Reference: Analysis, 2022

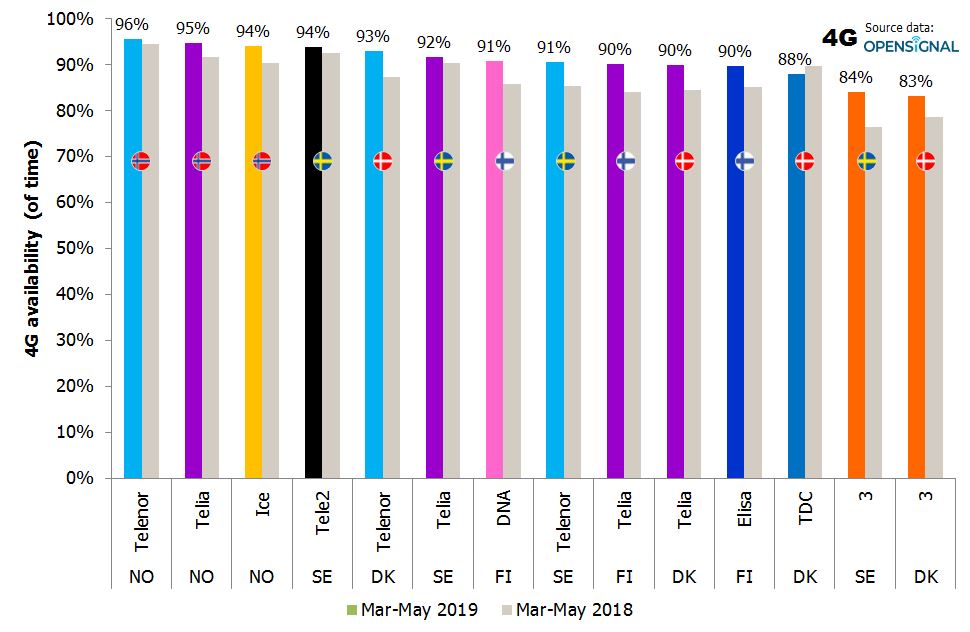

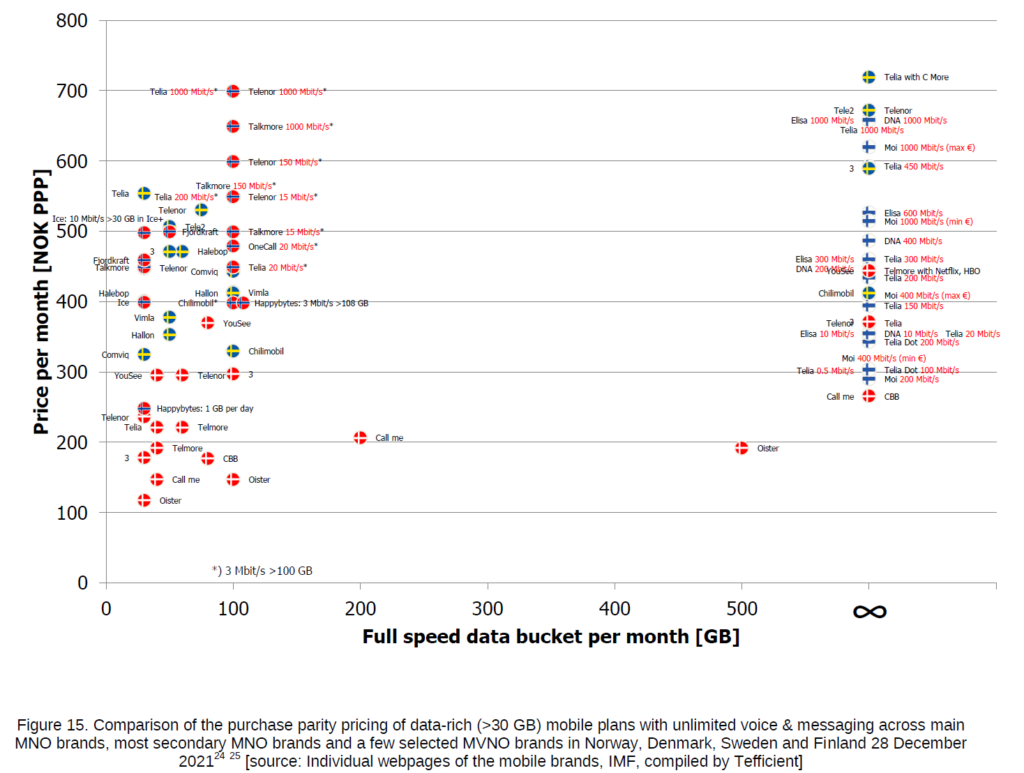

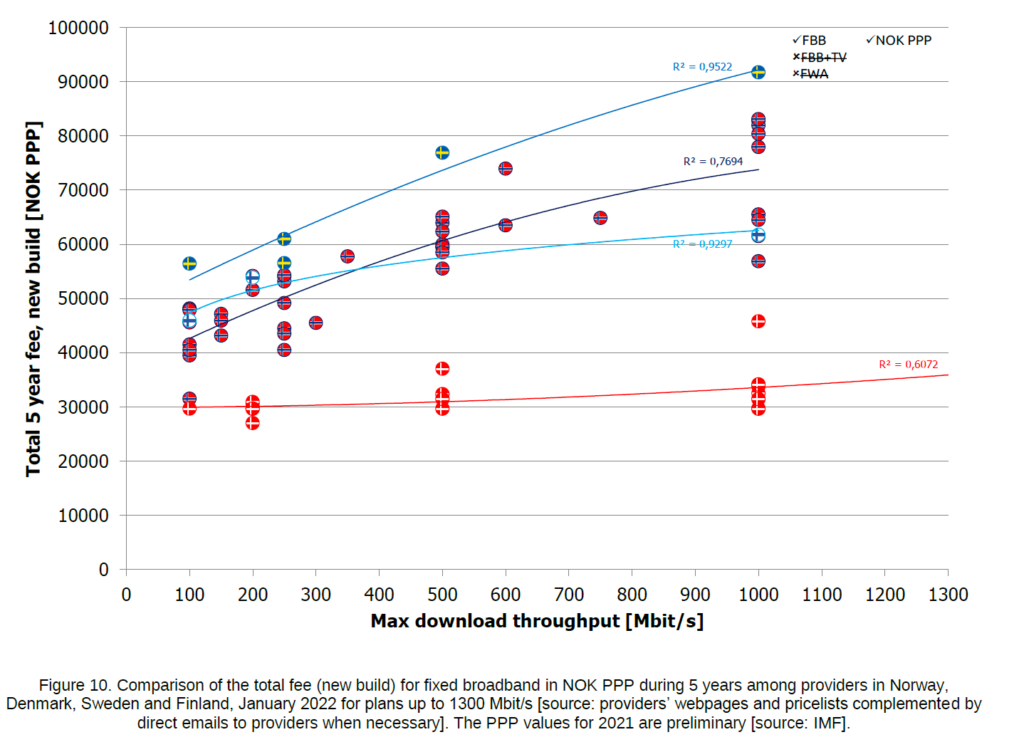

Norway’s Ministry of Local Government and Regional Development yesterday published two analyses commissioned from Tefficient.

The conclusion is summarised (in Norwegian) in a press release from the Ministry: https://www.regjeringen.no/no/aktuelt/norske-mobilpriser-er-fortsatt-hoye-i-nordisk-sammenheng/id2909632/

Both analyses are quite comprehensive and compare Norway to the three fellow Nordic countries Denmark, Sweden and Finland. It means that they are highly interesting not just for the industry and policy makers in Norway, but in all four countries.

Since the Ministry has made both analyses available for public download, you can access them directly and for free from here:

Assessment of Norwegian mobile revenues in a Nordic context – 2022

Assessment of Norwegian fixed broadband pricing in a Nordic context – 2022

The analyses are one-year-later updates of the original analyses that provided input to the government’s white paper to the Norwegian Parliament titled “Vår felles digitale grunnmur — Mobil-, bredbånds- og internettjenester“. See Tefficient’s reference from last year:

Commissioned by Norway’s Ministry of Local Government and Regional Development.