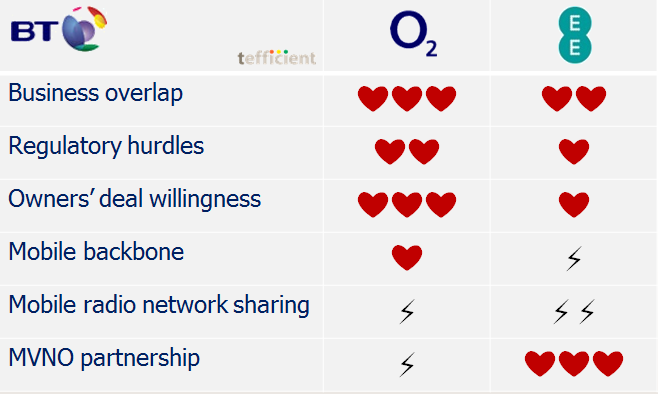

BT confirmed yesterday that they are in talks with two mobile operators about a possible merger in the UK – one being O2. EE is believed to be the other. To assist BT, tefficient presents a matchmaking table.

Business overlap: Since O2 last year sold its fixed business to Sky, a BT-O2 marriage means a minimal business overlap. EE is not bad as a partner either; EE’s fixed business is small. What complicates is that EE recently positioned itself in the upcoming quad-play market through the launch of EE TV. But it helps that EE didn’t enter the same content arena as BT to compete with e.g. BT Sport.

Regulatory hurdles: It took EU a year or more to agree to the mergers of ‘3’ and Orange in Austria, of ‘3’ and O2 in Ireland and of O2 and E-plus in Germany. These mergers were all consolidating mobile operators. Numericable, a French cable operator, received green light from French authorities to acquire SFR, an integrated operator, in just six months (and EU kept out). Since the experience from the merger in Austria is that prices went up, the new EU commission is believed to be more skeptical to mergers which increase market consolidation. A merger between BT and O2 would create a giant, but with the old way of looking at it (fixed and mobile are separate markets), approval might be as easy as in Numericable-SFR. A marriage with EE is somewhat more complicated since it would be a merger of two No 1 operators (in fixed and mobile respectively) plus, of course, the fact that EE today is competing with BT in fixed (and TV).

Owners’ deal willingness: Telefónica, who owns O2, sold O2 branded operations in Ireland and Czech Republic in 2013. Telefónica was behind O2’s entry into UK fixed market in 2006-2007, but demonstrated deal willingness when it was sold to Sky last year. Telefónica has also merged its O2 operation in Germany with E-plus. With all these deals in mind and with a need to control debt after the acquisition in Germany and the upcoming GVT acquisition in Brazil, Telefónica is so ready to sell. EE, on the other hand, has been surrounded by rumours on deals and IPOs, but EE’s owners have recently put an end to it saying that time is not now. The 50/50 ownership split between Orange and Deutsche Telekom makes decisions on EE slow.

Mobile backbone: O2 has continued to rely on BT as a provider not only for backbone transmission but also for field engineering services. EE has sourced much of its backbone from BT’s competitor Virgin Media.

Mobile radio network sharing: Regardless of choosing O2 or EE, BT will get a third party involved through network sharing within mobile. In O2’s case, that sharing partner is Vodafone (who recently said they would go after BT also in the consumer business in the UK), but O2 and Vodafone never went further than sharing passive infrastructure like masts and transmission. Marrying EE would bring ‘3‘ to the table since EE shares network with ‘3’. In contrast to O2/Vodafone, the EE/’3′ network sharing is based on sharing also active infrastructure like radio equipment. It’s not a showstopper, but calls for more coordination.

MVNO partnership: At last, a category where a marriage with EE would be the easiest: BT has a fresh MVNO agreement with EE which grants BT’s mobile customers access to EE’s network. In spite of being part of BT until 2001, O2 never had such an agreement with BT; it was Vodafone who was BT’s host prior to the change to EE this year.

To conclude, both O2 and EE would be good partners to BT. But a marriage with O2 would be quicker to the altar and contain more love. Hopefully.