Reference: Benchmarks, 2022

For the ninth year: Comprehensive business benchmark with 895 KPIs covering revenue, OPEX, CAPEX, headcount productivity, subscriptions & channels, performance, load, quality and innovation & growth – for 53 functions of mobile, fixed and integrated operators.

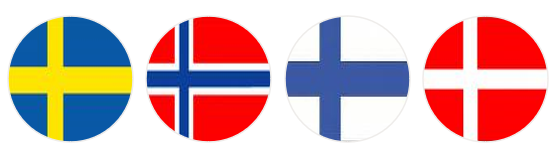

Peer group data exclusively from Swedish, Finnish, Norwegian and Danish operators. Due to pre-agreed confidentiality requirements, participating operators are anonymous (and of course their data).

The results demonstrate the value of a region-specific benchmark approach: Nordic operators have global leadership in a wide array of business aspects and a global benchmark would therefore leave them without guidance on how to improve further. In contrast, participating operators now have a great tool to improve their local competitiveness even further.

As every year, the Nordic operator benchmark will be enhanced further based on input from participants. It will run again in January 2023. Read more about the benchmark here.