The last day to confirm participation in the Nordic operator benchmark 2015 is 23 January.

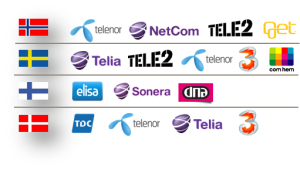

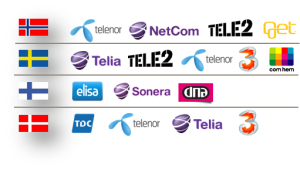

A few operators have confirmed their participation already, but since we 2015 expand the scope of the benchmark from mobile to mobile, fixed/cable and integrated operators (respectively) and add Denmark, there are a few operators who have been asked for the first time.

The operators who are asked are displayed.

You of course ask “why should I“?

To become aware of your blind spots. To measure and compare is to know. If you don’t participate, you blind spots will remain blind spots. You might even think you don’t have any.

If you don’t participate, you don’t know where competition is – and you don’t know what is local best practice.

If you do participate, you will get your business measured and compared to a relevant, local, unadjusted peer group.

33 functions are covered within these six domains:

- Marketing & sales

- Customer service

- Networks

- IT

- Support functions

- Product development

There are around 600 KPIs per each benchmark (mobile, fixed/cable, integrated):

There are around 600 KPIs per each benchmark (mobile, fixed/cable, integrated):

- 80 revenue,

- 130 OPEX,

- 15 CAPEX,

- 130 productivity,

- 90 subscribers & channel,

- 70 performance,

- 50 load,

- 10 quality and,

- 10 innovation & growth KPIs

The KPIs are carefully selected for each function – and have been improved in cooperation with the operators having participated in 2013 and 2014.

Your position is only showed to yourself. The identities of the actual participants are anonymous. The data is not used for any other purposes than this benchmark. That’s our confidentiality promise.

We also promise a 100% fact based benchmark where no numbers have been “adjusted”.

Think again. You do have blind spots. Spot them.

More information: Nordic operator benchmark 2015