When Canning Fok, the co-managing director of CK Hutchison (the group that owns ‘3‘), in the earnings webcast yesterday attributed the revenue headwinds of the group to oil, foreign currency and the iPhone, two things became clear: Continue reading Without an attractive iPhone, operators’ EBITDA margin surges

When Canning Fok, the co-managing director of CK Hutchison (the group that owns ‘3‘), in the earnings webcast yesterday attributed the revenue headwinds of the group to oil, foreign currency and the iPhone, two things became clear: Continue reading Without an attractive iPhone, operators’ EBITDA margin surges

All posts by Fredrik Jungermann

Roam Like Home – the beta

Review of the present Roam Like Home offers in France, the UK, Denmark, Norway, Sweden and Finland

15 June 2017 will be a milestone in the history of European telecoms: From this day, not only goods, workers, services and capital can move freely across EU borders: Also mobile phone calls, messages and data can start to move freely across the borders when the mobile roaming fees – after ten years of regulation – finally are abolished within the European Union. Continue reading Roam Like Home – the beta

Analysis of the development of mobile data monetisation in a specific country

Analysis, 2016

Analysis of the mobile market in a specific country: Development of market shares, subscription tiers, churn, offerings, pricing, data usage, revenue, ARPU, margin, network coverage and CAPEX for all operators.

Special focus on the development of mobile data monetisation and mobile TV/video over time.

Comparisons done to other countries.

Commissioned by a global solutions provider.

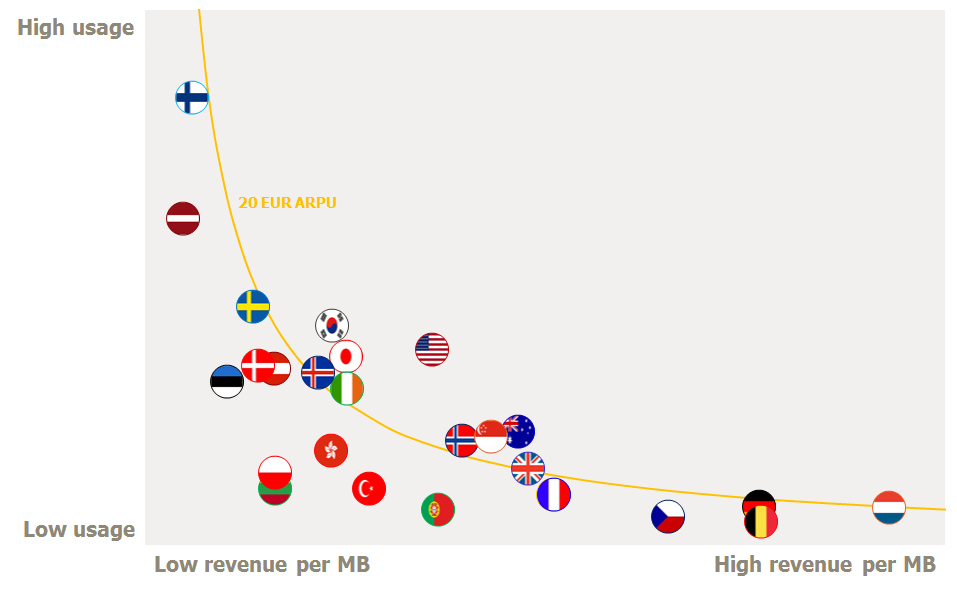

USA, Latvia and Finland combine high mobile data usage with fast growth

Which country had the highest mobile data usage in 2015? The fastest usage growth?

Which operator leads the world?

Which country has the lowest and highest revenue per Megabyte?

