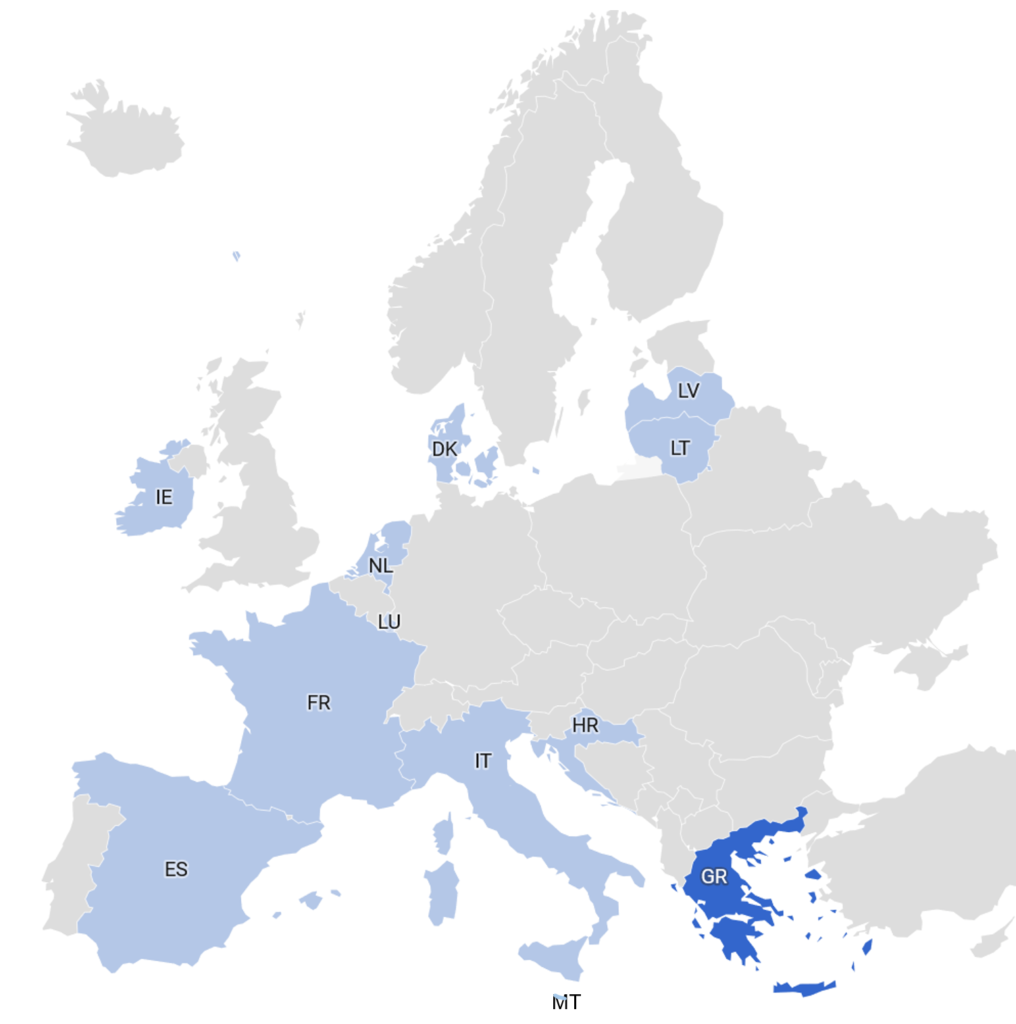

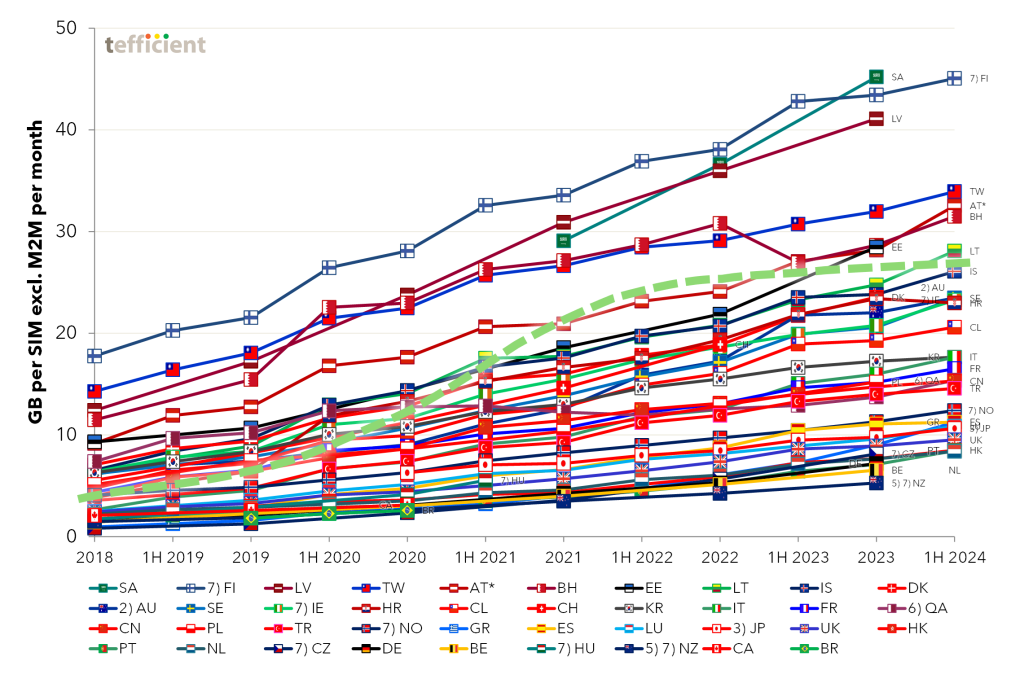

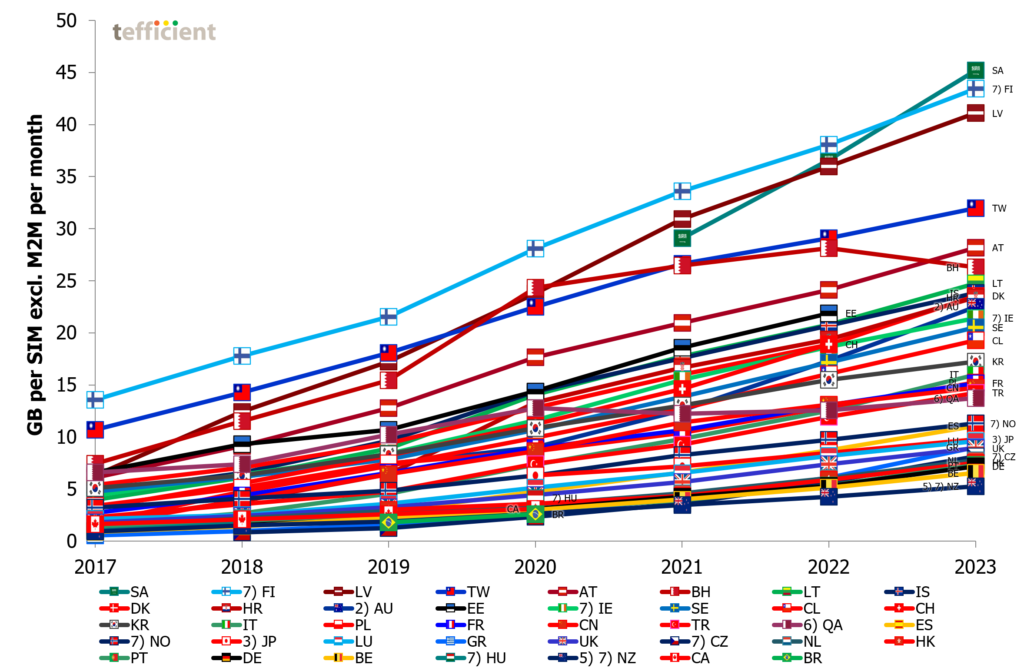

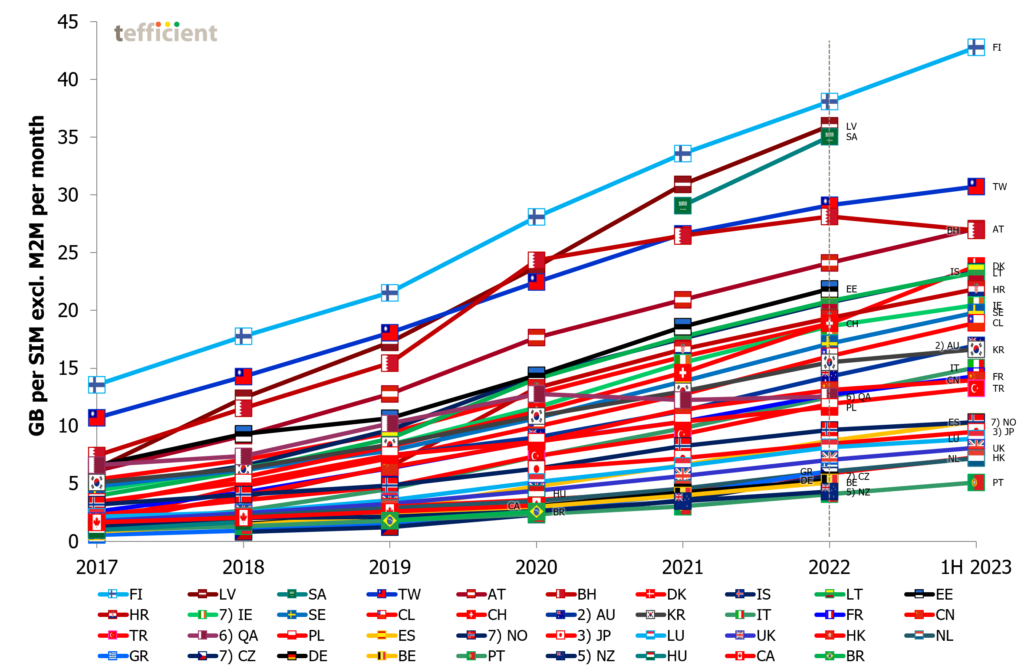

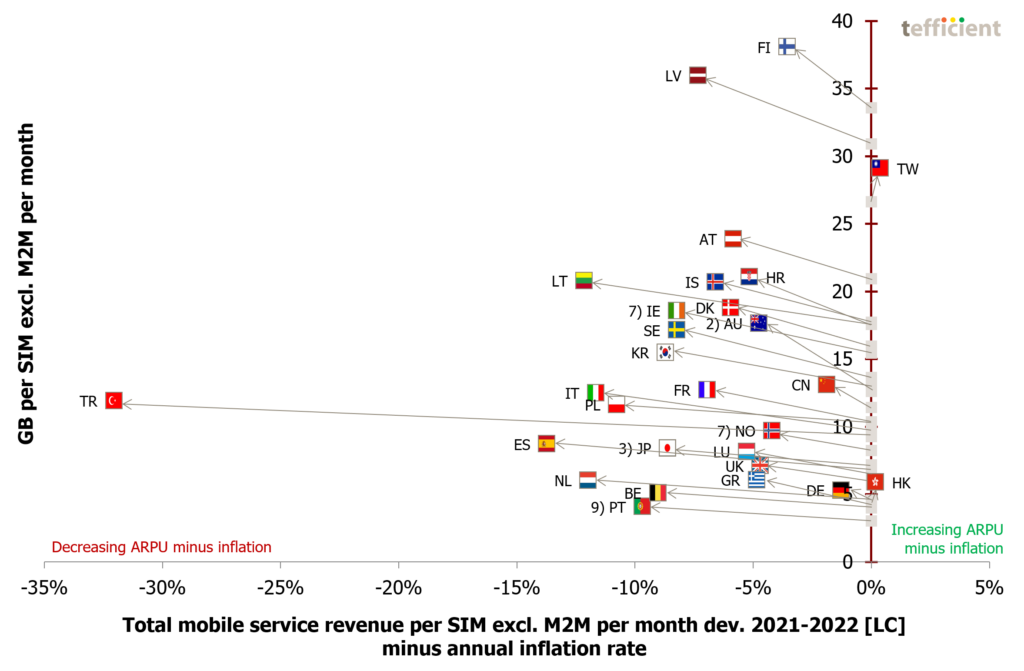

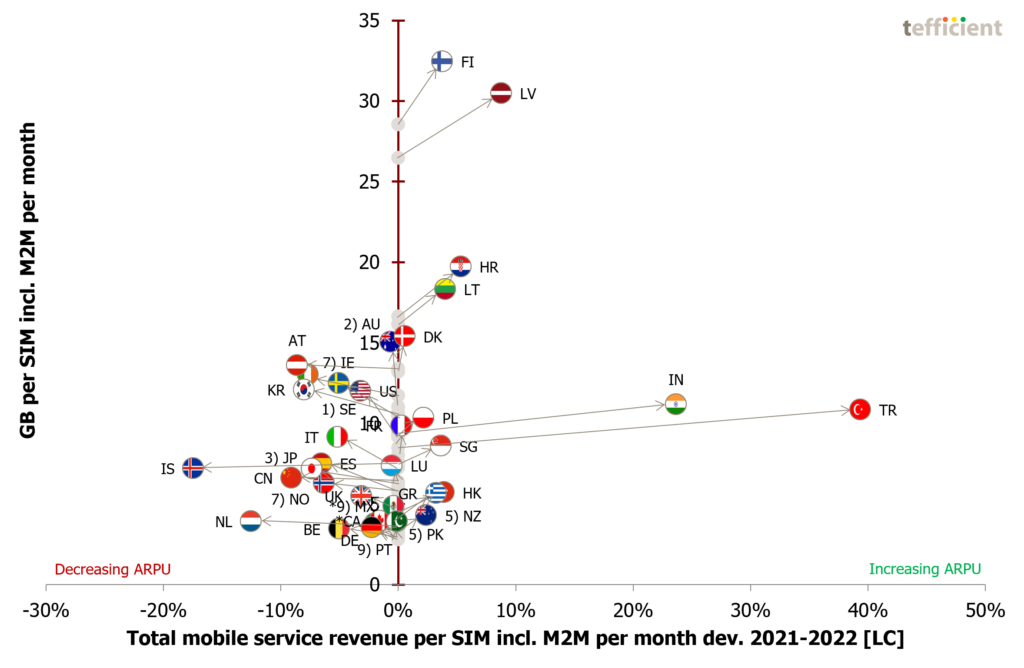

