productivity, subscriptions & channels, performance, load, quality and innovation & growth – for 33 functions within a mobile operator, within a fixed/cable operator and/or within an integrated operator – respectively. Continue reading Nordic operator benchmark 2015

You do have blind spots. Spot them.

The last day to confirm participation in the Nordic operator benchmark 2015 is 23 January.

A few operators have confirmed their participation already, but since we 2015 expand the scope of the benchmark from mobile to mobile, fixed/cable and integrated operators (respectively) and add Denmark, there are a few operators who have been asked for the first time.

The operators who are asked are displayed.

You of course ask “why should I“?

To become aware of your blind spots. To measure and compare is to know. If you don’t participate, you blind spots will remain blind spots. You might even think you don’t have any.

If you don’t participate, you don’t know where competition is – and you don’t know what is local best practice.

If you do participate, you will get your business measured and compared to a relevant, local, unadjusted peer group.

33 functions are covered within these six domains:

- Marketing & sales

- Customer service

- Networks

- IT

- Support functions

- Product development

There are around 600 KPIs per each benchmark (mobile, fixed/cable, integrated):

There are around 600 KPIs per each benchmark (mobile, fixed/cable, integrated):

- 80 revenue,

- 130 OPEX,

- 15 CAPEX,

- 130 productivity,

- 90 subscribers & channel,

- 70 performance,

- 50 load,

- 10 quality and,

- 10 innovation & growth KPIs

The KPIs are carefully selected for each function – and have been improved in cooperation with the operators having participated in 2013 and 2014.

Your position is only showed to yourself. The identities of the actual participants are anonymous. The data is not used for any other purposes than this benchmark. That’s our confidentiality promise.

We also promise a 100% fact based benchmark where no numbers have been “adjusted”.

Think again. You do have blind spots. Spot them.

More information: Nordic operator benchmark 2015

Nordic operator benchmark 2015

There are two major changes to this benchmark compared to 2013 and 2014:

- The scope has been expanded from mobile operators to mobile, fixed/cable and integrated operators

- The peer group country cluster has also been expanded: We now welcome Denmark as a complement to Sweden, Finland and Norway

In total, 16 operators (see above) will be invited to participate. As previous years, the identities of the actual participants will be confidential.

An operator can, depending on business scope, focus or budget, participate in one, two or three of the benchmarks: Mobile, fixed/cable and/or the integrated benchmark.

Integrated operators: Since the mobile-fixed mix is different from one integrated operator to another, integrated operators aren’t just compared “as is”. With tefficient‘s methodology, an operator’s actual mobile-fixed mix will be taken into account on a per-KPI basis making the integrated peer group totally relevant for this specific operator’s mobile-fixed mix.Other modifications to the benchmark are: Improved comparability for equipment sales via subsidy and instalment models; M2M split-out; Improved comparability between telesales in incoming and outgoing calls; Improved comparability between “make or buy” in Networks OPEX & CAPEX; More detailed network quality KPIs.

Mobile benchmark: 603 KPIs derived from a maximum of 376 input data points

Fixed/cable benchmark: 549 KPIs derived from a maximum of 471 input data points

Integrated benchmark: 555 KPIs derived from a maximum of 594 input data points (stand-alone) or just 99 additional input data points (if mobile and fixed benchmarks done)

All three benchmarks cover revenue, OPEX, CAPEX, headcount productivity, performance, traffic & load, quality and innovation & growth for 33 functions.

Deadline to participate is 23 January 2015. Input data (FY 2014) frozen 20 March 2015. Results available 24 April 2015. If you’re among the 16 operators, please contact tefficient for an introduction.

