Reference: Analysis, 2022

Fiberalliancen is a trade association for companies that own, operate and use fibre networks in Denmark. It is a part of Green Power Denmark.

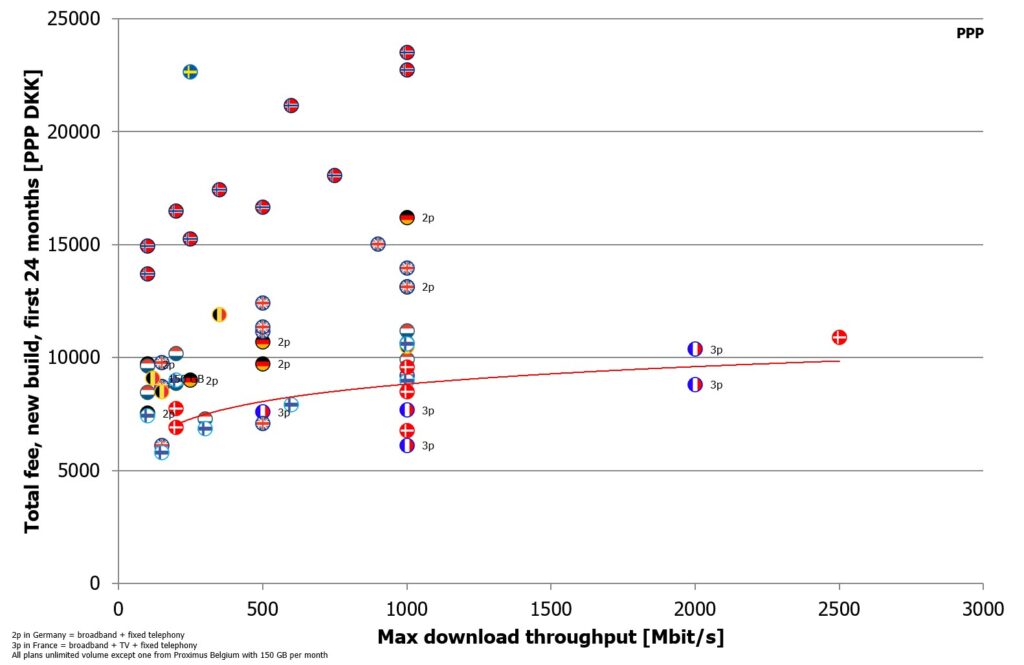

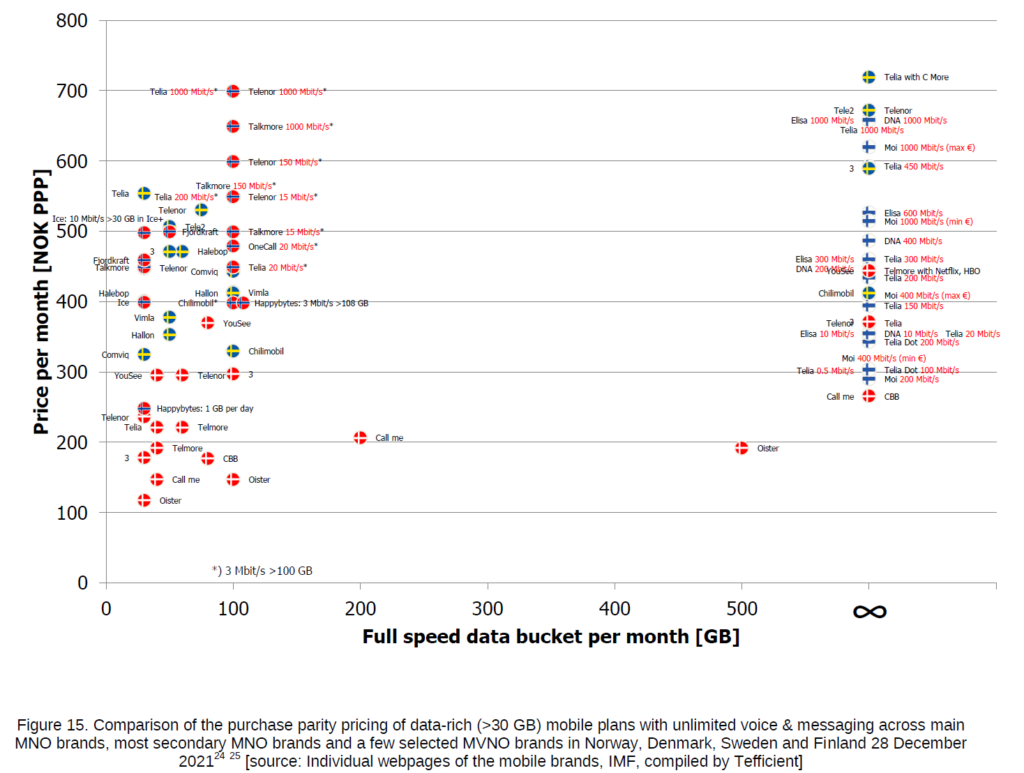

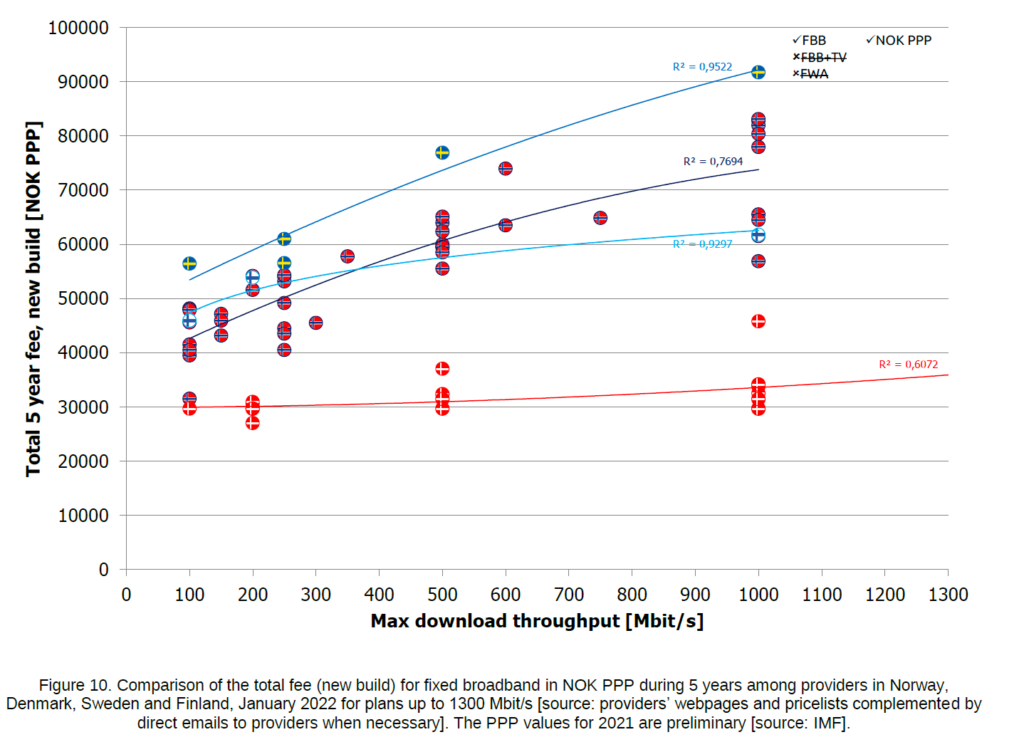

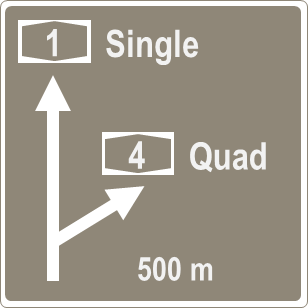

For the second time (the first analysis was done in 2021), Tefficient has performed a comprehensive fibre broadband pricing benchmark covering nine European markets: Denmark, Sweden, Norway, Finland (new since 2021), Germany, the Netherlands, Belgium, the UK and France.

As part of a press release, Fiberalliancen makes Tefficient’s analysis publicly available. Download it from the right ‘Links’ column. It’s in English.

The release concludes that:

- Denmark has some of the lowest consumer prices for both new and existing fibre connections. Only French consumers generally get a better deal than Danish consumers.

- Danish consumer prices – both for new and existing connections – have overall fallen from 2021 to 2022. This is only seen in Denmark and the UK.

- According to Ookla, Denmark has the fastest median broadband download speeds among the countries included in the comparison.

Tefficient’s approach has been thorough and the results are presented in a set of graphs like below.