How does it affect usage? How are data-only and 4G LTE adoption rates affecting usage? Continue reading USA, Latvia and Finland combine high mobile data usage with fast growth

Nordic operator benchmark 2016

For the fourth consecutive year: Comprehensive business benchmark including more than 600 KPIs covering revenue, OPEX, CAPEX, headcount productivity, subscriptions & channels, performance, load, quality and innovation & growth – for 41 functions of mobile, fixed/cable and integrated operators – respectively. Continue reading Nordic operator benchmark 2016

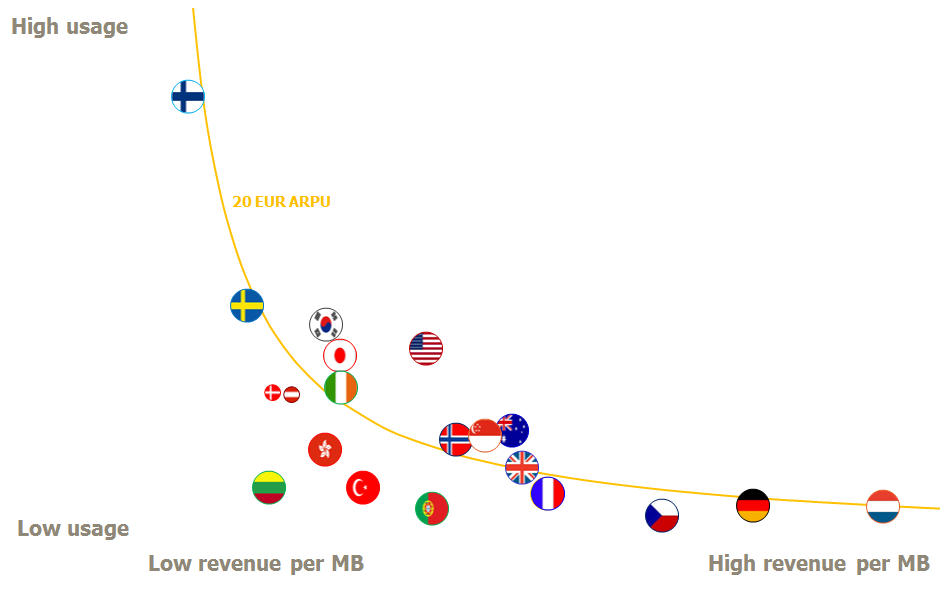

USA and Finland surprise: High and quickly growing mobile data usage

This is a preliminary analysis – to the final version.

Which country had the highest mobile data usage in 2015? The fastest usage growth?

The lowest and highest revenue per Megabyte?

How does it affect usage? How are data-only and 4G LTE adoption rates affecting usage?

Find the answers to these mobile data usage and monetisation questions in tefficient’s 13th public analysis on the topic. Continue reading USA and Finland surprise: High and quickly growing mobile data usage

Nordic operators’ networks have no equal in speed. On 3G.

4G coverage is great as well – but 4G speeds are slowing

Having ran the Nordic operator benchmark four years in a row now we know that Nordic operators have world-leading network quality.

![]() OpenSignal just issued its first State of Mobile Networks report covering the four Nordic countries Sweden, Denmark, Finland and Norway. Based on 34 million crowdsourced tests taken in Q1 2016, OpenSignal shows which country (and which operator in it) that has the best:

OpenSignal just issued its first State of Mobile Networks report covering the four Nordic countries Sweden, Denmark, Finland and Norway. Based on 34 million crowdsourced tests taken in Q1 2016, OpenSignal shows which country (and which operator in it) that has the best:

- 4G coverage

- 4G download speed

- 3G download speed

- Combined download speed

- 4G latency

- 3G latency

And it is a race of high standards and tight results. Continue reading Nordic operators’ networks have no equal in speed. On 3G.

Market share calculations for a country market

Analysis & Go-to-market, 2016

Developing a model for calculation and visualisation of operator market share trends in a specific country market. Continue reading Market share calculations for a country market

German operators: We listened to your customers. Maybe you should too?

This innocent tweet – based on official statistics from the German and Finnish telecom regulators – has currently been read by more than 90 000 people:

Finland, with 5.5M people, overtook Germany (with 80M) in total mobile data traffic in 2015. pic.twitter.com/fOZnEiIrLd

— Tefficient 🚥 (@tefficient) May 20, 2016

Continue reading German operators: We listened to your customers. Maybe you should too?

“The best network” worth 6% of EBITDA

Wondered why American carriers spent so much effort and marketing dollars claiming and defending “the best mobile network” position lately?

It started with Verizon‘s balls commercial: