For operators, the biggest piece of news in Apple’s event yesterday isn’t the iPhone 6S or the iPad Pro. Instead it’s Apple’s introduction of its own iPhone Upgrade Program. Continue reading With the iPhone Upgrade Program Apple makes operators replaceable

Category Archives: Consulting

Mobile data usage: Price and bucket size matter

Mobile data usage continues to grow: +58% for the markets in this analysis.

In some high usage markets like the US and Singapore, we however see signs of saturation with annual usage growth of just about 20%.

But it’s not a general trend: In other high usage markets – Finland, Estonia, Denmark, Japan and Ireland – the mobile data usage grew 60 to 80%. Continue reading Mobile data usage: Price and bucket size matter

Increase loyalty. Increase revenue. Reduce SAC/SRC. Is the combo possible?

Decoupled, non-binding, unsubsidised: A game changer?

Our analysis shows that mature market mobile operators on average use 15-20% of service revenue on subscriber acquisition and subscriber retention cost (SAC/SRC). In most cases without growing.

Consequently, we examine the success of the operators who – in order to reduce SAC/SRC and improve margin – are challenging the mature market norm with binding contracts with coupled, subsidised, equipment. Continue reading Increase loyalty. Increase revenue. Reduce SAC/SRC. Is the combo possible?

Operator proposition & positioning analysis and workshops

Analysis & Go-to-market, 2015

Preparing analysis of the commercial and financial development for competing operators – aligning it with their respective propositions and positioning. Focusing on the operators in the market in question – but supplementing it with analysis of other international markets relevant to take learning from and apply in a local context. Continue reading Operator proposition & positioning analysis and workshops

OPEX and CAPEX breakdown for operators in seven large countries

Analysis & Go-to-market, 2015

Providing a global solutions provider with a country-per-country OPEX and CAPEX breakdown comparison between all major operators in seven large countries – based on combining operator reported figures, regulatory data, market data and operators’ communicated plans & targets with tefficient‘s understanding of what is industry typical given market position and strategy.

T-Mobile’s churn lowest ever – following introduction of Data Stash

Since T-Mobile’s plans for Data Stash were made public in December last year, we have looked forward to T-Mobile’s reporting of Q1 results – since we hoped to see the first indications of if rollover data actually helps customer retention. Continue reading T-Mobile’s churn lowest ever – following introduction of Data Stash

Liberty Global buys a mobile operator. What does it mean for Europe?

Liberty Global has through a number of major acquisitions – Virgin Media in the UK and Ziggo in the Netherlands being the latest – expanded its European cable footprint. Continue reading Liberty Global buys a mobile operator. What does it mean for Europe?

Liberty Global has through a number of major acquisitions – Virgin Media in the UK and Ziggo in the Netherlands being the latest – expanded its European cable footprint. Continue reading Liberty Global buys a mobile operator. What does it mean for Europe?

BT Mobile: Surprisingly disruptive

After 14 years, BT is back into consumer mobile. The long-rumoured launch of BT Mobile happened today. Continue reading BT Mobile: Surprisingly disruptive

Freedom to stay – The power of 40000 Tweets

Consumers often think of carriers being somewhat stuffy and dusty, being slow to give customers flexibility and big at small print. But there are great exceptions to the rule with T-Mobile in the US, Free in France and Tele2 in Sweden, and we believe the next two years will see some further fun, entertaining and disruptive carrier offerings on the market. Continue reading Freedom to stay – The power of 40000 Tweets

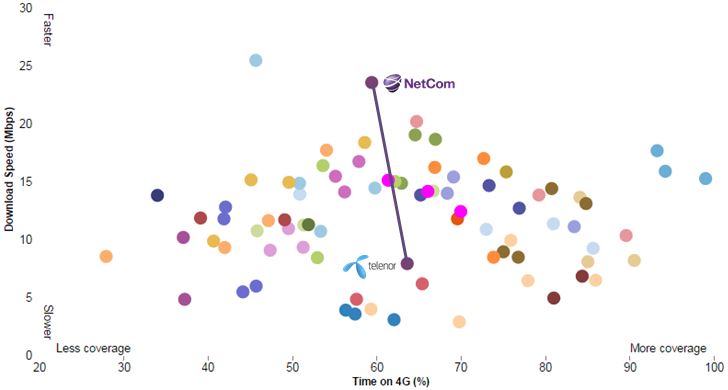

If you sell Mbytes, why slow your customers down?

We’ve been awaiting Telenor’s official comments to OpenSignal’s new crowdsourced 4G coverage and speed test, but since Telenor hasn’t yet commented it we try to interpret the Norwegian results ourselves.

Continue reading If you sell Mbytes, why slow your customers down?