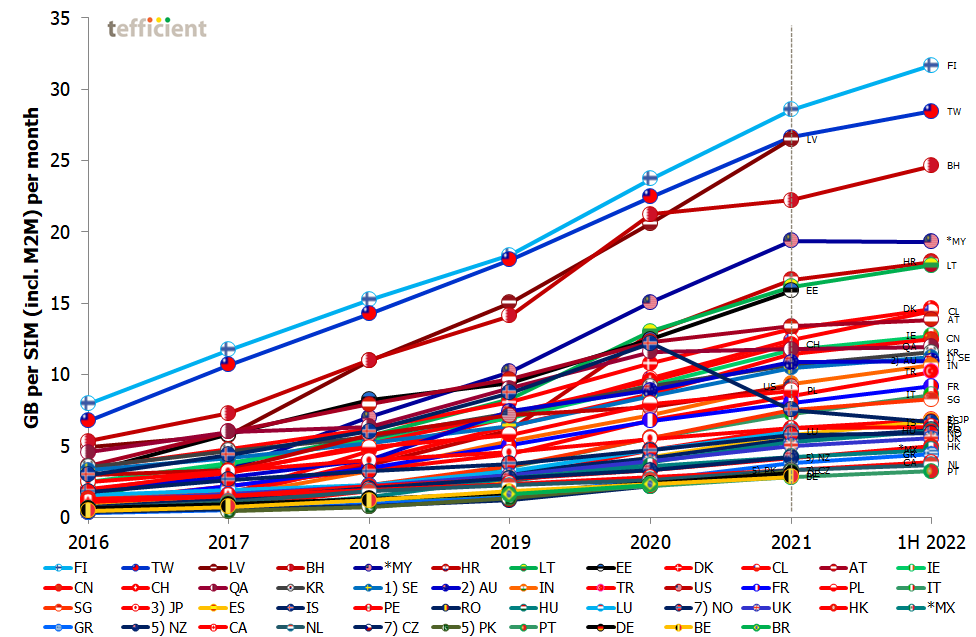

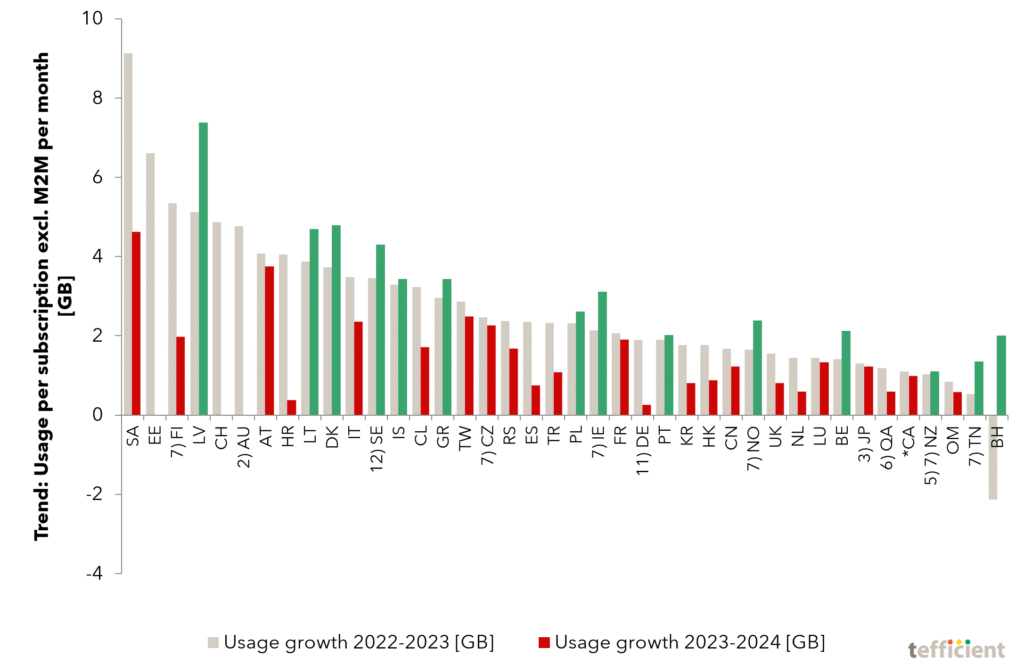

Tefficient’s 44th public analysis of mobile data trends and drivers compares data from 40 countries, where M2M/IoT can be excluded from the total bases. Mobile data usage grew year-on-year in every country, with Saudi Arabia maintaining its position as the usage leader and Latvia emerging as the new runner-up.

Growth decelerated again – also in GB terms

However, growth rates have decelerated. Greece recorded the highest annual increase at 38%, while Croatia posted the lowest at just 2%. Even in absolute terms [incremental GB per subscription], most countries experienced slower growth in 2024 than in 2023. Overall, the demand for additional mobile data is weaker than ever – although FWA is included in most figures.

Continue reading The demand for additional mobile data is weaker than ever – ARPU growth softens