The risk of being too ungenerous with data allowance

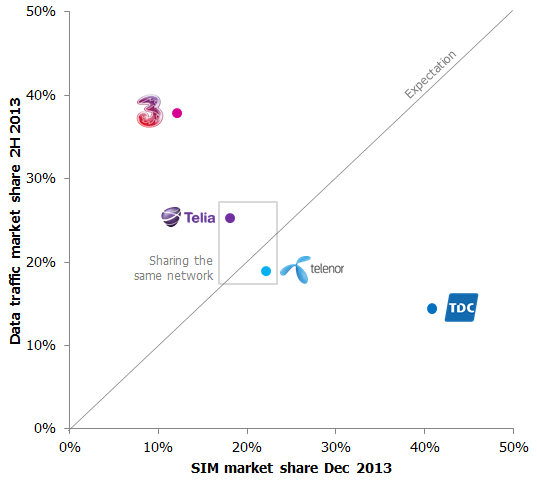

The Danish mobile market – with 4 operators in a country with less than 6 million inhabitants – has always been very competitive and price-centric. So far, only the market leading incumbent TDC has fared relatively well – but the question is if that is about to change.

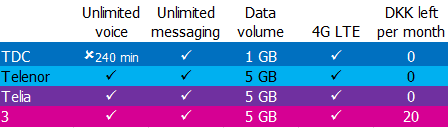

Unlike its competitors, TDC has been very restrictive with data allowances. TDC is still even restricting voice use on most of its plans.

At tefficient, we like regulators who publish not only the total usage volumes of their country, but break it down on the individual operators – like Erhvervsstyrelsen does for Denmark. The graph above compares the SIM market share with the data traffic market share: TDC has 41% of the Danish SIMs but just 14% of the data traffic. ‘3’ is TDC’s antipode: 12% of the SIMs but 38% of Denmark’s mobile data traffic.

A comparison of what a mobile smartphone customer gets for 199 DKK [27 EUR] demonstrates the allowance difference well. What the table doesn’t show is that TDC gives significant multi-user discounts on more expensive plans – and that TDC allows every smartphone user to attach up to 3 data-SIMs under the same allowance without any additional fee. [Telenor has lately partly matched some of this].

Still, the mobile users with an interest for mobile data – undoubtedly the future – seem to prefer TDC’s competitors: The average TDC phone SIM used 250 Mbytes of data per month during 2H 2013. Telenor had 530, Telia 680 and ‘3’ 1170 Mbytes. The average TDC data-only SIM used 650 Mbytes. Telenor had 2600, Telia 4200 and ‘3’ 5100 Mbytes per month.

The competitive context has sharpened further as Telenor and Telia have launched their new, shared, network. A network test – ordered by Telenor – showed that the new Telenor/Telia network is best in Denmark. Marketing has had its point towards TDC.

In what appears to be a reaction, TDC has recently increased some of their data allowances – especially in the multi-user plans.

The case should serve as learning for operators in general: Whereas we’ve spoken much about the risk of being too generous with data allowance it’s perhaps time to address the risk of being too ungenerous?

How six months contracts changed mobile in Belgium and Denmark

Denmark has had it for more than 10 years, Belgium got it a year ago and now EU proposes it for all of EU: Maximum effective binding period of 6 months for consumer mobile contracts.

Denmark has had it for more than 10 years, Belgium got it a year ago and now EU proposes it for all of EU: Maximum effective binding period of 6 months for consumer mobile contracts.

What happens to a mobile market when such a change is introduced and why is this change actually so significant?

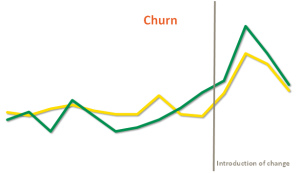

This analysis shows that when Belgian consumers no longer are locked into long contracts, it has a major impact. The question is also if the transition is over in Belgium: Danish figures suggest it might get worse.

Since the EU commission – as part of the 11 September 2013 “Connected Continent: Building a Telecoms Single Market” plan – is proposing that EU consumers should have a similar right to cancel contracts after six months, the question is obviously: Is this also your future?

Download analysis: tefficient public industry analysis 12 2013 Six months contracts