Orange Switzerland (which since 2012 isn’t owned by Orange Group) is just about to be sold to Xavier Niel’s private holding company. What makes it interesting is that Niel is the person behind Iliad, the company who operates under the Free brand in France. Continue reading Niel buys Orange Switzerland: So will Swiss headcount follow French?

Network sharing JV benchmark 2015

Previous years’ benchmarks showed that network sharing JVs – through focus and new operation models – have established cost and productivity levels which few mobile operators can match within their own network departments. JVs’ network quality is also higher – in spite of higher network load. Continue reading Network sharing JV benchmark 2015

Previous years’ benchmarks showed that network sharing JVs – through focus and new operation models – have established cost and productivity levels which few mobile operators can match within their own network departments. JVs’ network quality is also higher – in spite of higher network load. Continue reading Network sharing JV benchmark 2015

Four years (and a net neutrality law) later, Dutch operators foul again

Dutch operators KPN and Vodafone were both fined for violations of net neutrality today.

KPN got a fine of 250000 EUR for having blocked access to voice over IP services on public Wi-Fi hotspots. Vodafone was fined 200000 EUR for having zero-rated content from HBO. Continue reading Four years (and a net neutrality law) later, Dutch operators foul again

Rollover: The next big thing for customer retention

Bucket plans – with volume caps on the number of minutes, messages and Mbytes – have been offered by mobile operators for years. Even though the composition has varied over time (e.g. through elements made unlimited), the concept is well known to customers.

Bucket plans – with volume caps on the number of minutes, messages and Mbytes – have been offered by mobile operators for years. Even though the composition has varied over time (e.g. through elements made unlimited), the concept is well known to customers.

Monthly caps have become the standard of our industry. Another standard is to reset those caps at the start of a new month. This means that any balance left – minutes, messages, Mbytes – is voided. Or confiscated – to use the word of John Legere, CEO of T-Mobile USA. Continue reading Rollover: The next big thing for customer retention

The Alps operator benchmark

In 2013, tefficient introduced the Nordic operator benchmark to telcos in Sweden, Finland and Norway. The feedback has been strong, leading to repetitions in 2014 and 2015. Denmark was added in 2015.

Unlike other benchmarks, it has a local view since the peer group only contains operators from the covered countries – which have been selected based on high comparability. Unlike other benchmarks, it is therefore 100% fact based since no numbers need to be “adjusted” in an attempt to mask that they weren’t comparable in the first place. Continue reading The Alps operator benchmark

Zero-SIM game

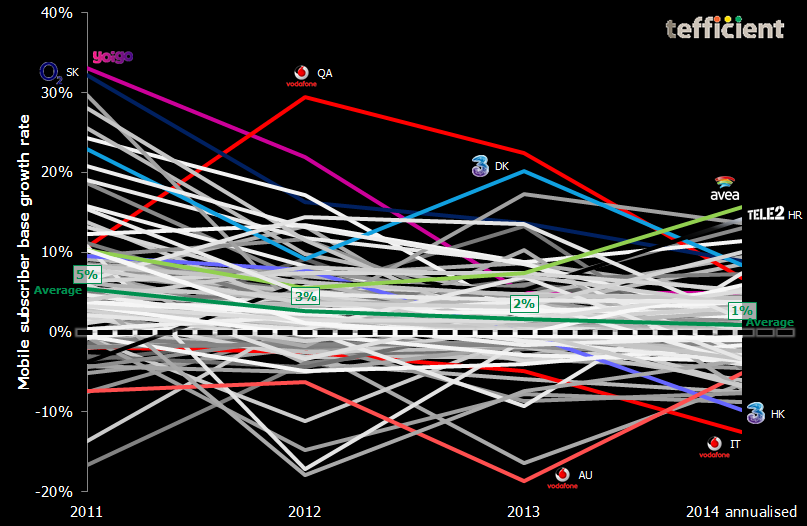

The graph below shows the annual (2014: annualised) growth rate in reported mobile SIM base for about 100 mobile operators in mature markets globally.

Copper Europe?

Whereas the “Europe is behind” accusation today is a myth rather than a fact when it comes to 4G LTE rollout, Europe still has an issue when it comes to really fast, two-way, fixed broadband – something only fiber-to-the-home (FTTH) or fiber-to-the-building (FTTB) networks can deliver. Continue reading Copper Europe?

Churn: Still a concern

The subsidy model – which dominated operators’ handset and equipment sales in mature markets for decades – is rightfully retiring. It wasn’t a brilliant idea to discount goods not produced inhouse (taking cost pressure away from equipment manufacturers like Apple) and, to compensate, overcharge for the services actually produced (making over-the-top services and Wi-Fi more attractive). Continue reading Churn: Still a concern

4G LTE coverage: Europe catching up, led by less populated countries

For a long time, lobbyists used the 4G LTE rollout and -adoption discrepancy between US and Korea/Japan (on one hand) and Europe (on the other hand) as a “proof” of too rigid European telecom regulation.

The basic fact that major US, Korean and Japanese operators are running CDMA2000 without the European possibility to gracefully migrate to 4G LTE was tactically neglected in this comparison. Continue reading 4G LTE coverage: Europe catching up, led by less populated countries

You do have blind spots. Spot them.

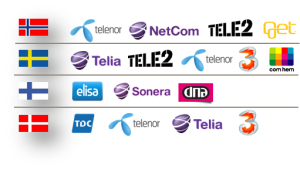

The last day to confirm participation in the Nordic operator benchmark 2015 is 23 January.

A few operators have confirmed their participation already, but since we 2015 expand the scope of the benchmark from mobile to mobile, fixed/cable and integrated operators (respectively) and add Denmark, there are a few operators who have been asked for the first time.

The operators who are asked are displayed.

You of course ask “why should I“?

To become aware of your blind spots. To measure and compare is to know. If you don’t participate, you blind spots will remain blind spots. You might even think you don’t have any.

If you don’t participate, you don’t know where competition is – and you don’t know what is local best practice.

If you do participate, you will get your business measured and compared to a relevant, local, unadjusted peer group.

33 functions are covered within these six domains:

- Marketing & sales

- Customer service

- Networks

- IT

- Support functions

- Product development

There are around 600 KPIs per each benchmark (mobile, fixed/cable, integrated):

There are around 600 KPIs per each benchmark (mobile, fixed/cable, integrated):

- 80 revenue,

- 130 OPEX,

- 15 CAPEX,

- 130 productivity,

- 90 subscribers & channel,

- 70 performance,

- 50 load,

- 10 quality and,

- 10 innovation & growth KPIs

The KPIs are carefully selected for each function – and have been improved in cooperation with the operators having participated in 2013 and 2014.

Your position is only showed to yourself. The identities of the actual participants are anonymous. The data is not used for any other purposes than this benchmark. That’s our confidentiality promise.

We also promise a 100% fact based benchmark where no numbers have been “adjusted”.

Think again. You do have blind spots. Spot them.

More information: Nordic operator benchmark 2015