Reference: Analysis, 2021

Norway’s Ministry of Local Government and Modernisation has today published an extensive white paper to the Norwegian Parliament titled “Vår felles digitale grunnmur — Mobil-, bredbånds- og internettjenester“.

Tefficient has written two comprehensive analyses to support chapter 7 in the white paper addressing mobile and fixed broadband networks:

- “Assessment of Norwegian mobile revenues in a Nordic context”

- “Assessment of Norwegian fixed broadband pricing in a Nordic context”

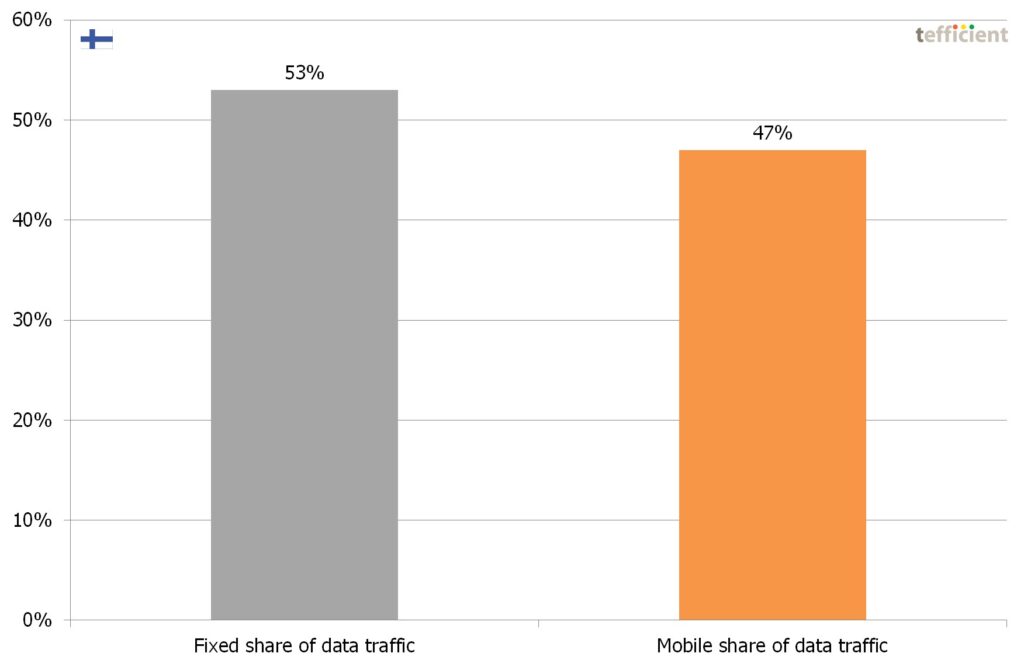

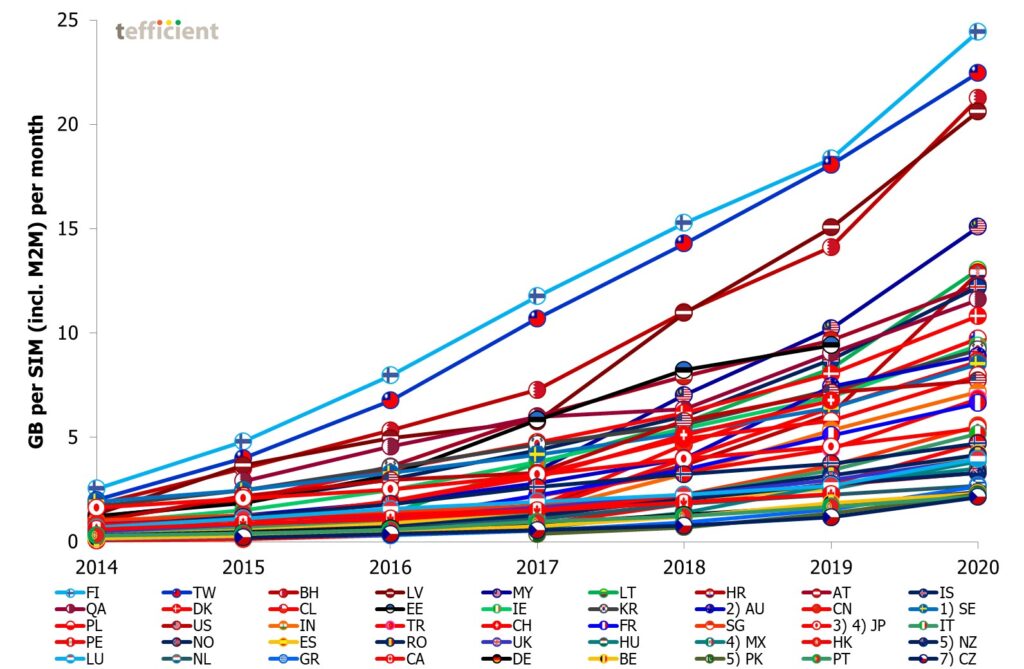

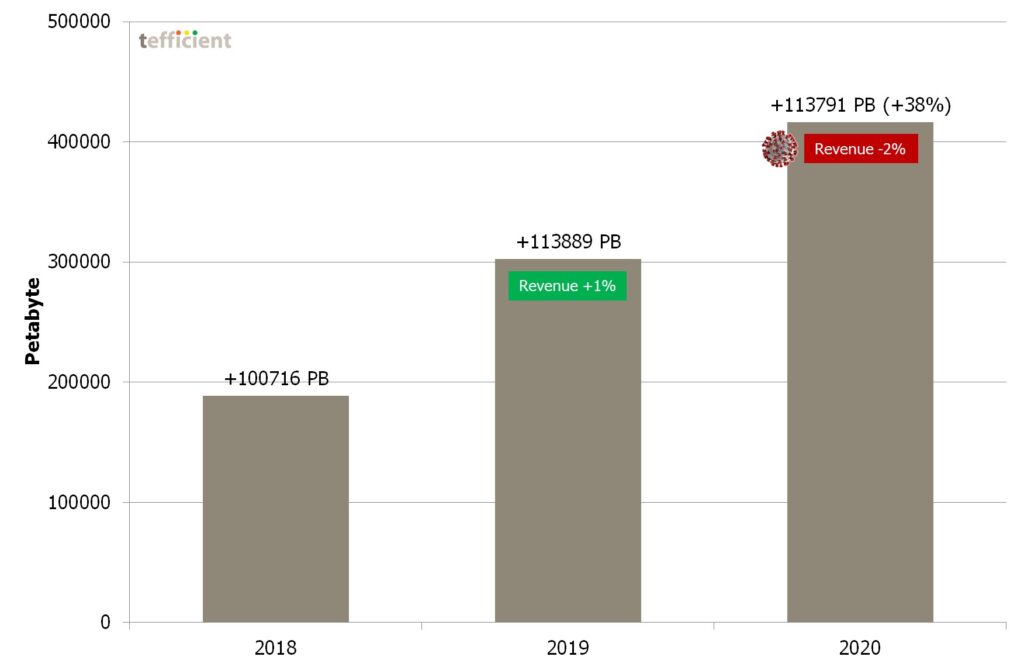

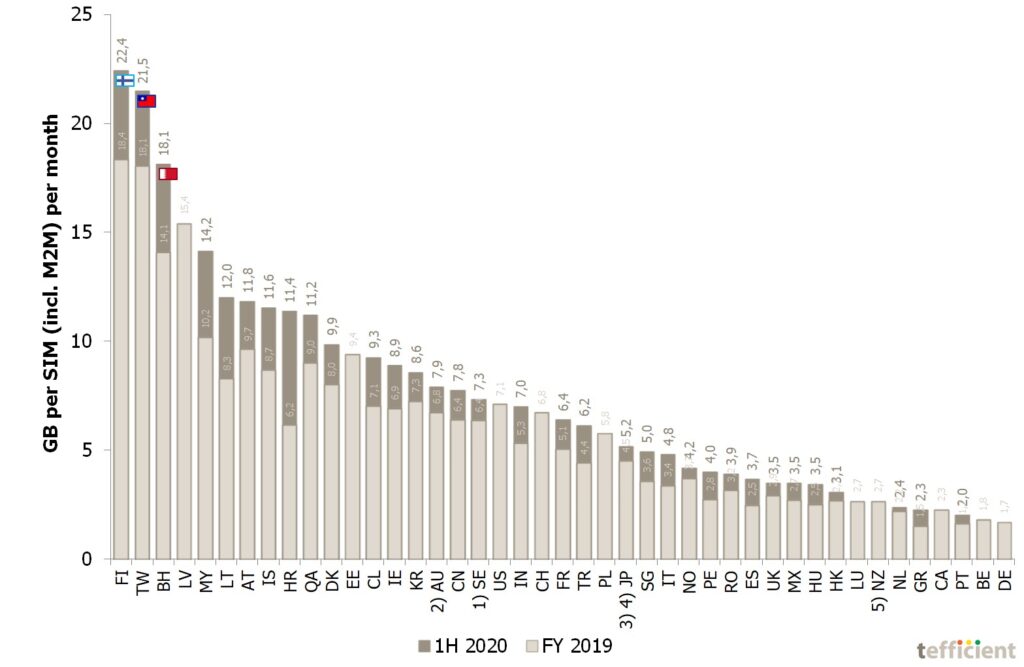

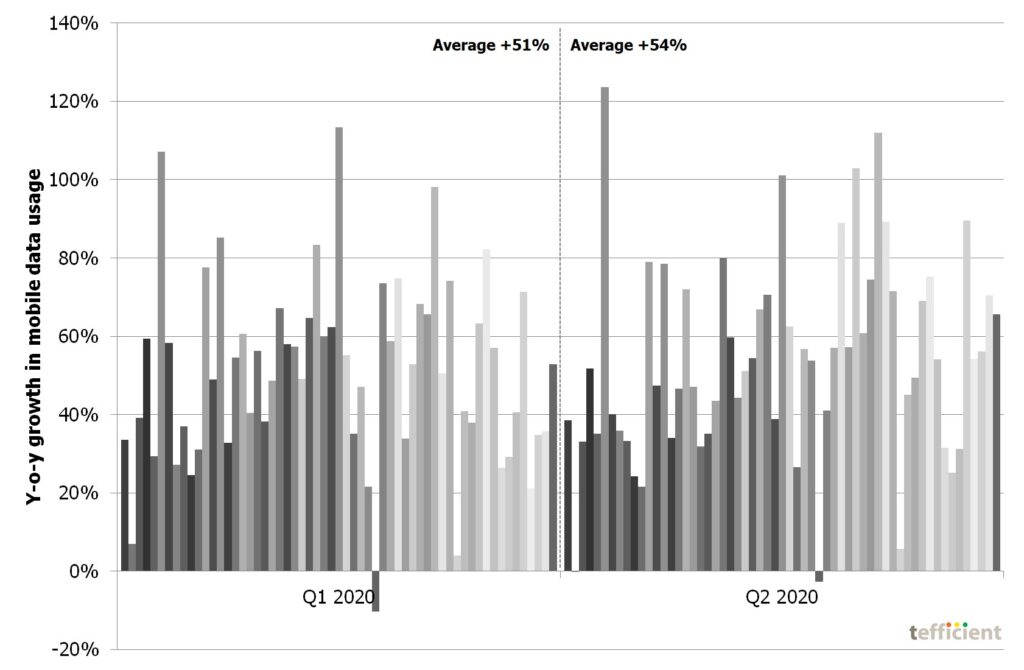

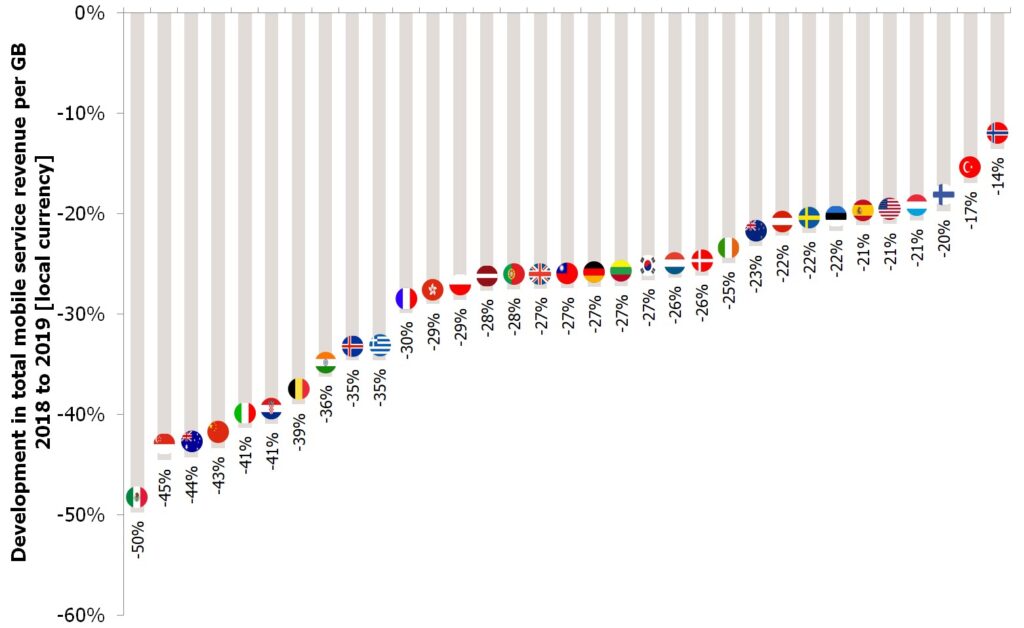

The first analysis investigates whether Norwegian mobile prices should be considered high or moderate given certain specific Norwegian conditions. A multitude of metrics are used – always compared between the same four markets: Norway, Denmark, Sweden and Finland.

The second analysis investigates Norwegian broadband prices, comparing them against three other Nordic markets: Denmark, Sweden and Finland.

The white paper (in Norwegian) summarises the two analyses in sections 7.2.1.4 and 7.2.2.3 using selected graphs and conclusions. The ministry has integrated the key findings with own and independent research, data and viewpoints to form a basis for future policy.

Continue reading Assessment of Norwegian mobile and fixed broadband pricing in a Nordic context →